There is a lot of jargon in the cryptocurrency market. Some of these phrases may be daunting to newbies, but they are necessary knowledge.

A market squeeze is one such term. Squeezes are a type of situation in which market forces cause gains to fall or market momentum causes a rapid domino effect in which a large amount of money is lost or made all at once.

Let’s discuss the top five tips to use and profit from them.

What is the squeeze in crypto trading?

A’ short squeeze’ or a ‘long squeeze’ are two market squeezes. Short sellers are affected by a short squeeze, in which they are effectively ‘squeezed’ out of the market due to fast-rising prices. Therefore, to minimize their losses, they will try to exit their short positions as soon as possible.

A long squeeze occurs when buyers who are long on a cryptocurrency are ‘squeezed’ out of the market due to rapidly falling prices. Naturally, they’ll want to get out of their positions as quickly as possible to avoid significant losses.

In the cryptocurrency market, short squeezes occur more frequently than long squeezes.

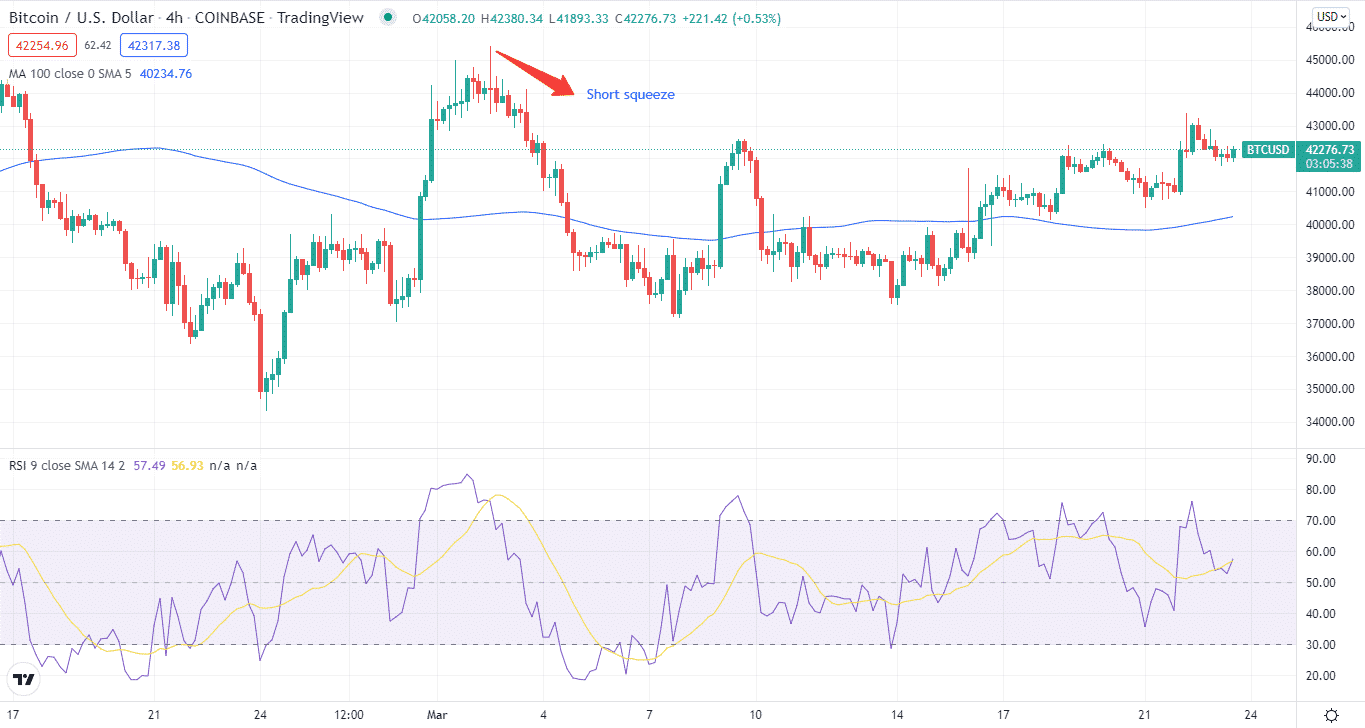

When the price of BTC or ETH rises, for example, there will be some hoping for a sudden drop. But on the other hand, shorting Bitcoin is even more tempting due to the usage of derivatives and high leverage.

