Forex trading has gathered all the hype in recent years, but we can see many cases where young traders get lost in the frenzy of rapidly changing market conditions.

This results in significant losses, which can easily be avoided. This is where copy trading comes into the picture. By following the techniques for copy trading, you can start investing with limited knowledge and save your time by learning from the best.

It is the perfect option for a passive income where you can generate considerable profit with minimal effort. According to research, with copy trading, you can gain between 1-15% per month.

This article will discuss the top five tips that will help you successfully benefit from copy trading.

What is social/copy trading?

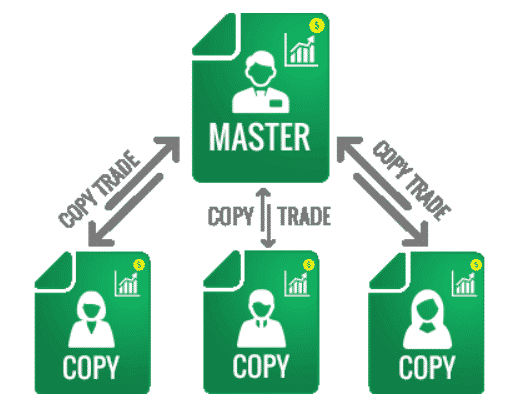

Before we jump on to the tips, you should first know what social trading is. It is a type of trading where investors copy the trading positions of expert traders.

Newbie traders imitate the trading system of a successful trader with one click, and all of their trading positions will replicate in your account. Thus, it is a viable solution for those who want to learn while generating profits.

You need to follow the tips for a successful career as a forex trader through social/copy trading.

