Investing in low-priced stocks has the advantage that patterns often repeat themselves. The bull flag can be used as a crucial momentum indicator by traders who know key patterns. FX traders have used it for ages. Currently, it is commonly used by all kinds of market participants. In the penny stock world, it is widely used for intraday trading.

It isn’t easy to find a reliable, usable tool that can assist you in predicting price direction based on technical indicators and patterns. Short continuation flag patterns are perhaps the most famous.

Despite this, they generally fall into two categories:

- Bull pattern

- Bear pattern

We will discuss the bull flag pattern strategy in this article, which signifies a continuing uptrend.

Bullish trade setup

This type is a high-level technical pattern that may appear on any time frame, from the smallest to the monthly chart. Furthermore, the bullish flag pattern is a market-neutral pattern that can appear in any market.

After all, the similarity between the bullish flag pattern and the national flag is not coincidental; the bullish flag term was inspired by the similarities between the bullish flag pattern and the national flag.

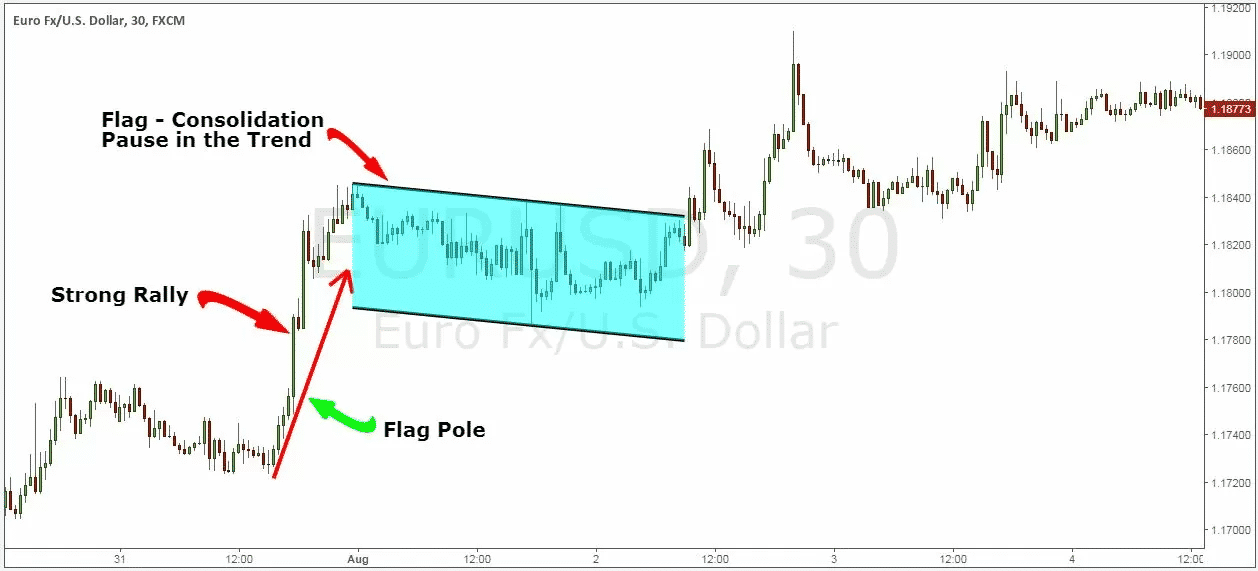

The bullish flag pattern is made up of two parts:

- A powerful and long-lasting rally.

- Afterward, the narrow range moves gradually lower to complete the flag portion of the bullish flag pattern. In addition to being narrow, this region must also fit within two straight lines.

Not only is the bullish flag pattern a basic technical signal, but it may result in changes of the same size as the flagpole movements. Therefore, the next part will explain how to trade a bullish flag pattern and the best technique.

The bullish flag pattern and how to trade it

Considering that this is a continuation pattern, we want to trade it in the direction of the maximum trend. A bullish trend should follow this pattern, as implied by the name. As part of our trading strategy implementation, we also guide laying the groundwork.

Here, we will break over the flagpole or flag “border” at the top. It is an ongoing pattern.

Take profit

When trading a bull flag, you should wait for confirmation that the flag is complete before entering the trade. Never invest in a stock that you believe will break out.

If you buy too soon, you may find yourself in a difficult situation. Even if you are correct, the stock might remain in consolidation for several weeks.

