Automation is the future. Like every industry, robots have started spreading their roots in trading as well. If you want to know how you can employ robots in your trading business, keep reading because we have shortlisted five of the best tips for that.

What are robots in forex trading?

In forex, a trading robot is a computer-based system that uses forex trading signals to decide whether to buy/sell a specific currency pair at a given point in time.

Tip 1. Use strategy tester for a robot

Trading heavily depends upon the strategy you use. First, however, you need to test it to find the best working model for yourself.

With a strategy tester, you can improve your auto trading techniques before actually using them. These testers evaluate the technique using historical data and summarize the winning and losing positions with specific metrics.

Why does it happen?

Like everything else, using automation in forex has its pros and cons. Investors do not conduct thorough market research before running a robot on a live account which is why they can never truly rely on it.

Moreover, you need sufficient previous data to obtain reliable results from a tester. Unfortunately, this is what most traders miss out on.

How to avoid the mistake?

You will have to combine the strategy tester with different settings and instruments to get authentic and well-grounded information. One of the most popular testers is MetaTrader4.

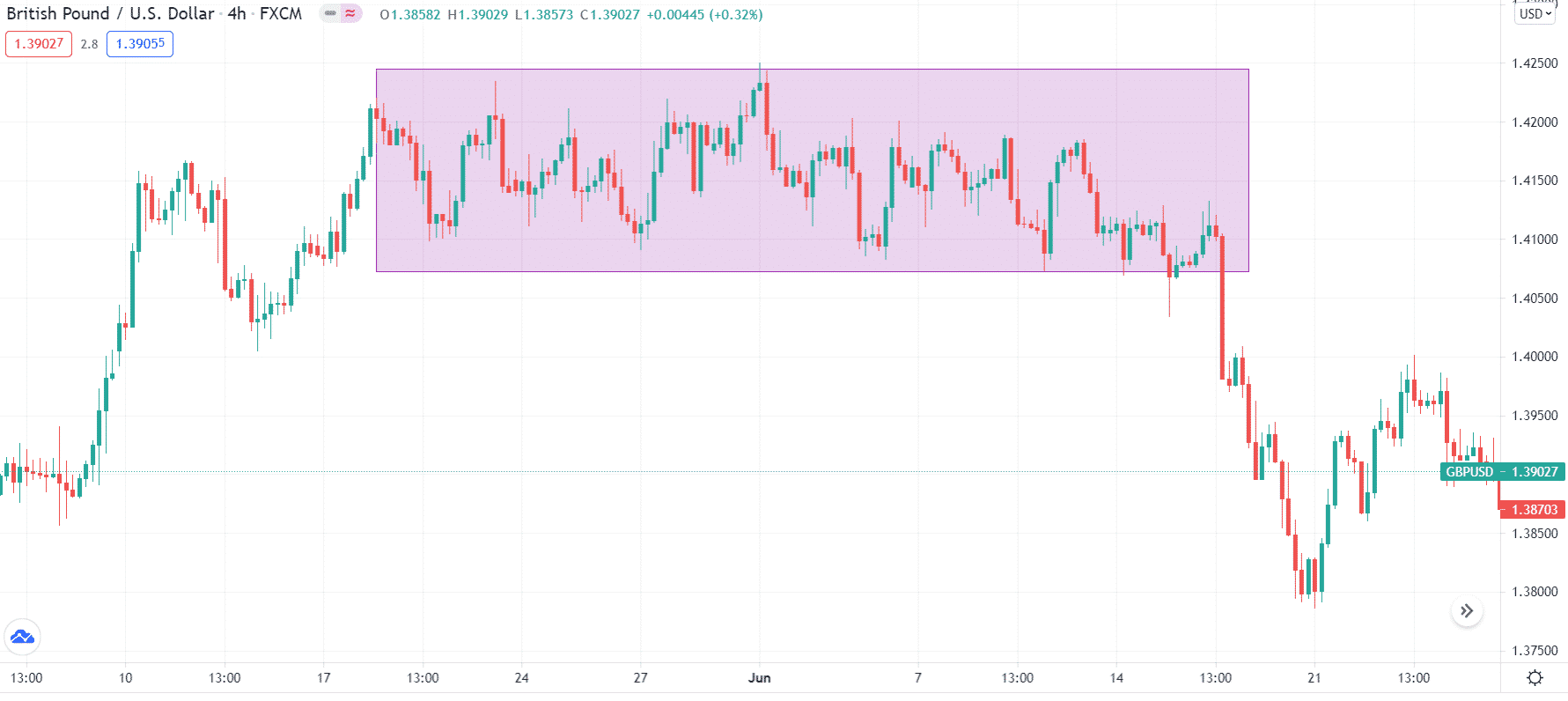

Let’s further elaborate this with an example. If your robot works in ranging markets, what happens if the price breaks a range with a stronger trend?