Tip 1. Use multiple platforms

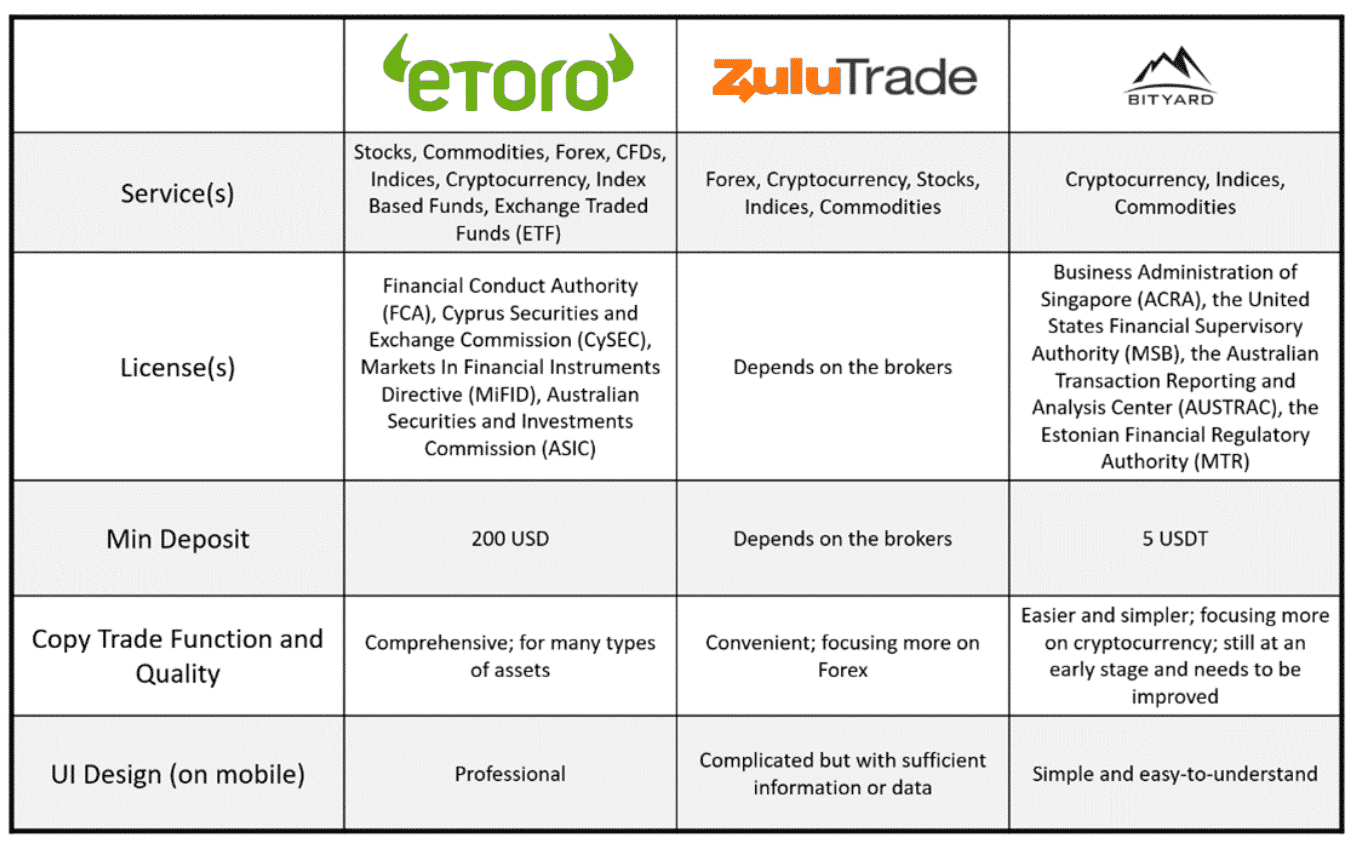

A trader should look into multiple trading platforms to find the best possible copy trader. You have several options available such as MQL, FBS, ZuluTrade, OctaFX, eToro, AvaTrade, and many others.

It is essential to diversify the platforms if you want to gain maximum profits. Unfortunately, the traders who do not adopt this approach often find themselves in trouble.

Why does it happen?

It is hard to find one master trader that suits all of your requirements. Traders usually invest all of their capital with one trader or system, which increases the risk of loss.

If the system fails, you will have to bear heavy losses.

How to avoid the mistake?

You should divide your investment across multiple platforms. This way, if one system fails, you can still generate profit from some other platform. This divides the risk significantly.

Find multiple platforms that suit your trading objectives to make the most out of copy trading.

