Investing in the FX market is becoming popular day by day. Any individual trader can make limitless profit from this market by obeying some textbook rules and following appropriate strategies, including money and trade management.

Anyway, it is a market with the most considerable liquidity, so the currency market or FX market is volatile. It is not always easy to survive in the FX market with a tiny account without a proper strategy. However, building or mastering the right potentially profitable strategy requires time, research, practice, and affordance. Most newcomers in this market are losing money for lack of appropriate strategy.

Let’s discuss the top five investment strategies in trading, which will help you make your strategy invincible and improve your observation capacity during analysis.

Is investment profitable in the forex market?

The FX market is a highly profitable marketplace that has the potentiality to multiply your investment within a short time. It is not like the stock market, where you can only make money when the price is moving upward.

No matter where the direction is, upward or downward, you can make money from both types of price directions of any currency pair. There are traders with deep pockets making enormous amounts of money from hedge funds managements. It requires excellent skills to be a successful forex trader.

However, the FX is more likely a place for banks and financial institutions. Although it is a decentralized marketplace, it involves the highest liquidity, so it faces volatility. Most of the individual traders are losing money in this risky market, so it can cause you to lose your whole capital. It always requires fine skill and sound money management to become a successful forex trader.

Overall, this market is suitable for both trading and investing. You can buy an asset and hold it for years as an investment without any hassle.

Top five strategies for the FX

We list the top five strategies to trade in this area, which techniques are popular and frequently choosable among professional forex traders.

1. Higher time frame trading

The main participants of this market are banks and financial institutions. The trading style is not the same for institutions and individual traders. So we suggest doing a multi time frame analysis while making trade decisions.

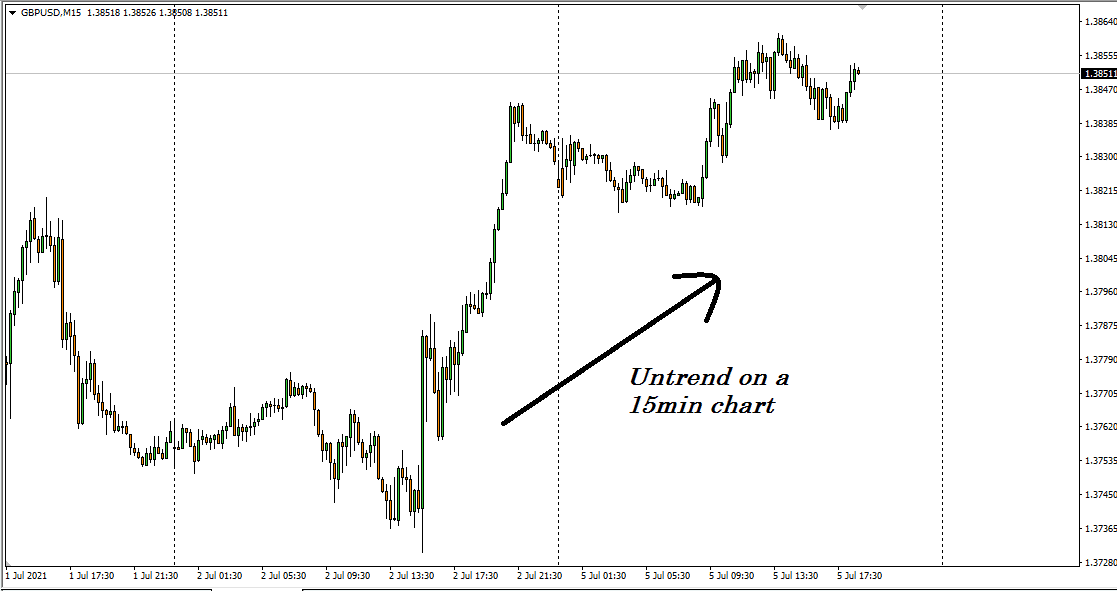

The figure above shows a 15-min chart of GBP/USD. On the chart of 15-min, the price is on an uptrend. A novice trader or scalper might look at the 15 min chart and seek to put buy orders to have a profit of 10-50 pips.

