Renko chart allows traders to look at the price chart by eliminating the short-term market noise and volatility. As a result, investors can make a precise trading decision without any distractions.

The perfect use of Renko’s trading strategy needs the core knowledge of Renko charts. You cannot open a trade just by looking at the candle’s color. It requires patience, a system, and a trade management system to benefit from the overall market. If you are interested in building a trading strategy using the Renko trading chart, the following section is for you.

Here we will discuss the basics of the Renko calculation system with extensive buy and sell trade setups.

What is the Renko trading strategy?

Candlestick and Heiken Ashi help traders to make a good trading decision, but one of the most significant demerits of these tools is that they are based on time. In financial trading, we can consider time to discord the price movement. Therefore the birth of Renko charts solved the problem as it focused on the price movement only. The meaning of “Renko” came from the Japanese word “Renga,” which means brick.

Unlike traditional candlesticks, Renko charts show the candlestick pattern after predetermined intervals. Therefore, it focuses on the price more than the time. As a result, you can see a cleaner chart as less information is available there.

Therefore, tradersRenko’s trading strategy is profitable for traders who focus on building an objective-oriented trading approach.

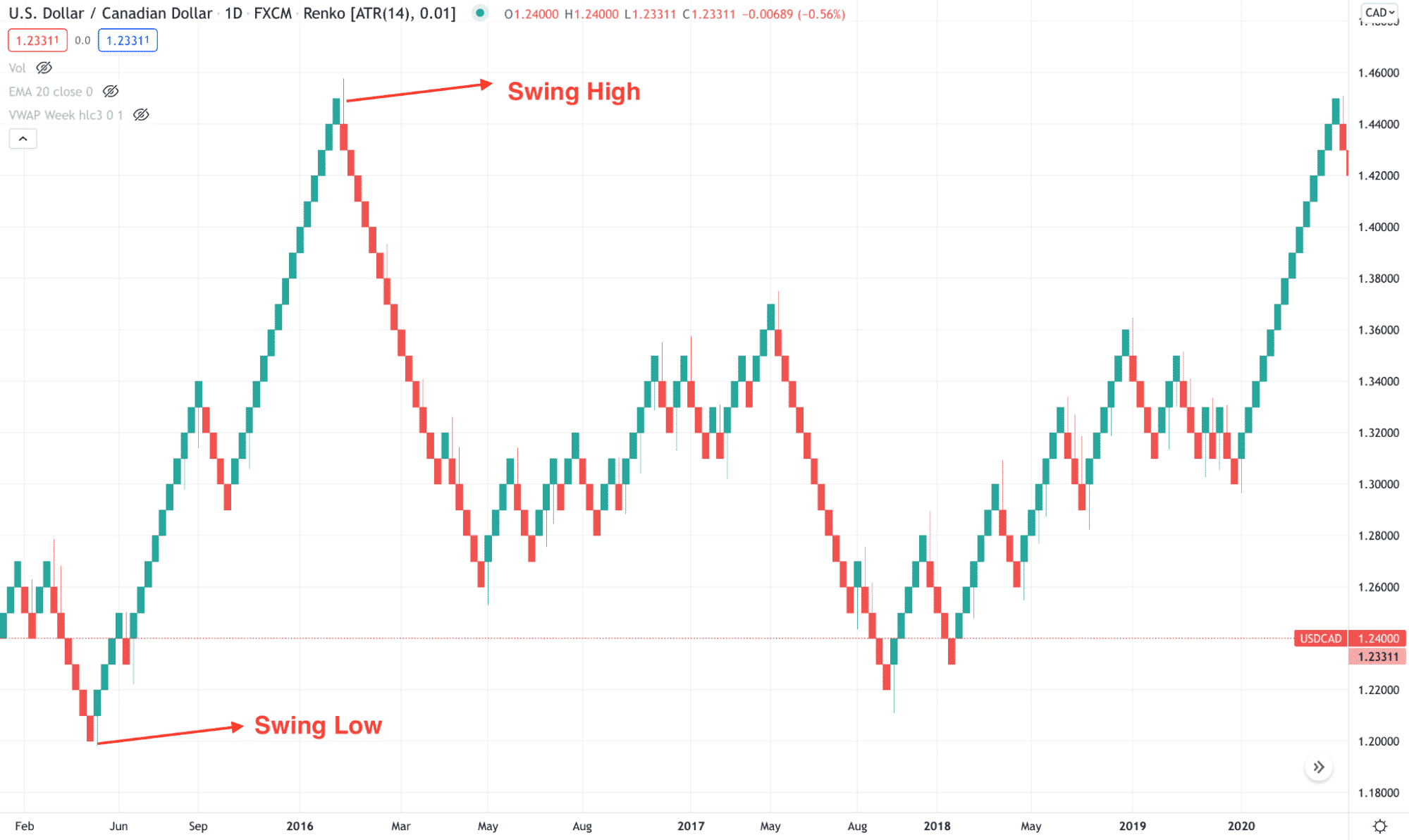

In the above image, we can see the daily price of USD/CAD in the Renko chart, where finding the swing high and swing low are easy. Moreover, candles in the Renko charts are similar in size where the green color represents a bullish candle, and the red color means a bearish candle.

How to trade with the Renko trading strategy?

In any financial trading, finding a trend and following it has a higher possibility of providing profits. Therefore, in the Renko trading strategy, we will find the swing low to open a buy trade and swing high for a sell trade. In that case, the most probable trading entry comes when the Renko candles change their direction with a reversal pattern.