You have to collect data like how many times such a trend occurs and your potential losses in such scenarios. You can also estimate the drawdown and devise a mechanism to cope with it.

Tip 2. Drawdown calculation in robot testing

Drawdown is a common method to calculate the total loss, incurred or floating, to your account. It shows the risk that comes with any investment.

There are two types of it:

- One is the drawdown calculation that you do with historical data through a strategy tester.

- The second is where you run a live demo account and evaluate the drawdown.

The essential rule to making it big in the forex business is to control your drawdowns. But, unfortunately, this is where most traders fail.

Why does it happen?

Inexperienced investors mostly load too much risk in hopes of making large sums of money. Successful forex trading is about maintaining a balance between gaining profits and preserving your capital by minimizing losses.

How to avoid the mistake?

If the drawdowns are high, you need to change the presets and play around with instruments. Risks are inevitable, but you have to keep them as low as possible.

The question here is, how much of your capital should you risk per trade? There is no hard and fast rule to it. The decision depends entirely on your risk-bearing abilities. However, it is advised to risk less than 2% of your balance.

It would help if you reduced the drawdown with each subsequent loss. Once you recover, you will be in a better position to take risks.

Set a weekly or monthly drawdown limit for yourself. For example, if you risk 1% of your balance per trade, you can set a limit of 7% drawdown per month. Once you get that percentage, you discontinue trading until the next month. Once your robot closes seven straight losses or cumulatively reaches a 7% drawdown, it can stop trading automatically. You can feed all these settings in your robot once you have adequate data.