Bearish market patterns can persist with a volatile asset like Bitcoin. When the stock market falls for a few days, many people expect the trend to continue.

Furthermore, it creates a negative market mood, encouraging others to short the crypto asset. As a result, a short squeeze may occur in some instances, resulting in a price turnaround.

Top five tips for trading with a squeeze in crypto trading

Now that you know what squeezes are in crypto trading, let’s move to the top five tips for trading. Squeezes are hard to identify so these tips will guide you through the whole process.

Tip 1. Identifying squeezes

While we know what to look for to figure out when it can occur, there is never a guarantee of a squeeze.

Why does it happen?

Unfortunately, price drifting lower and negative market sentiment are typical occurrences in the cryptocurrency market. As a result, it’s acceptable to state that a short squeeze is more of a technical pattern than a real event.

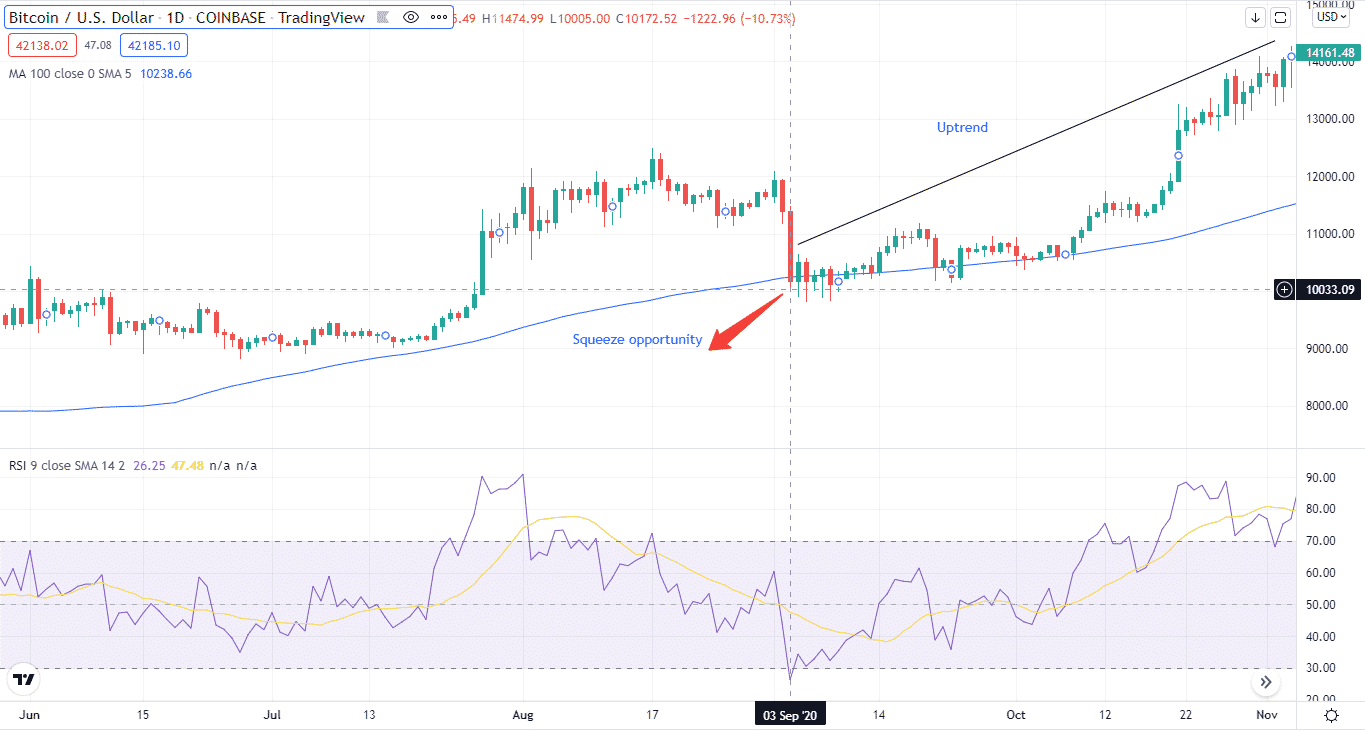

Take a look at the Bitcoin price range from September 2020 below. After a rapid drop to the negative, the price was contained in a range. On the other hand, price sped through the range so quickly that it wasn’t even retested for a long time.

How avoid the mistake?

Traders wanting to profit from a short squeeze should think again. A quick price spike is usually brief and does not necessarily indicate a market reversal. Yet, there is very little time to take advantage of such an opportunity, which is still risky.

Tip 2. Take a note of circulating supply

The circulating supply tells you the number of crypto coins available for everyone to trade or acquire. A cryptocurrency circulating supply is essentially telling you how much supply of a coin is available on the open market.

Why does it happen?