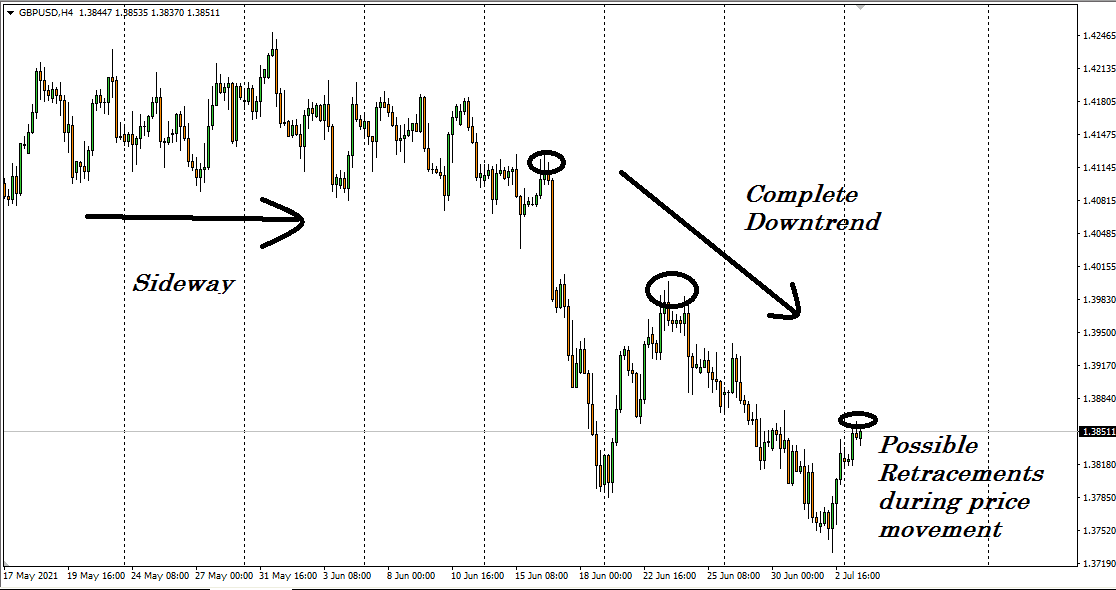

On the other hand, the 4-hour showing the whole recent uptrend of the previous figure (15min chart) is just a slight retracement of a downtrend price movement. Who is looking at the 4-hour chart may be looking for a sell order for maybe 100-200 pips or more than that. So it’s always better to use multi time frame analysis and check the price direction of upper time frame charts before making any order.

For the investment approach, you can build a trading strategy for H4, the daily or weekly time frame where you do position trading monthly and quarterly.

2. Fundamental trading

Besides many other technical factors, macroeconomic and socioeconomic fundamental factors affect currency prices. Many economic events such as GDP data, interest rate decisions, job data, etc., put an impact for a certain period on currency exchange rates with other currencies. Smart traders always keep updated about the economic events of related currencies.

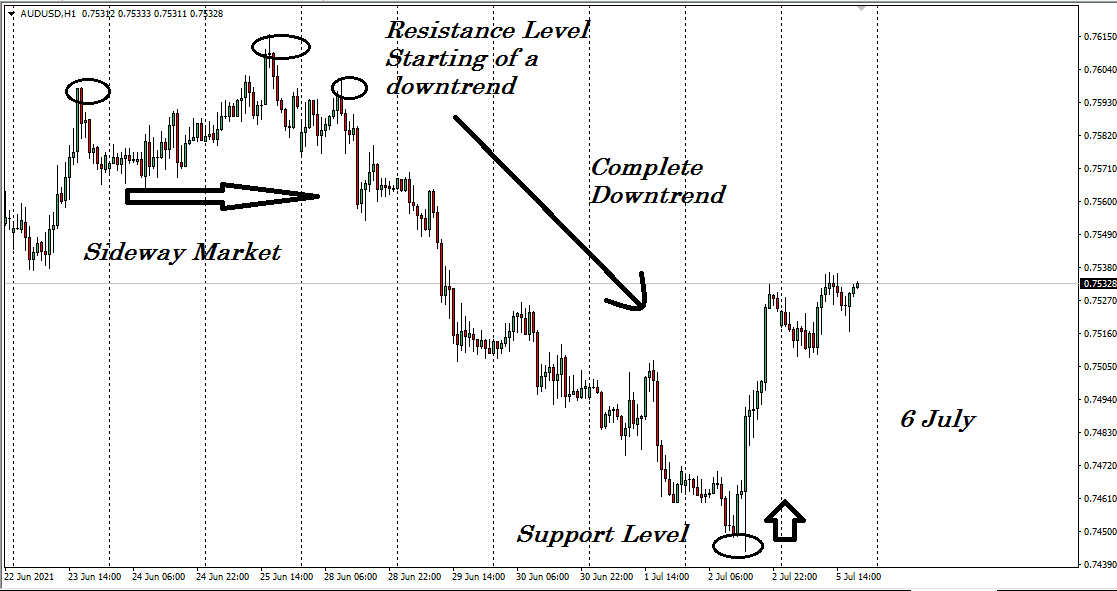

Observing the figures above clearly shows the sellers of the AUD/USD pair stops selling just before the RBA rate statement data release. Suppose they change the rate so there would be a dramatic price movement. Otherwise, the price may continue to go further downward for an unchanged rate.