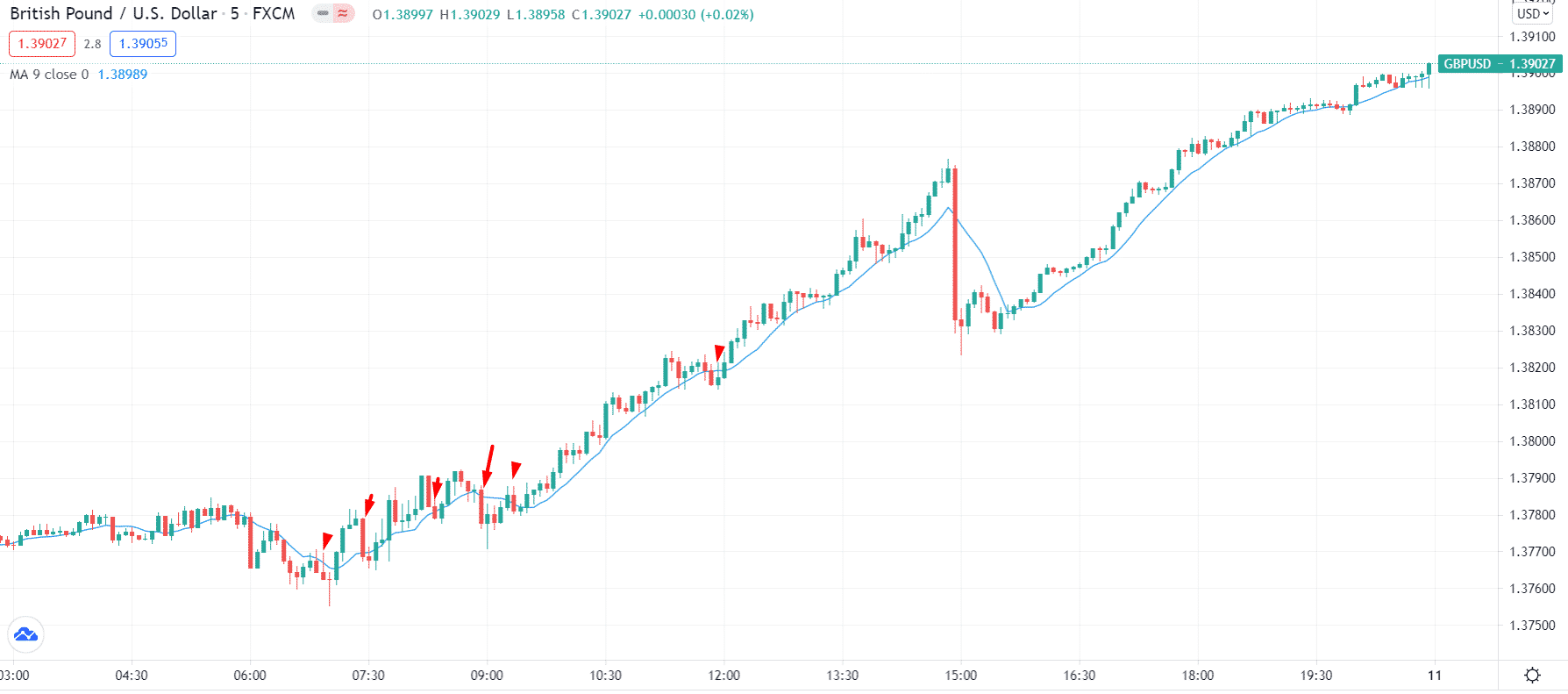

Look at the above chart. It shows five-minute robot trading based on the moving average (period nine). The chart shows short position entries that turned bad. Such frequent losses can give you a significant drawdown. Staying neutral after some losses can give you better results later.

Lastly, sometimes you need to lose the battle to win the war. If nothing works out, take a momentary break from trading. Study the market, analyze your method in this period and come back stronger.

Tip 3. Consecutive wins and losses

Your winning to losing ratio decides the dynamics of your trading. When you run a strategy test or test live data, notice how many consecutive wins and consecutive losses you are getting. Traders who keep on investing blindly end up in hot waters.

Why does it happen?

As an investor, you have to keep a tab on your previous activities. When investors do not evaluate their win-loss ratio, they find themselves in a situation where calculating decisions is out of the question.

They do not have historical data to analyze their technique.

How to avoid the mistake?

Track your wins and losses to take strategically correct steps in the future. First, calculate your percentage win rate. It is how many trades you are making money in versus how many trades you are losing money in.

Alternate wins and losses counterbalance each other. So, for example, if you say 50% of your trades are winning, 50% of your trades are losing, which is not very profitable.