Tip 2. Minimize your drawdowns

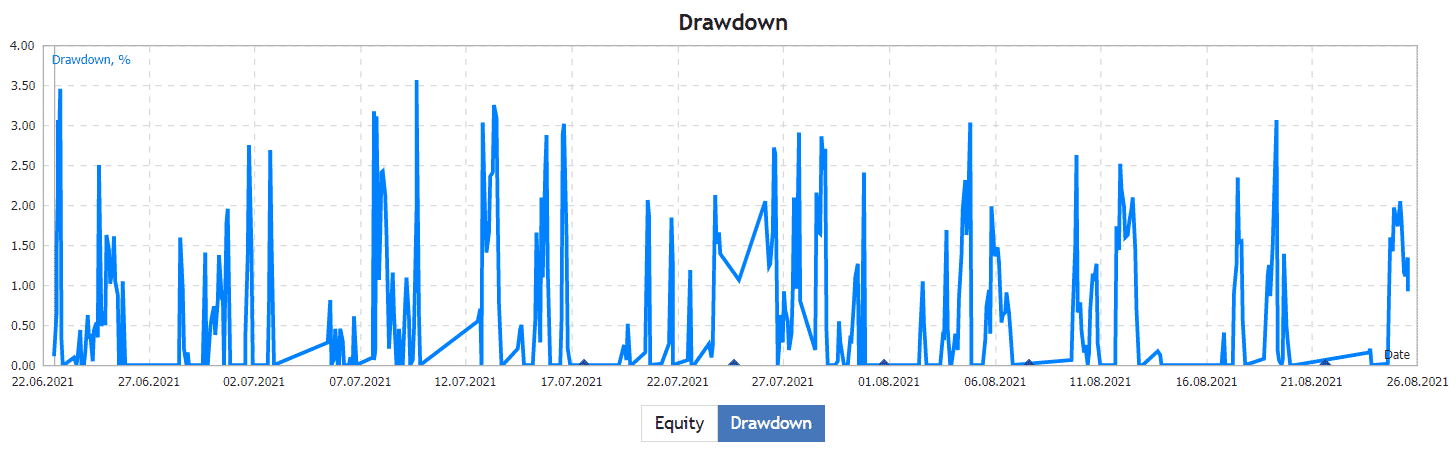

The drawdown is the extent to which your capital can be reduced. It is the difference between the high and low points in the balance of your trading account. The difference represents the loss of capital because of losing trades.

To become an accomplished trader, you need to keep the drawdowns as low as possible, or else all of your investment will go in vain.

Why does it happen?

Traders keep a check on the profits of a master trader but skip over the drawdown, which is why they fail to manage risk efficiently.

In addition to that, they might choose platforms that show constant fluctuations in drawdowns. This can be another reason for unpredictable losses.

How to avoid the mistake?

Choose the master trader that shows consistent drawdowns. For example, a system that represents 2-3% drawdown one month and 20-30% the next month is unstable and poses a greater risk of losses.

The maximum drawdown of a system should be 15%. Anything greater than that is troublesome.

Tip 3. Track monthly gains

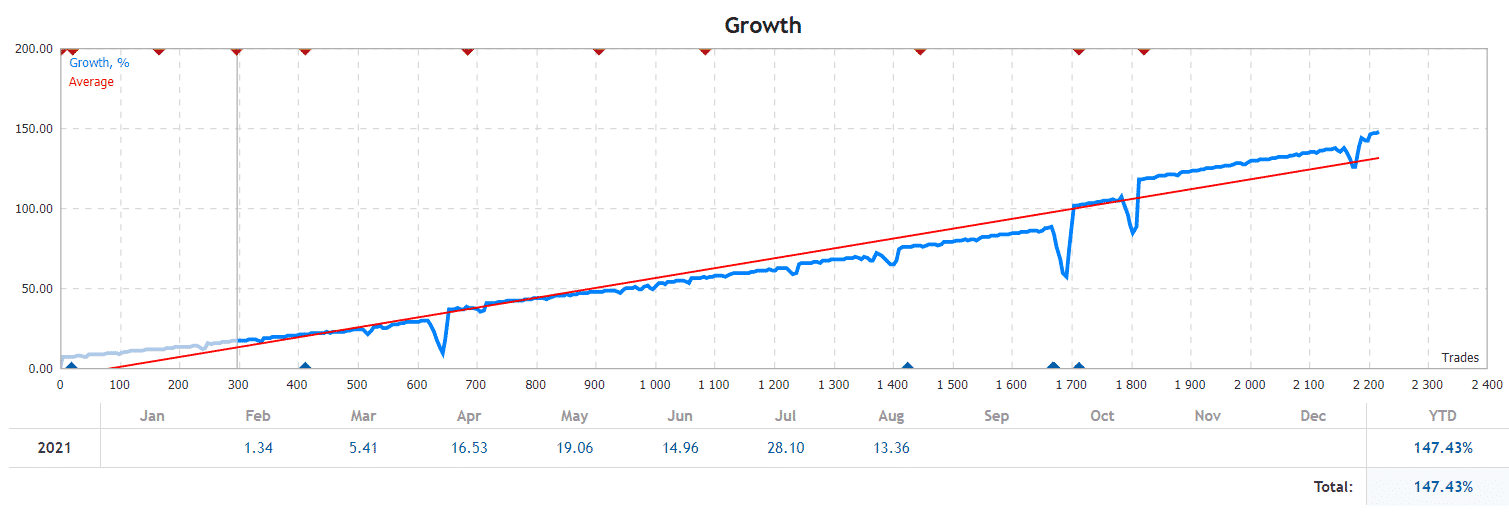

Monthly gains are the profits you generate from your trades every month. This varies from system to system. While deciding upon your master trader for copy trading, you should track the monthly gains of the system.