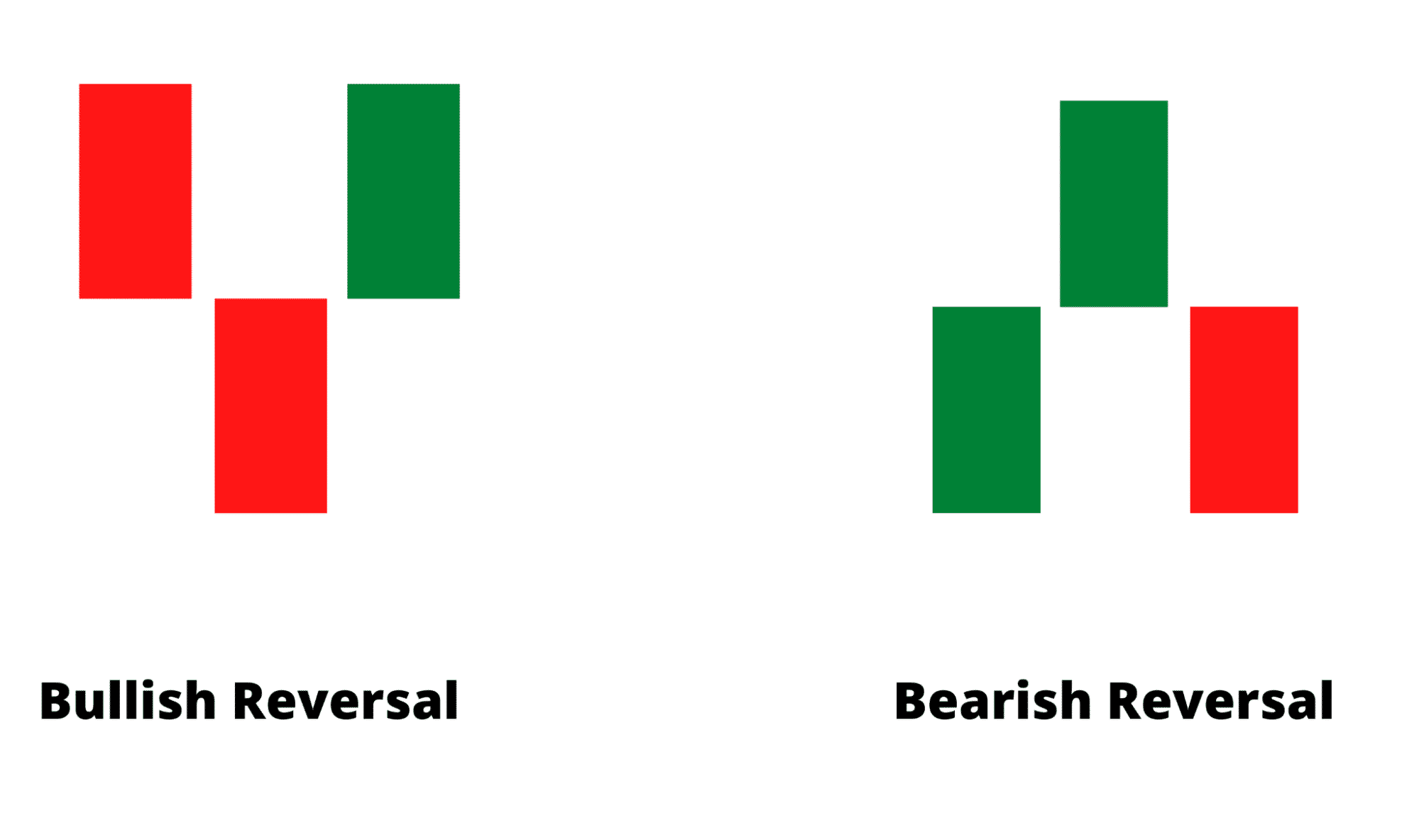

Let’s see how the reversal pattern forms in the Renko chart.

In the bullish reversal pattern, there are two bullish candles and a bearish candle in the middle. It tells a story about the market where bears tried to push the price down but failed to hold the momentum, and bulls appeared and rebounded the price action. The opposite scenario applies to the bearish market, where the third red candle confirms the bearish reversal. Traders should open a buy/sell trade as soon as the third candle closes.

It is a trend-following method where traders save a clear idea of where the primary trend is heading. If the overall market context is bullish, we should focus on buy trades only and leave any selling opportunity. In that case, using 50 SMA would increase the trading probability.

When the price is above the 50 SMA, we can consider the trend as bullish. On the other hand, below the 50 SMA, we will look to sell trades only. Besides, it is better to use an oscillator like MACD or stochastic to increase the trades probability.