3. Wyckoff trading

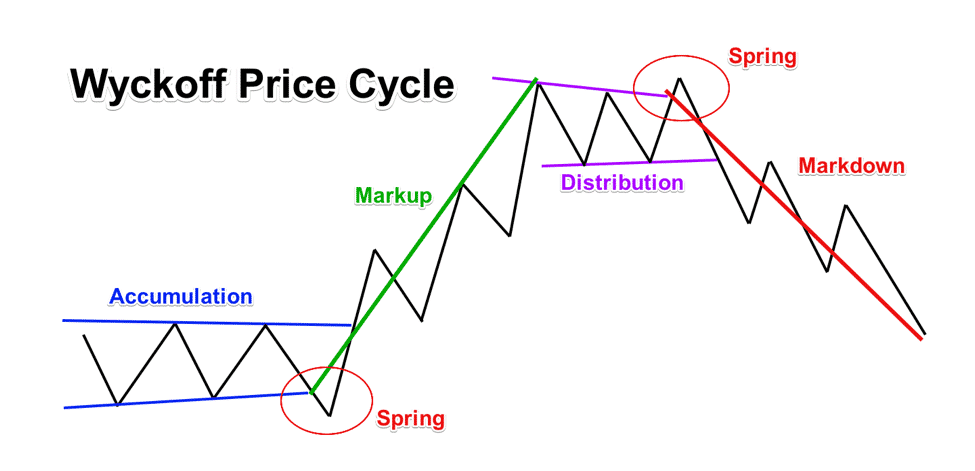

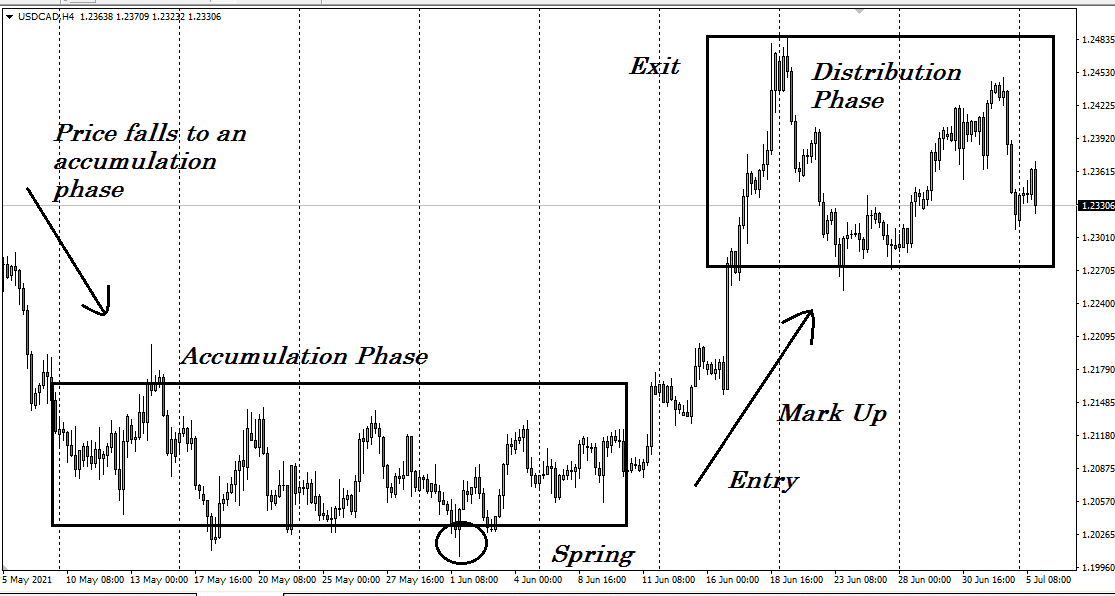

During the price movement at the FX market, it always follows some patterns. Wyckoff trading concept helps you to understand the ‘smart money’ and ‘dumb money concept.’ Smart money moves by following some designs, and there are some common phrases that price movement creates.

