RED FOX EA uses the traditional grid trading strategy on a number of pairs and comes with live results. The robot currently works only on the MT 4 with a minimum account balance of $1000. To understand better about the algorithm, we will discuss all the pros and cons below.

Vendor transparency

RED FOX EA is developed by Sinry Advice. The company has multiple robots in the marketplace. They fail to share much information about their experience and whereabouts. They share their address as Jalan PJS 2C, Taman Medan, 46000, Petaling jaya, Selangor, Malaysia.

How RED FOX EA works

The robot comes with the following features:

- It uses grid strategies for getting out of positions that are at a loss

- It can work with 5-9 currency pairs at the same time

- It has a news filter to avoid uncertain conditions

- It keeps the drawdown low while trading

Time frames, currency pairs, deposit

The robot works on EURCAD, EURUSD, GBPUSD, GBPCAD, and USDCAD for low drawdown settings. Traders can employ other pairs, but it will add to the risk. The minimum amount required to start trading is $1000.

Trading approach

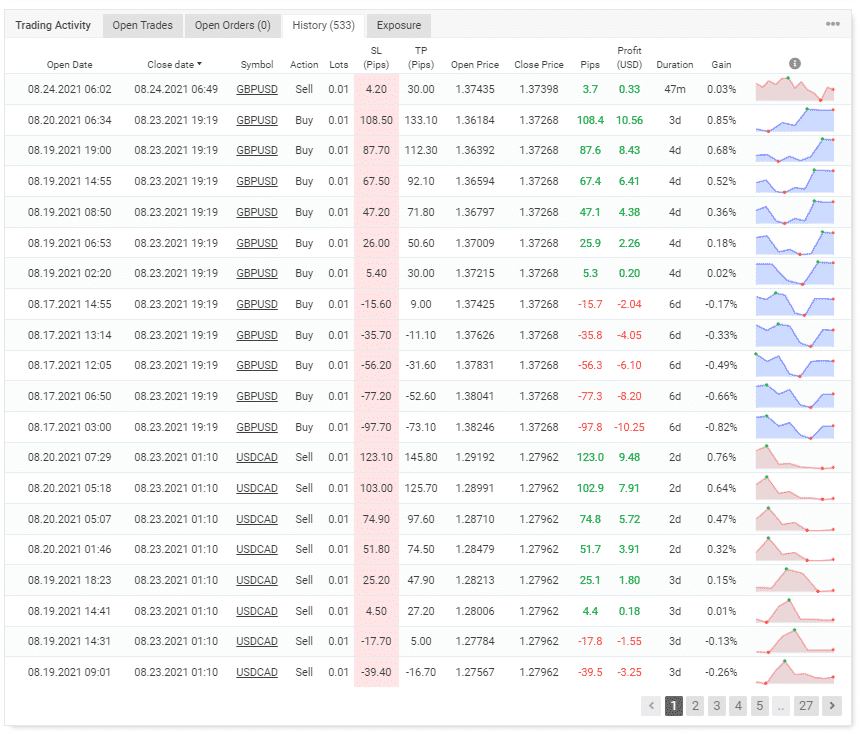

The developers don’t share much information about the strategy except that it uses internal indicators for analysis and is based on market reverse price. Through the records on Myfxbook, we can easily see that the EA uses a grid strategy. It trails the stop loss when the position enters the profit. The open trades are private, so we cannot see if the original trades have a stop loss or not.

Pricing and refund

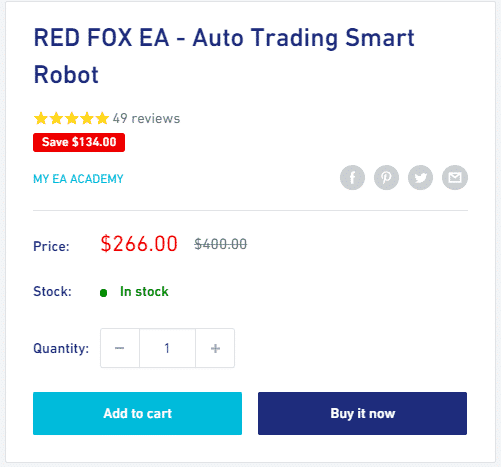

The robot is available for $266. The developers try to attract traders by showing that there is a big discount. There is no money-back guarantee if you are not satisfied.

Trading results

There are no backtesting results available which is a poor approach. This means that the EA might have hit a drawdown. The developers may have been afraid to show the results.

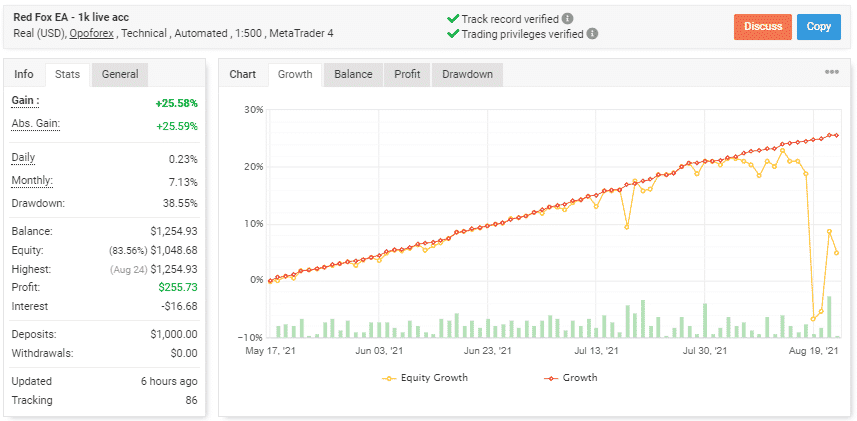

Verified trading records on Myfxbook show performance from May 17, 2021, till the current date for the 1k account. The system made an average monthly gain of 7.13%, with a drawdown of 38.55%. This is a high value of drawdown, which shows nearly half of the loss in account balance. The ratio between the drawdown and monthly gain is also poor—the robot loses seven times to make a little gain.

The winning rate stood at 78%, with a profit factor of 2.11. The best trade was $10.56, while the worst was -$10.25. There were a total of 533 trades. The developer made $1000 in deposits and $0 in withdrawals. The high losses on the account are due to the implementation of the grid strategy.

People say that RED FOX EA is…

Risky. The current drawdown on the account far exceeds the one that the company mentions on its website. Even though they are transparent in their live records, there are no backtesting results that we can use to verify their performance.

Verdict

| Pros | Cons |

| Live records available on Myfxbook | No transparency on the developer |

| Live account results are for a small duration | |

| The company does not provide enough information on the strategy |

RED FOX EA Conclusion

RED FOX EA does not have satisfactory results on Myfxbook. It uses a grid strategy that can cause huge drawdowns if the market trends in one direction. The chances that the account will result in the margin call in the future are possible. Traders should avoid investing in algorithms that use risky game plans and are not clear on records.