Bullish trade setup

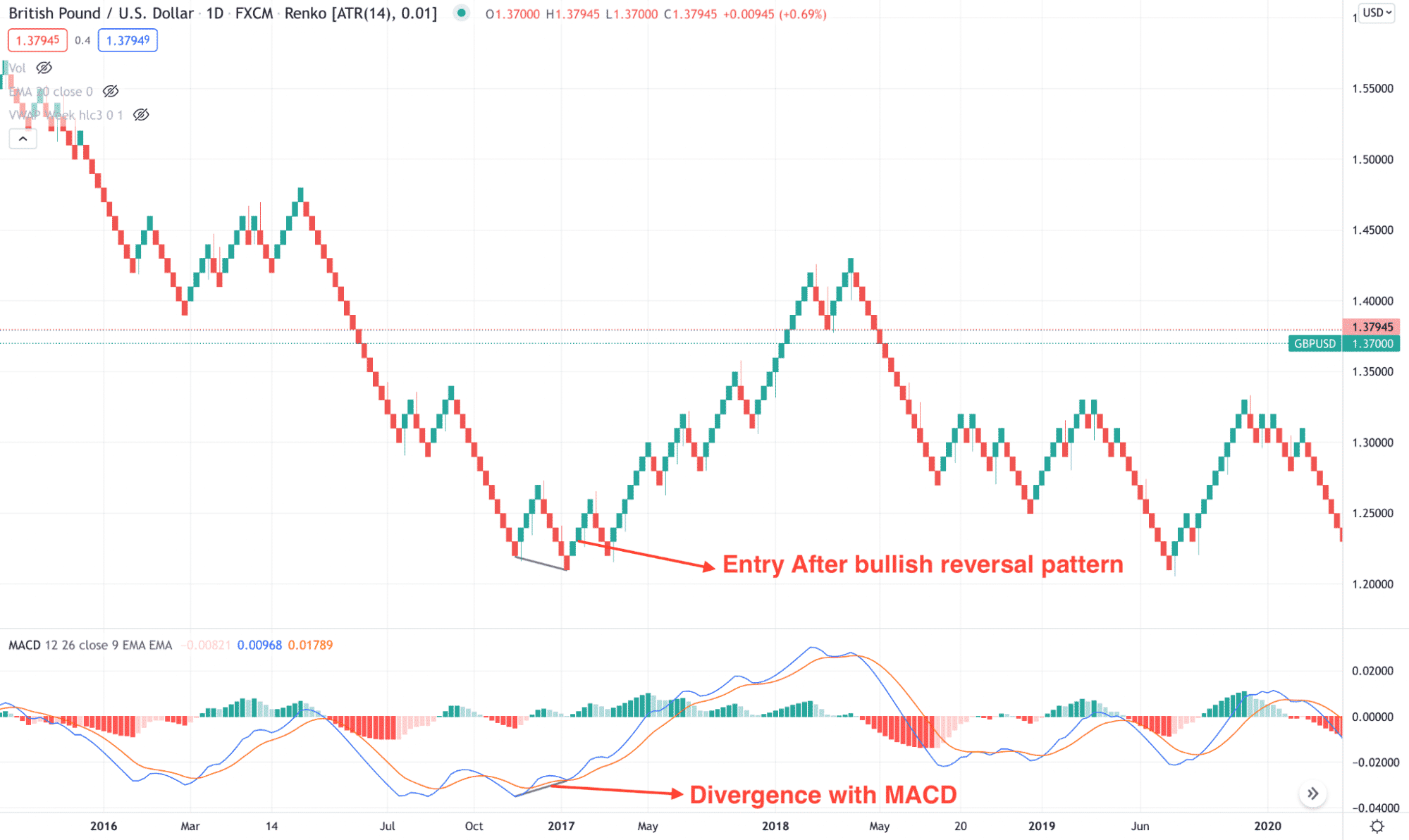

In the Renko bullish trade setup, we will use the Renko chart instead of Japanese candlesticks and follow the primary trend. Finding the trend is very easy with the Renko chart as it eliminates the market noise and shows the precise swing level. Later on, we will wait for the bullish reversal pattern to appear from a swing low and open the trade as soon as the pattern completes.

Besides, the trading probability will be vital if there is any regular or hidden divergence in MACD. Here the regular divergence happens where MACD lines do not follow the price swing.

The above image shows the daily chart of GBP/USD, where the price made a new swing low from 1.2197 to 1.2090, but MACD made higher highs. Later on, a bullish reversal pattern formed that confirmed the new bullish swing.

Enter

In this method, the trading entry is valid with the following condition:

- The overall market trend is bullish.

- Regular divergence formed after a bearish swing.

- A bullish reversal pattern appeared.

Take profit

In this method, you can hold the trade as long as possible but grabbing some profit after making 1:1 R: R would be an excellent way to manage your trades.