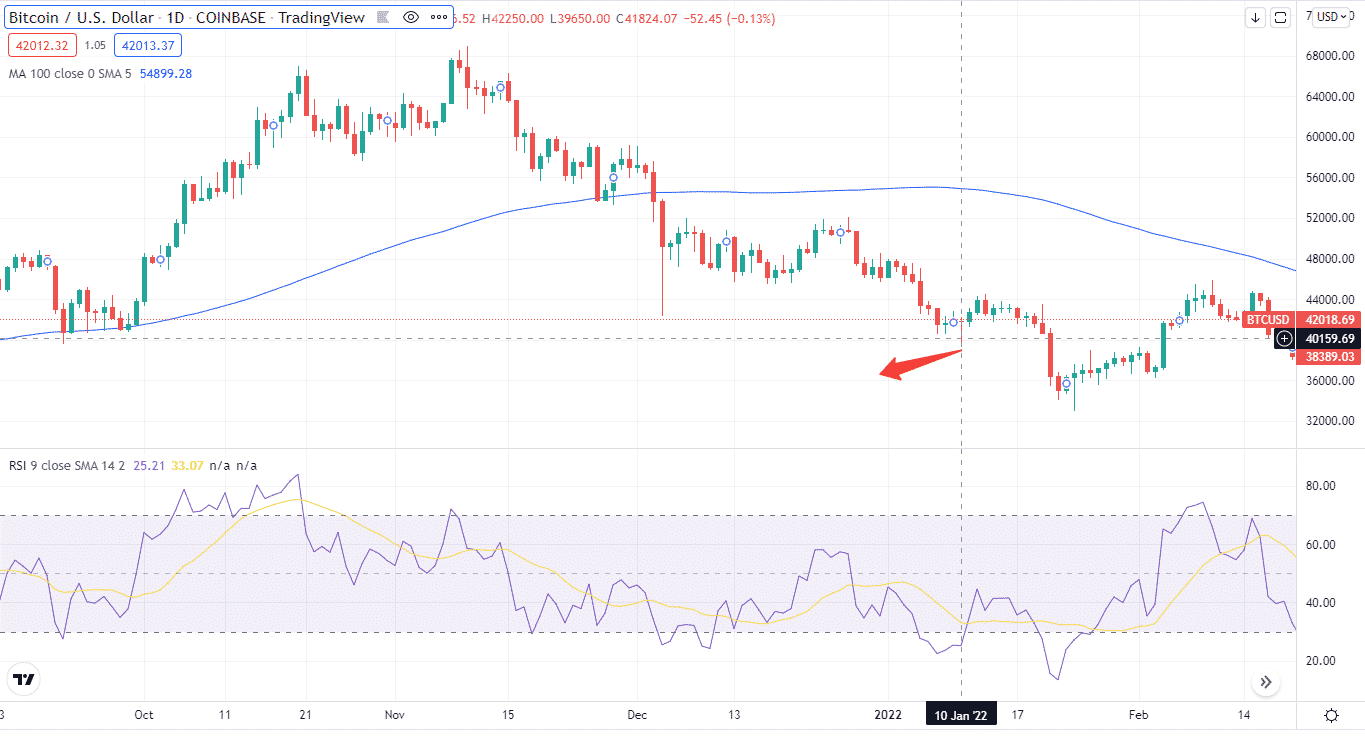

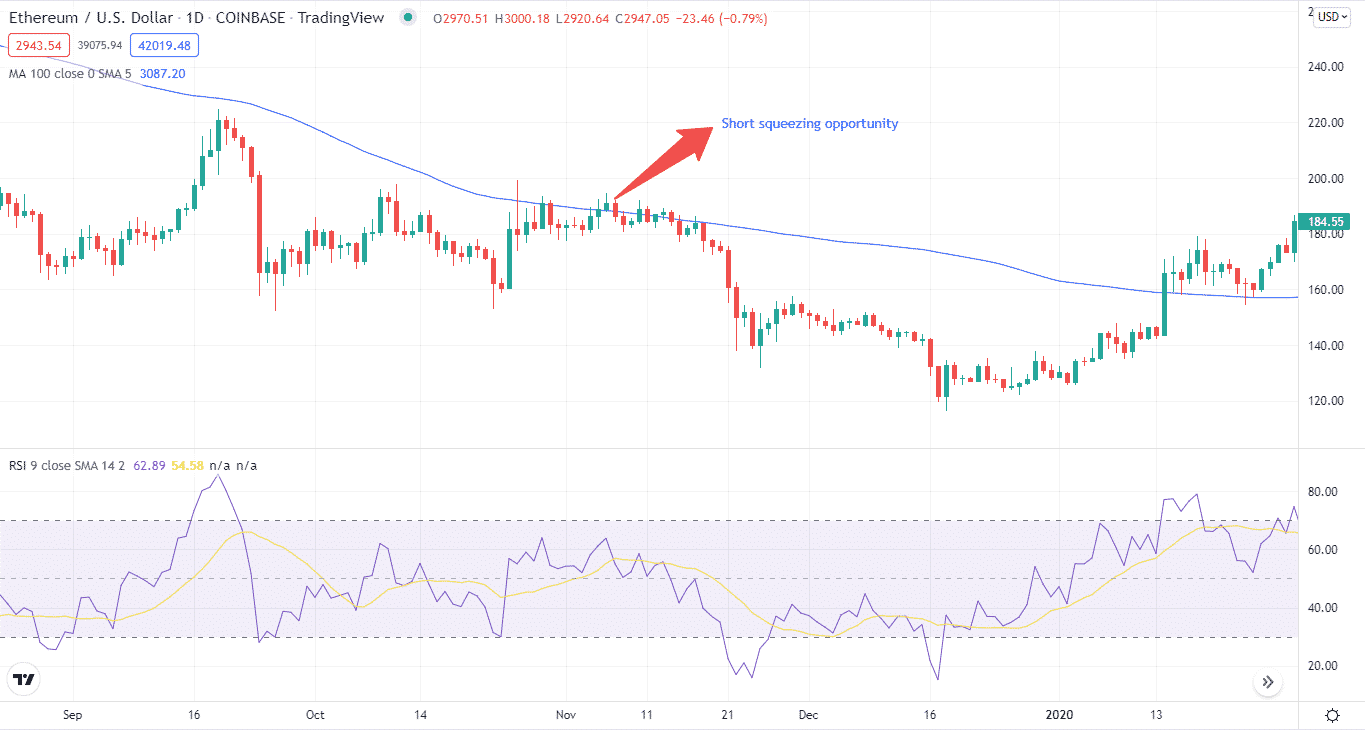

The most volatile coins are those with a sizeable circulating supply. It indicates that they are cryptos with a high likelihood of making a significant move in a short period. On the chart below, you can find that on January 10, BTC presented an excellent short squeeze opportunity.