The accumulation and the distribution phases are standard terms in the forex market. Between these two phases, the price goes up or down for a particular currency pair. Moreover, it shows the supply and demand relationship with the price movement.

The figure above shows the Wyckoff price cycle. Now, look at a 4hour chart of USD/CAD below for better understanding.

Price falls from somewhere and remains at the accumulation phase. Then it goes straight up with the increasing demand, and the distribution occurs. When the distribution phase makes another sharp movement over the price, either more upside or Markoff will happen.

So the theory is simple:

- For long trades, identify the accumulation phase and the spring point. Then place a buy order with an initial stop loss below the spring point. So the exit or take profit level will be near the top of the distribution phase.

- For short trading positions, the scenario is just the opposite.

4. Elliot wave strategy

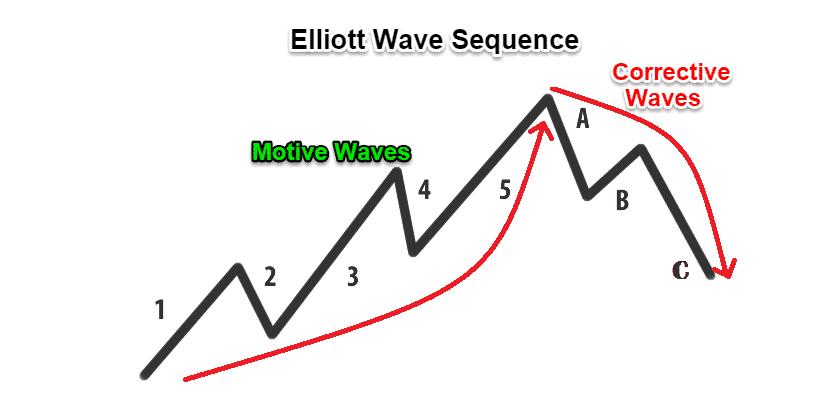

There are two types of waves at the Elliot wave trading. The first five waves are in the same direction as the trend. Traders also call these first 1-5 waves of this Elliot wave method as motive waves. In comparison, the other three waves at the Elliot wave represent the corrective phase against the first five waves.

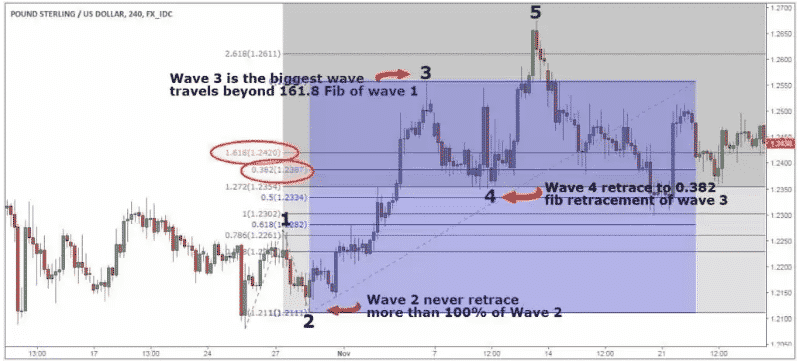

The figure above shows the price movement of the Elliot wave technique. This method uses the Fibonacci retracement tool to identify the waves.

Rules of Elliot wave strategy:

- Wave 2 is never retracing more than 100% retracement level of wave 1.

- Similarly, the fourth wave never retraces more than 100% of wave 3.

- Wave 3 must be a larger wave than the previous two, and it is more likely near the 161% retracement level of wave 1.

The figure above shows the Fibonacci level corresponding to the waves of the Elliot wave strategy.

5. Copy trading

The last way of investing in forex is copy trading. For traders who don’t have much time to learn to trade, copy trading is a good option. It is simply following the action of expert traders. For example, suppose someone, an expert trader with a good portfolio, makes a buy entry at EUR/USD pair for 80 pips. A copy trader also puts a buy order at the EUR/USD pair.

However, you have to be careful to choose who you follow. Must check the portfolio, trading style, and match that suits your expectations before copy their trades.

Final thoughts

Finally, now you know some best strategies to survive in the FX market. Mastering the concepts is more complex than how it seems now. We suggest practicing more and verify the strategy before adopting it on your trading account.