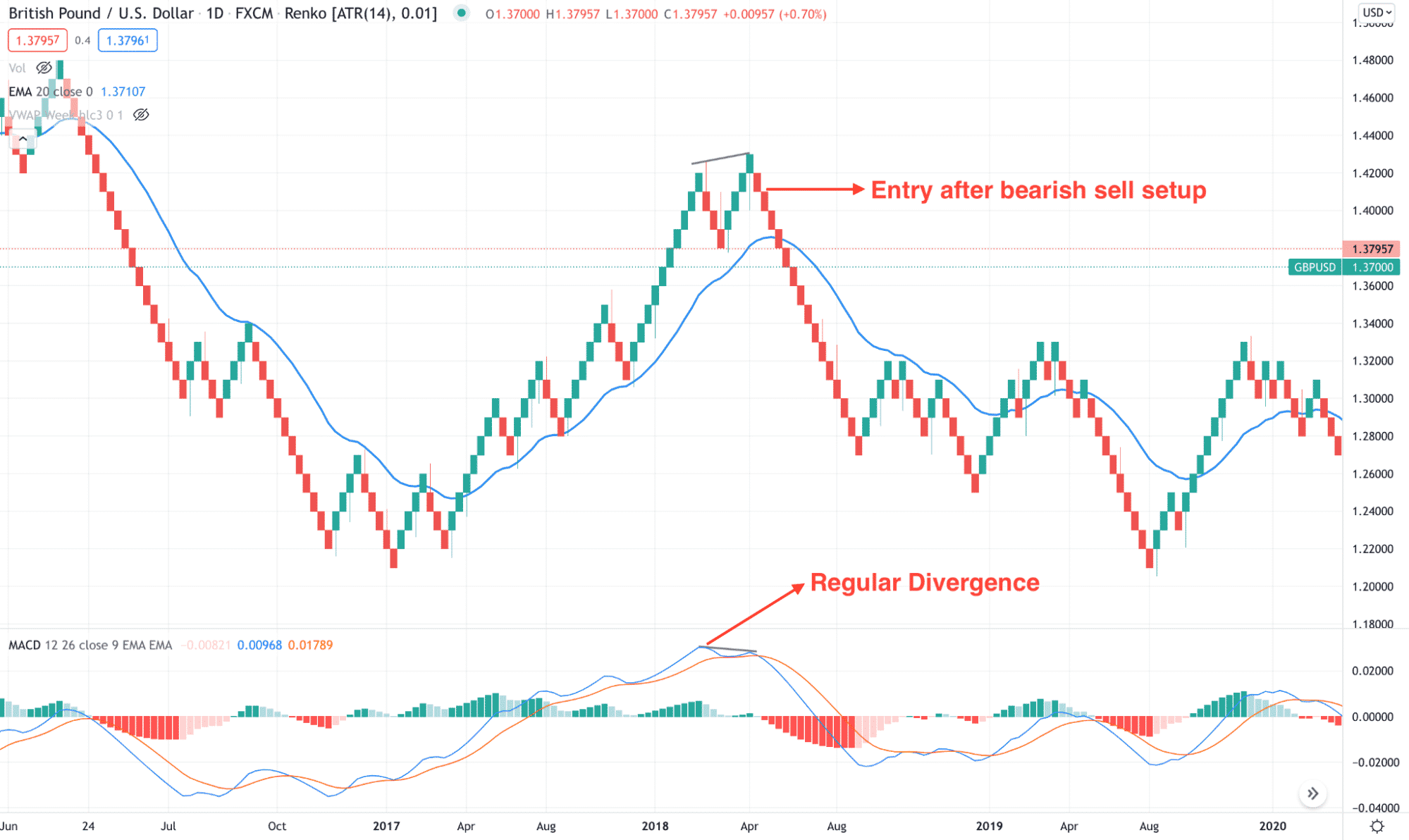

Bearish trade setup

The bearish trading system is opposite to the bullish trade setup. Traders should find the overall market trend as bearish and open trades from any suitable swing high in the bearish trade. In that case, the highly profitable swings should have a regular divergence with the MACD.

The above image shows how the swing low in the MACD line failed to match the direction of the trend. As a result, the price moved down with a definite bearish trend with more than 1:7 risk vs. reward.

Enter

In this method, the trading entry is valid with the following condition:

- The overall market trend is bearish.

- Regular divergence formed after a bullish swing.

- A bearish reversal pattern appeared.

Take profit

First, you have to close the trade after reaching 1:1 risk: reward and move the stop loss at breakeven. Later on, you can hold the trade until it comes to a critical support level.

How to manage risks?

Like other trading systems, Renko trading’s strategy needs attention to the trade management. You cannot open a trade by risking all of your investment in a single trade. Instead, the ideal approach is to take not more than 2% risk per trade. It will help you to come back later and recover from the loss at any time.

Besides, make sure to use stop loss above or below the reversal pattern with some buffer. Therefore, if the price shows any unexpected movement, you can get out of it with a small risk.

Final thoughts

Overall, Renko’s trading strategy is very profitable if you implement it as a trend following system. It eliminates the unusual market noise and allows traders to find the perfect swing levels. However, investors should remain cautious about the economic releases and fundamental outlook while opening trade using this method.