The pump & dump scheme is a process to boost the price of a trading instrument by manipulation. It is an illegal approach, but traders can make profits by observing the price action during the aggressive movement.

The forex market is full of uncertainties where it is prevalent to see a massive move upside and recover it immediately. In FX trading, the leading market movers are institutions and central banks that play with millions of dollars. As it is a decentralized market, one party cannot manage enough liquidity to move the price in any direction. Still, in the past chart, we have seen several examples of manipulation that can make transparency questionable.

For retail traders, pump and dump would be a great trading opportunity to provide profits more than usual. In the following section, we will see a complete trading guide from such a scheme.

What is the pump and dump scheme?

It is a process of fraud in trading securities by creating artificial inflation or pump through providing false/misleading information and quickly selling securities from the high price or dump.

The concept of a pump and dump scheme came from the stock market, where people who will buy instruments at a high price will be the biggest loser. However, pump and dump are rugged in forex trading as there is no central exchange to exchange currency pairs.

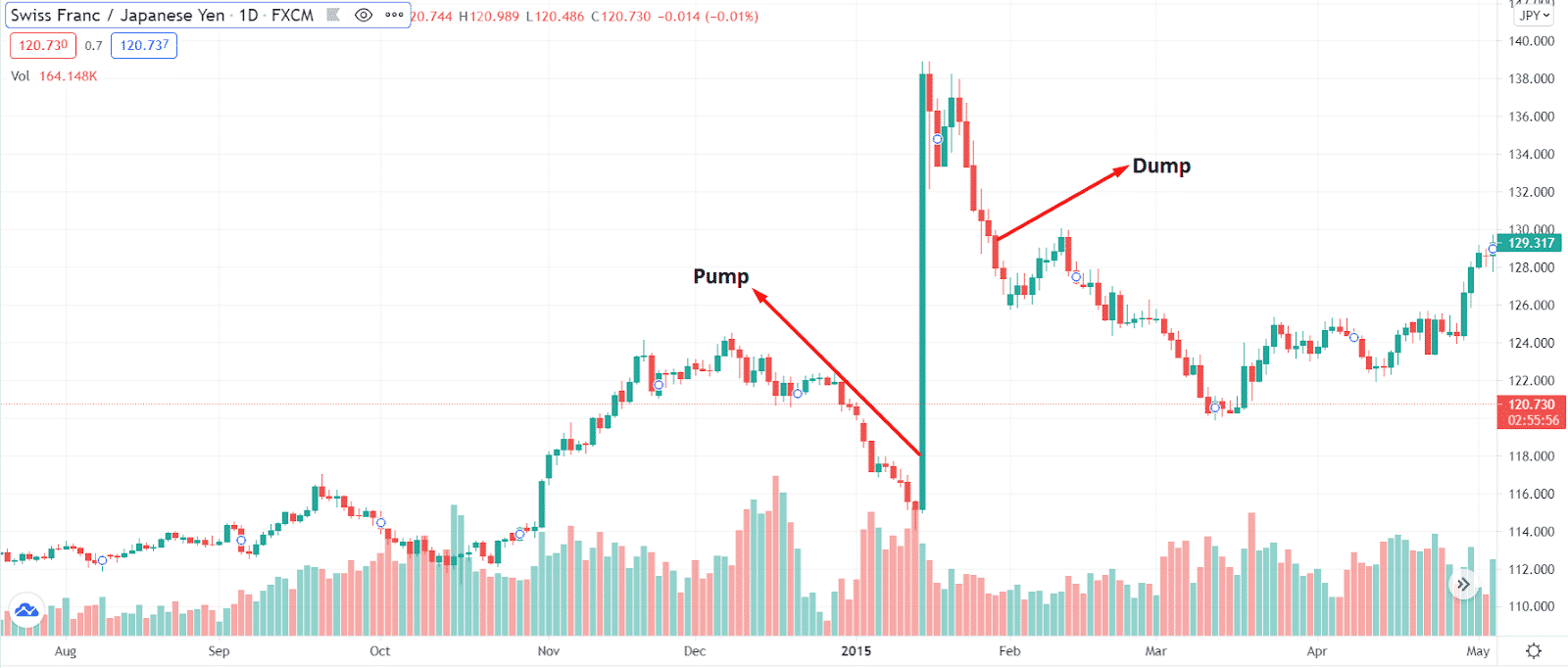

One example of a pump and dump scheme is the Swiss Franc scam of 2015. At that time, the Swiss central bank decreased the interest rate to a harmful level for the first time, pushing the CHF/JPY price up by more than 1500 pips in just 5 minutes. As a result, millions of retail traders made losses, and many brokers became bankrupt.

How does the pump and dump scheme work?

This scheme involves manipulation in the price of mostly microcap stocks. The small market capitalization allows big investors to alter the market direction illegally. Moreover, microcap stocks are available to trade in the over-the-counter market without requiring any public listing.

There are many ways to manipulate prices under pump and dump schemes, as mentioned below.

- Classic pump and dump scheme

The classic approach is to manipulate the price of a stock or trading instrument by providing information about the company and stock. Investors often scam the market by delivering fake news or insider information.

- Boiler room

In this process, brokerage firms follow dishonest sales practices to risky investments. In that case, brokers work as market makers, and for forex trading, they often provide false candles, unusual moves below the low or high, etc. Once people start to close their position or get a stop loss hit, they return the price to a normal position.

- “Wrong number” scheme

Nowadays, wrong number schemes may come through emails, phone calls, social media knocks, etc. In this process, a unanimous person will appear and tell you to invest in a particular stock. If the majority of the people start to believe them, they will change the price direction.

Trading tips for pump and dump scheme

In such a scheme, prices make a sharp movement but immediately recover the pressure. If we can measure the speed and logic behind the move, we can generate a good profit from the market.

Let’s see what the ways to make profits from this sharp movement are:

Technical analysis

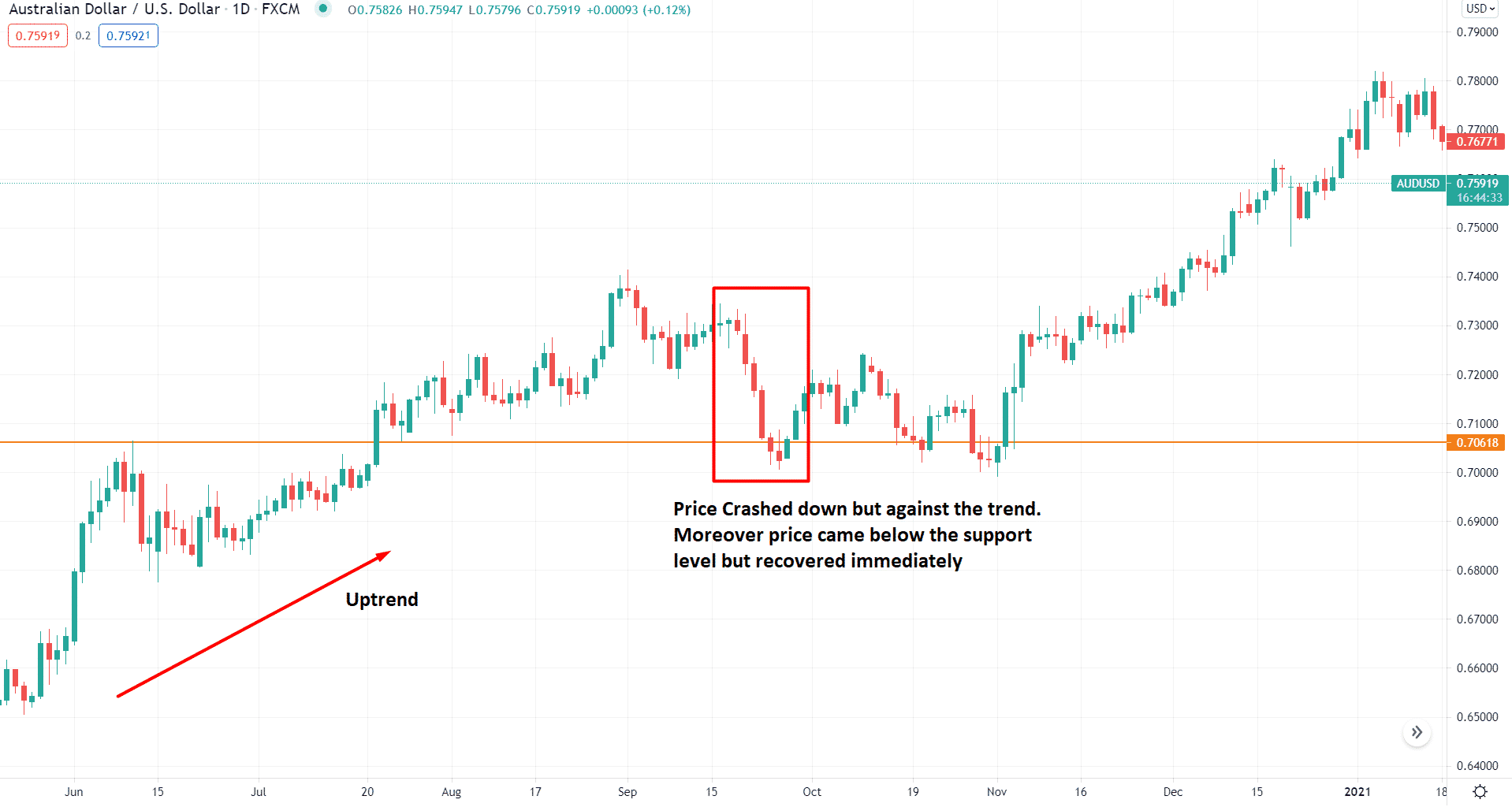

In technical analysis , traders use price levels and swings, and they can track any unusual movement by observing the price action at the near term level. If the price breaks any vital support or resistance level, but there was no strong candle above or below the level, we can consider the breakout invalid. Moreover, after the breakout, investors should see how long the price is holding.

The best approach is to follow the overall market trend, and any unusual movement against the trend will recover soon. Therefore, find a reliable candlestick formation at critical support/resistance levels and enter the trade with the hope of price recovery.

The above image shows the daily chart of AUD/USD where the price crashed but against the trend. Moreover, the price came below the support level but recovered immediately. So, here the trading approach will be to find the price at a support level and wait for bearish rejection and a bullish candle before entering a buy trade.