How avoid the mistake?

A high circulating supply doesn’t mean the crypto is worth short squeezing for. It doesn’t take much selling force to drive it lower once it has momentum and volume. As you can see on the chart above, we got a short squeezing opportunity, but the price did retrace a bit.

Tip 3. Finding the short interest

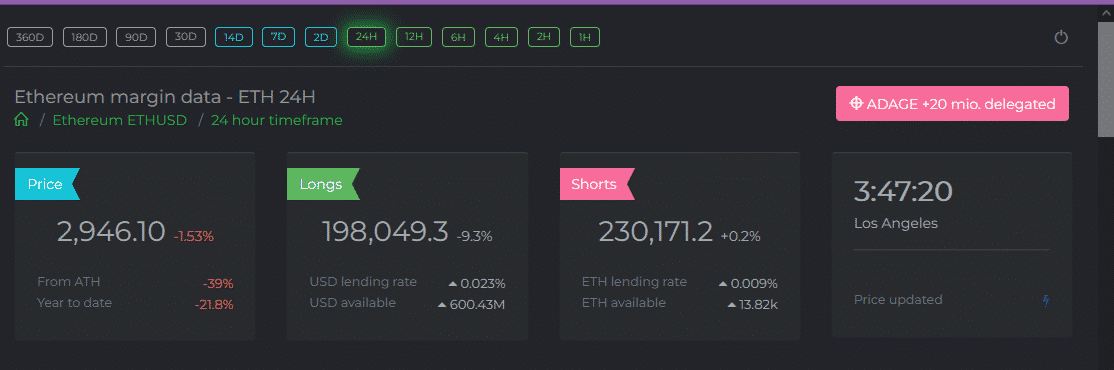

You can calculate the short-interest ratio by dividing the number of short positions in a cryptocurrency by the average daily trading volume. It enables traders to determine if a cryptocurrency is heavily shorted or not, based on its average daily trading volume.

Why does it happen?

A significant increase or drop in short interest in a company from the previous month might indicate investor sentiment. For example, let’s imagine the short interest in ETH climbed by 20% in a month. The number of those who believe the cryptocurrency price will fall has increased by 20%. Investors would be wise to learn more about such a huge move.

Below you can find a short-interest chart from Datamish. It can tell you ETH or other cryptocurrencies’ longs and shorts interest over a chosen timeframe. As you can see, short interests were more than long ones for ETH during the past hours.

So, it presents a good squeezing opportunity.

How avoid the mistake?

Short positions may be required to liquidate and cover their holdings by purchasing the cryptocurrency if the coin has a substantial short interest.

If there is a short squeeze and enough short sellers purchase back the crypto, the price may rise even further. Unfortunately, this is a challenging thing to forecast.

Tip 4. Using MA to predict short squeeze

A moving average chart shows the average price of a cryptocurrency across a set of time intervals.

Why does it happen?

Moving averages help to show the underlying trend direction by smoothing out period-to-period price volatility. You can spot price peaks by looking at a chart with a 50-day or 100-day moving average.

How avoid the mistake?

All indicators do not ensure a short squeeze will occur; they indicate that many individuals expect the price to decrease.

Therefore, if you choose to trade with the short squeeze method, you must have further evidence that the price will move in your favor.