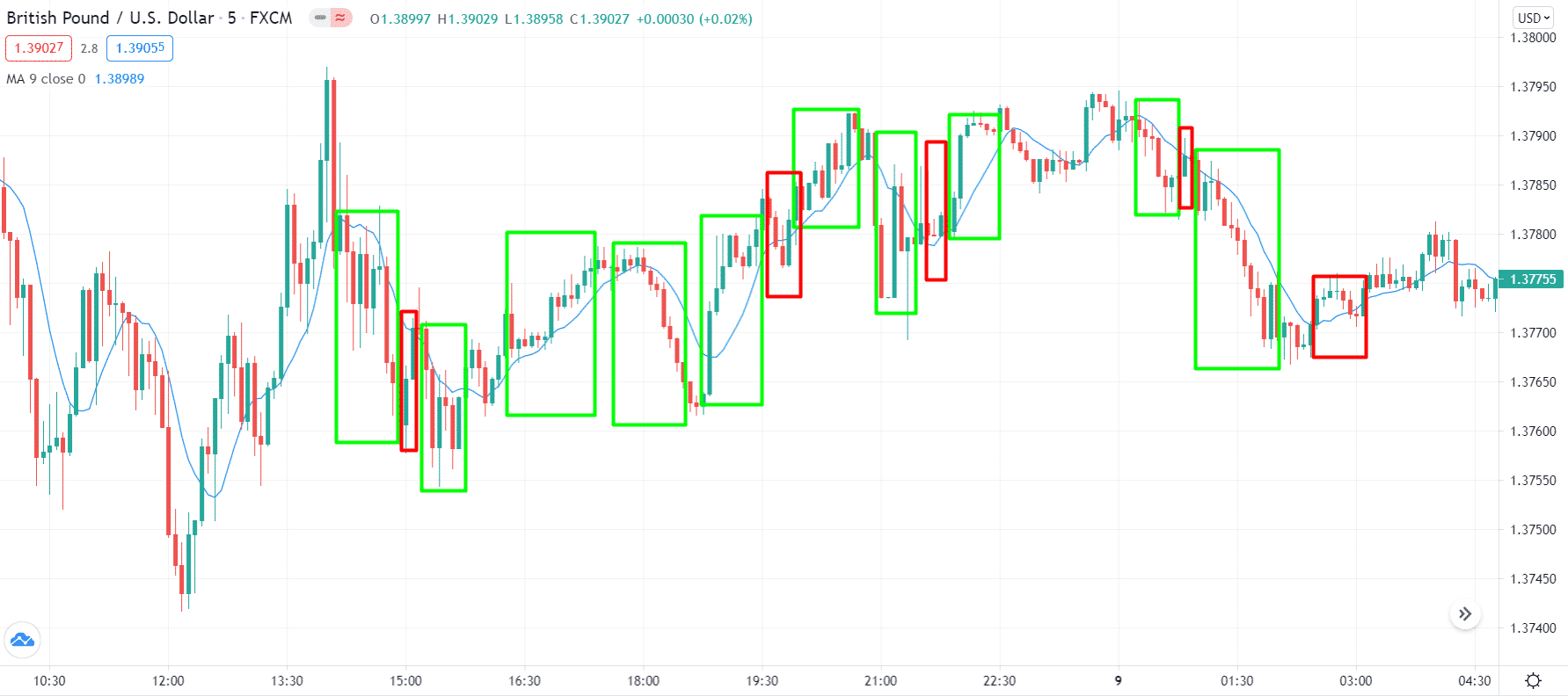

Like the above chart shows wins (green box) and losses (red box). The auto trading strategy shows that we have more consecutive wins than losses.

Consecutive losses are an alarming situation because that means the drawdowns are pretty high. On the other hand, successive wins are a good signal since it means you have a large margin for recovery.

Tip 4. Try different presets

Experimentation can lead to surprisingly good outcomes, which is why you should try different presets. But, unfortunately, traders usually fail to benefit from this tip.

Why does it happen?

Most investors stick to one preset and are afraid of trying something new. This might help them, but in the long run, they will be deprived of success.

How to avoid the mistake?

You have to keep altering your presets. For example, change your time frame, switch trading instruments, play with the robot’s entry and exit points.