Bearish trade setup

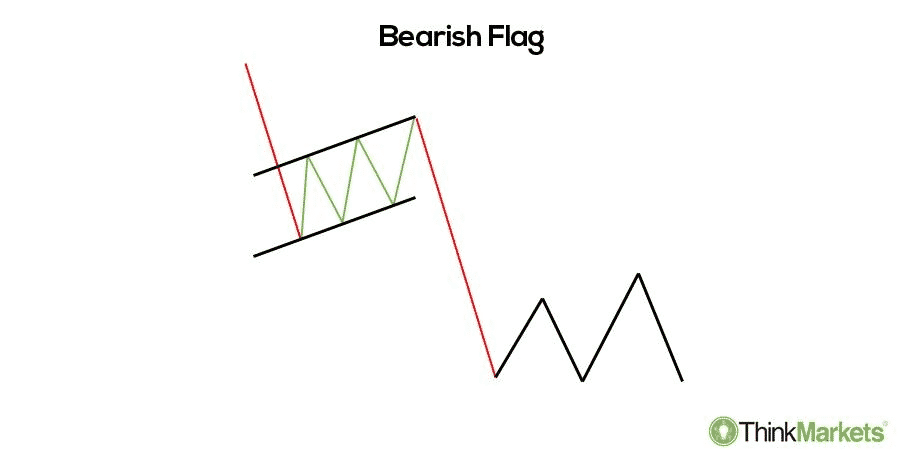

The bearish flag is a candlestick chart pattern that indicates that the downturn will continue once the momentary break has ended. The bear flag, as a continuation pattern, aids sellers in pushing the market to move downward.

Following a significant downturn, price movement merges inside two parallel trend lines, pointing to the reverse of the downturn. The bear flag pattern is triggered when the supportive trend line breaks and the price decreases.

Bear flag pattern and trading in it

Trading the bearish flag follows the same rules as trading other candlestick patterns. Once we’ve identified the flag, we’ll have to wait and see if the supportive trend line will be broken.

Many traders are very excited to enter the market, and they frequently “jump the gun” before the real breakout has arrived. As a result, keep in mind that the pattern only becomes “active” after the breakout.

The first approach implies you can’t miss out on a trade because there’s no assurance that a throwback will happen at all. On the other hand, we can decide to wait for a throwback when the price action returns to the “crime scene” to retest the broken range. Because the entry cost is higher, this option has a better risk-reward rationale on the other hand.

We chose option no. 1 to be sure we’re in a trade. As a result, a sell trade is initiated whenever the breakout candle has closed securely below the lower trend line. The stop loss is around 20 pips above the entry point and is located within the channel territory. A straight movement to the interior of the flag, like with the bull flag, makes the bear flag pattern invalid.

Take profit

The distance between the flagpoles is used to calculate the take profit level. The trend line is then copied and pasted, beginning at the breakout and finishing at a level where we should consider taking profits if the possibility comes.

Finally, our take-profit order is completed, resulting in 85-pip gains. Based on the linked risk of 20 pips, this results in a high R: R ratio. If we had selected the second option, we would have profited five pips more while risking the same amount.

The bear flag and bull flag both indicate the same chart pattern but in different directions. Therefore, to trade forex with bear and bull flags, traders must understand that the patterns must be understood in their own right, as they can easily be misinterpreted when taken out of context.

How to manage risks?

So, as you’ve seen, we don’t have to be afraid of a bear market; rather, by utilizing various techniques, we may do pretty well in situations when many others are experiencing big losses in their investments.

Mining stocks, such as gold and silver, can outperform at times. Food and hygiene products equities, sometimes known as “defensive stocks,” generally perform well. Bonds can rise in value when equities fall.

Sometimes, a certain economic sector, such as utilities, real estate, or health care, will do well even while other industries lose money. In other words, by analyzing the market and using appropriate strategies, you can minimize your trading risks.

Final thoughts

A common mistake among investors is to mistake a bearish flag pattern for a bullish breakthrough. Flag patterns are characterized by low price increases in a downward trend, while breakout patterns are characterized by stronger price increases in an upward trend.

Just stay away from trading bull flags if there isn’t one. A pennant and flat top breakout are two minor changes to the pattern. Intraday or daily charts may be used to use the bull flag. The type of trade you make depends on whether you are a day trader or a swing trader. It is common for people to trade on the side because they are unable to work full-time.