Tip 5. Squeezing in on meme coins

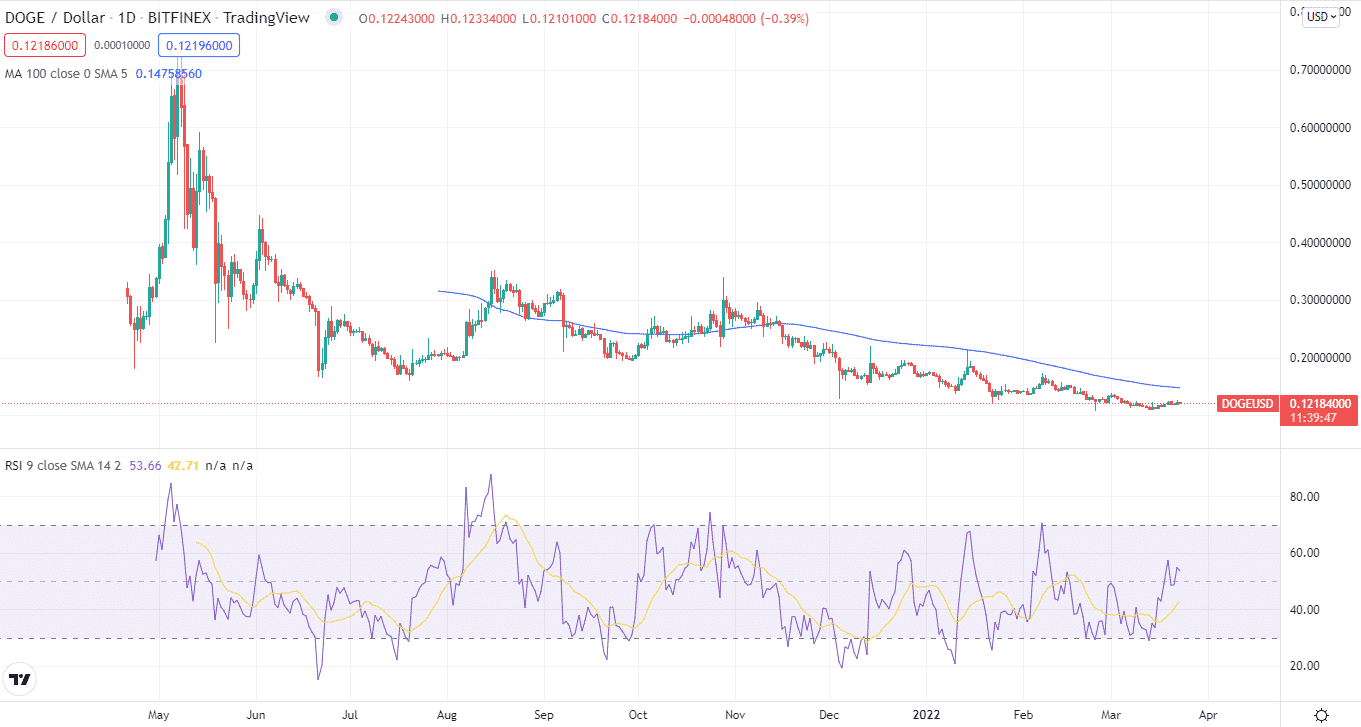

In the world of cryptocurrencies, meme coins are nothing new. For example, DogeCoin, a famous cryptocurrency, was founded in 2013 as a prank based on a popular Shiba-themed meme.

So, they present squeezing opportunities from time to time.

Why does it happen?

The rally for Dogecoin in 2021 has been a resounding success. DOGE’s value has increased by almost 14,000 percent since the beginning.

SHIB and DOGE, with circulation supplies of over 500 trillion and 100 billion coins, respectively, could become more feasible for squeezing due to their scarcity, compared to BTC’s significantly more limited capped quantity of 21 million coins, for example.

How avoid the mistake?

You run the risk of being mistaken about a future squeeze. For example, following failed breakouts, many stellar meme coins lose their value.

Final thoughts

That isn’t to say that shorting individual markets can’t be profitable when the time is right. Although no asset can continue to appreciate indefinitely without a correction, specific markets tend to deviate from the norm. Cryptocurrencies, such as Bitcoin, are an excellent example of market volatility.