Fundamental reason

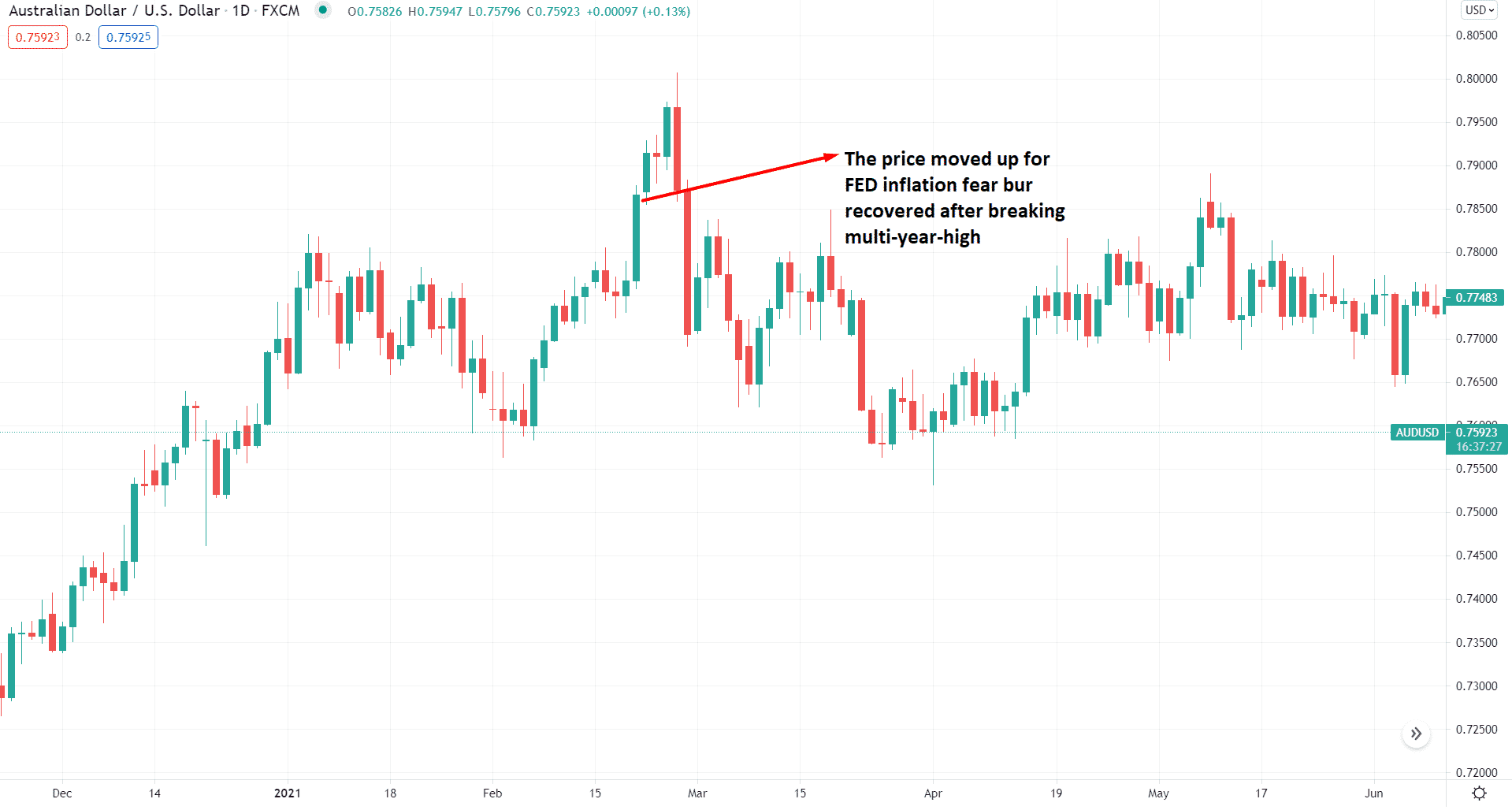

“Buy on rumor and sell on actual”— is a common term in financial trading. If the central bank provides any expectation about the economy or currency value, the price of that particular currency will rise. However, it will recover all losses as soon as the current report is published.

Moreover, central banks often speak about tension or uncertainties about the economy that put a massive spike in the market. However, in most cases, price breaks any vital support and resistance levels and comes back immediately.

In the above image, we can see the AUD/USD price that moved above the multi-year high as soon as speculators believe that the inflation may rise in the coming days. However, as it was a rumor, the price moved down and recovered 100% of the spike.

Traders should closely monitor the price and speech regarding the tension and open buy positions from intraday swing levels. Later on, if any significant rejection candle appears, close all buy positions with profit and open sell positions. It is often a risky method as we don’t know whether the price will rebound or not. Therefore, traders should use stop losses in every trade.

Final thoughts

In the above section, we have seen how the pump and dump scheme works and how price manipulation happens in the financial market. However, the SEC remains active and does not allow brokers and financial institutes to manipulate prices beyond the tolerance level.

The price manipulation is a sign that the financial market is very uncertain, so traders who open positions without stop losses are the main victims. However, smart traders can read the reason behind the movement and can generate much more profit than usual from the pump & dump scheme.