You must observe their record of at least one year before making a decision. Traders who skip over the tracking out of haste regret later.

Why does that happen?

When traders do not run a background check before investing, they are automatically more vulnerable to losses.

Most investors check the monthly gains of the previous one or two months, which can be misleading. For example, a trading platform that shows a gain of 10% one month and 2% the other and then rises to 5% the next month is unreliable.

How to avoid the mistake?

First and foremost, whatever system you choose to copy shall have a track record of at least one year. Secondly, it should reflect consistent gains over the months.

The account needs to be stable even if the monthly gains are low. For example, if an account shows monthly gains ranging from 8-12% where the average is 10% gains, you can deem it fairly reliable.

Tip 4. Reduce the risk of ruin

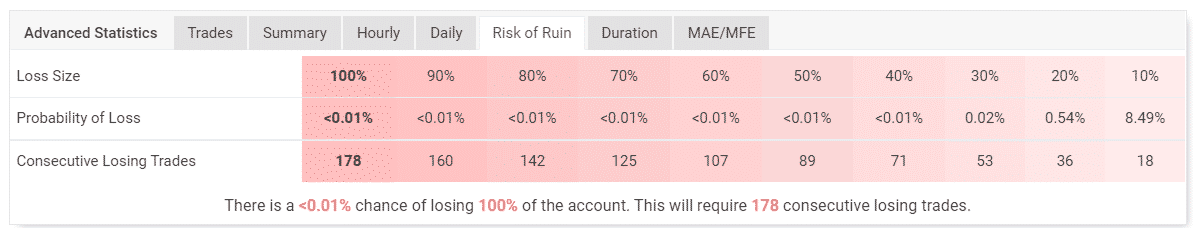

It is the probability of a system losing an irrecoverable amount of money while trading. In other words, the risk of losing 100% of your equity is called the risk of ruin.

For instance, if the risk of ruin of a system is 10%, it means there is a 10% chance that the system will collapse completely as a result of a trade.

Why does it happen?

Traders who have a high-risk appetite opt for high-risk copy systems. However, such accounts also have a greater risk of ruin, which can be troublesome for traders.

Moreover, My FxBook has a risk of ruin calculator, but most platforms do not, so investors miss this part.

How to avoid the mistake?

Keep a check on the risk of ruin of a platform before investing. Choose a platform that has lower than 5% chances of ruin.

Study the trading history to confirm that the trading volume is consistent. Lastly, if a system does not have a ruin calculator, you can evaluate the risk by combining your drawdowns and monthly gains.

Tip 5. Carry a cost analysis

It would help if you carried a cost analysis to make financially efficient decisions. It compares the amount you are investing in getting a copy trading account to the profit you make.

Traders that do not analyze their costs are more likely to face problems.

Why does it happen?

Let’s try to understand this situation with an example. Suppose you open a copy trading account for $500 and make an average monthly gain of 10%, which will be $50.

Now, if your subscription cost for copying the system is $50, your entire profit will go there, and you won’t be left with anything to spare. This is not a good deal.

How to avoid the mistake?

First, you need to compare your subscription cost to your initial capital to evaluate the benefits.

Secondly, you can increase your investment to maximize the gains. Lastly, you can avoid platforms that have fixed costs. Instead, opt for platforms that demand a share from the gains.

For example, if you made a profit of $1, you’ll have to give a certain percentage of that, say 10 cents, to the platform.

Final thoughts

Copy trading is a good technique for amateur traders. Newbies can benefit from their experience and make fewer mistakes compared to fellow beginners.

Not only that, once you have been following experts for some time, you will understand how the market works. You can then make a strategy for yourself that suits your trading objectives.