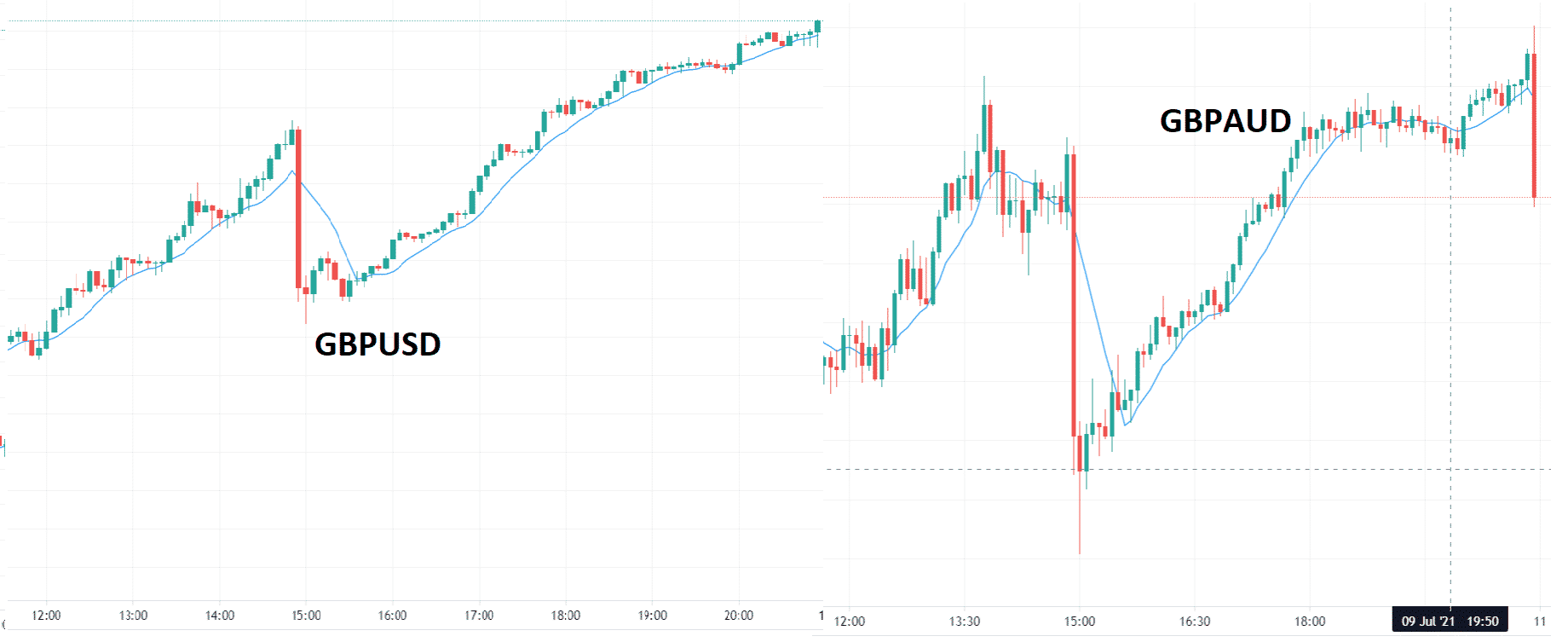

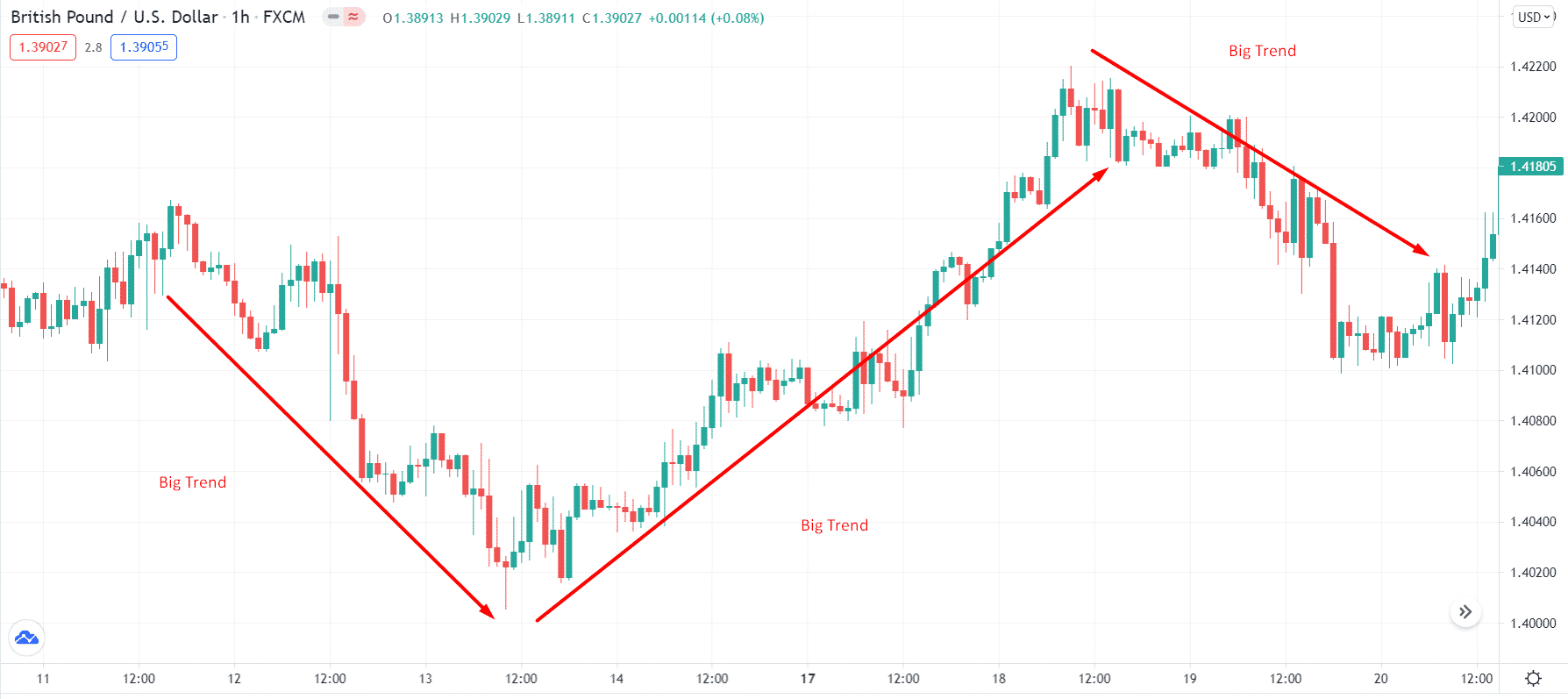

Look at the above comparison. The GBP/AUD and the GBP/USD show different dynamics on different timeframes.

You will acquire different results each time which will provide you with more room for inspection. The more you research, the more insight you will have. Subsequently, you will be able to optimize your trades better.

Tip 5. Equity SL in robot trading

This is an automated solution to the problem defined in tip two. If the drawdowns are not coming under control, you can install equity stop loss (SL) in the system.

Why does it happen?

Investors continue handling everything manually, which might harm their business. On the other hand, robots may not have the option of equity SL to protect your capital from further losses.

How to avoid the mistake?

Using an automated system like the one mentioned will help in mitigating the risk. For example, you can set an estimated risk extent, and the robot will automatically close the trade once the limit is reached.

For example, if your robot is based on the martingale technique. Look at the above chart. You may end up losing all of your money if you find such trends that resultantly open multiple positions ending up in losses.

Final thoughts

Using an FX robot has many pros. What sounds better than you vacationing on a beach while the software manages all your trades? As much as they will make your trading life more accessible, robots are not for beginners. Acquire some real-life exposure in the market and then take automated assistance.