Kapola Trader EA promises not to wipe out your accounts like other EAs that provide bad signals, thus ending your trading career. The vendor says that the robot will ensure you engage in successful trades, minimize risk, and subsequently attain skyrocketing profits. Apparently, the system can help you to triple your investment.

Vendor transparency

The professionals responsible for the development of this product are mysterious. Info on their names, professional background, location, contact details, reputation, etc., is missing. Subsequently, it is impossible to determine whether they have a good or bad reputation in this market.

How Kapola Trader EA works

These are the features of the system:

- It’s a fully automated trading system.

- The company provides full-time customer support.

- The EA is compatible with the MT4 trading terminal.

- Free updates are offered.

Timeframe, currency pairs, deposit

Kapola mainly trades on several currency pairs, including the USDJPY, EURUSD, NZDUSD, AUDUSD, and GBPUSD currency pairs. All of these instruments work with the M15 timeframe. Unfortunately, the devs don’t mention which amount of deposit is best suited for working with the system.

Trading approach

The EA automates your trading income using several indicators. First, it uses Bollinger Bands to place the right buy/sell orders. The software also studies the present market price data in order to compute the exact and precise points of entry. Sometimes it decides to identify multiple entry points in attempts to optimize profits.

To exit the market, Kapola relies on the CCI indicator and moving average. Whereas the latter parameter computes the exit point, the work of the CCI is to confirm if that exit point is correct. Moreover, a trailing stop is applied to ensure you don’t lose the profits earned.

Pricing and refund

For you to access the EA for a lifetime, the devs expect you to pay $99 for the Bronze package and $149 for the Silver one. The Gold plan is a bit more expensive at $249. Real and demo accounts are included in the three plans.

Trading results

The vendor doesn’t share the backtest results for this EA. The stats would have helped us to see the kind of results the system generates on historical data. At the same time, it would have been possible to see if the stats match the ones produced in the live market or are different.

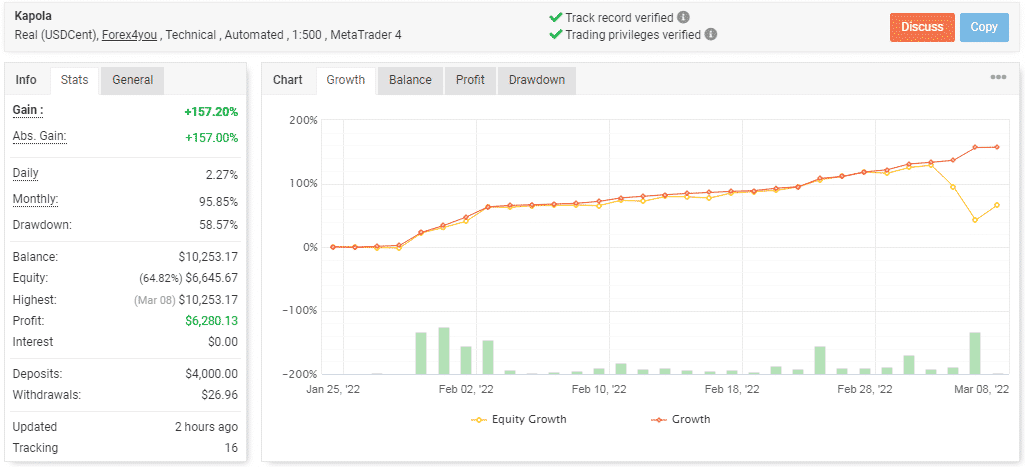

Kapola has been running the above account for 2+ months now using a $4000 capital. Its profitability rate is high since it has already recovered the cost of investment and earned an additional $2000 in the process. So, the account’s standing has risen by about 157.20%. Unfortunately, high trading risks are applied as we currently have a large drawdown—58.57%.

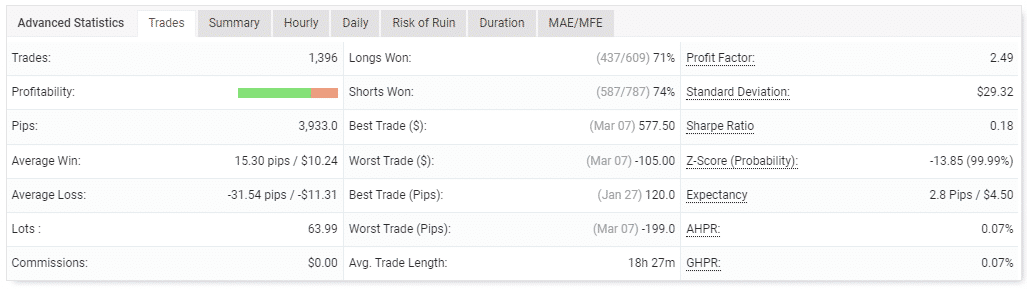

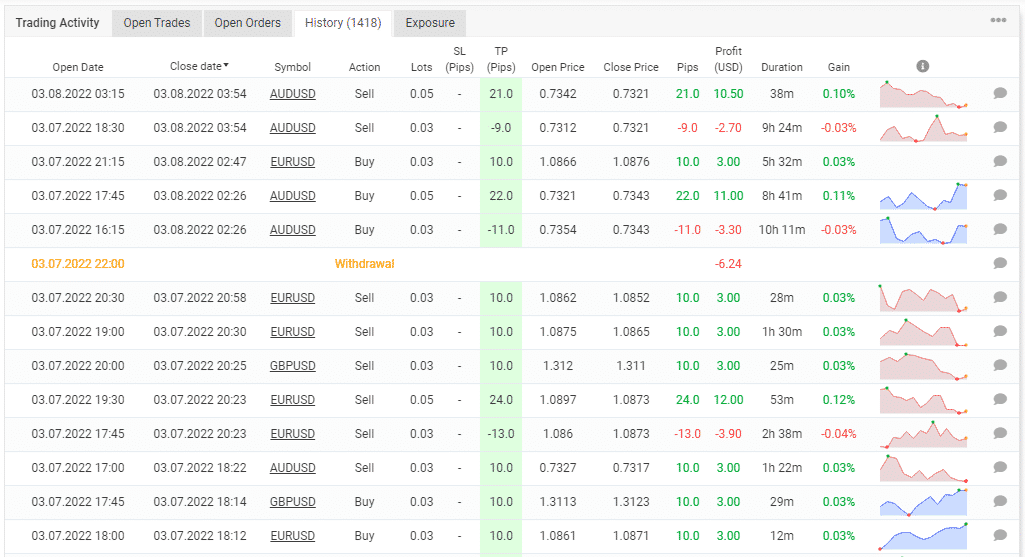

The system trades regularly. From the table above, it’s obvious that the completed trades are nearing the 1400 mark. The achieved win rates for long (71%) and short positions (74%) are pretty decent but not outstanding. On average, the EA wins 15.30 pips and loses -31.54 pips. This means that the user’s chances of incurring a loss are higher than making profits.

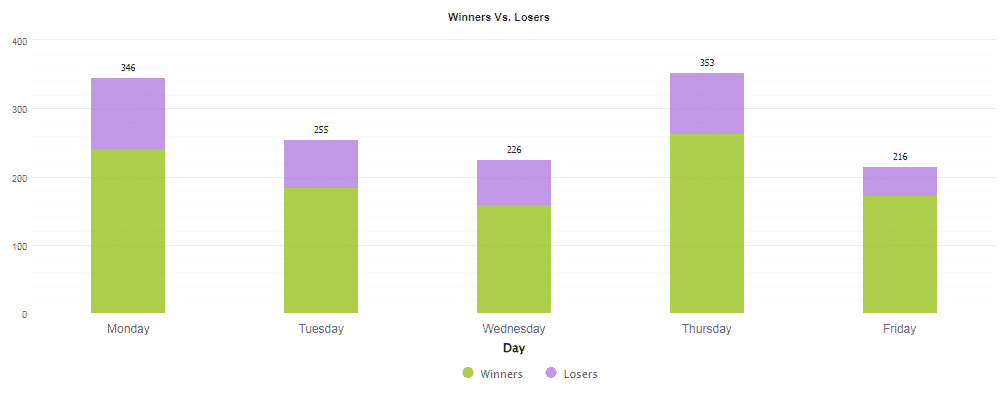

Hundreds of trades are completed weekly, but the EA’s activities on Thursday are heightened compared to the other days.

Dangerous strategies are used in trading. The grid and martingale approaches are on the board. Varying TP levels are applied.

People say the Kapola Trader EA is…

The EA hasn’t been reviewed by customers as trustworthy verification websites like Myfxbook, Forex Peace Army, and Trustpilot lack such testimonials. So, we don’t know if the above trading results can be replicated in traders’ accounts or not.

Verdict

Pros

- High profitability rate

- Cost-friendly

- Free updates

Cons

- High drawdown

- Lack of customer reviews

- Grid+martingale combo

- Vendor is anonymous

Kapola Trader EA Conclusion

Kapola is a cost-friendly EA that generates high returns on investment. Be that as it may, the presence of the grid and martingale trading methods makes it a dangerous tool. The system has been trading live for nearly 2 months, and almost 60% of the capital is gone. Moreover, the devs are unknown, so their trustworthiness cannot be established.