Forex is a complicated market that is not easy to predict. Therefore, foreseeing the market might be a difficult task; nevertheless, it’s not impossible.

The rapid market movements, ever-changing conditions, rising numbers, and tons of cash can be a little overwhelming for beginners, but here’s the thing, with time and dedication, one can climb even the toughest peaks.

Not knowing something is not a hurdle because there’s nothing that you cannot learn. We have compiled a list of the top five forex trading tips for beginners, which will tell you everything you need before venturing into the business.

Tip 1. Learn microstructure

The microstructure is the study of financial markets and how they operate. American economist Maureen Patricia O’Hara defines it as “the study of the process and outcomes of exchanging assets under explicit trading rules.”

Every beginner needs to learn the market microstructure. Look at it this way. How can you predict the market movements when you do not know what moves the market? Exactly, so equip yourself with the required market knowledge.

Most beginners miss out on this point.

Why does it happen?

Forex is a tempting market. But, in the haste of making money, they dive straight into investing without studying the market structure.

This results in substantial losses.

How to avoid the mistake?

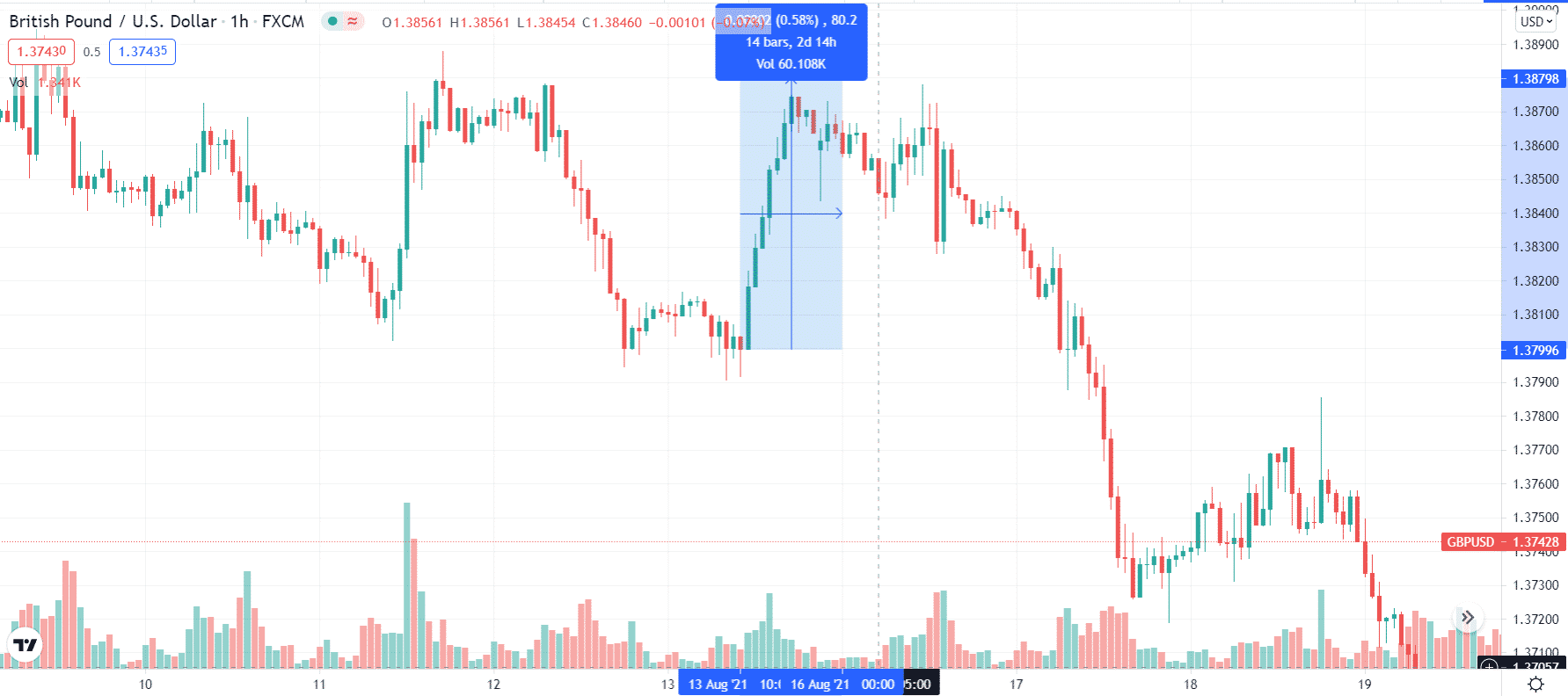

Market microstructure is relevant to your daily trading. You can relate it to your trading charts. For example, volatility shoots when the London session opens on a GBP/USD chart because most high-volume traders initiate their positions.

Tip 2. Learn fundamental analysis

It analyses the market based on political, social, and economic factors that may affect currency prices.

Beginners need to develop a thorough understanding of it and carry out fundamental analysis before opening a trade. It helps traders predict long-term trends in the market.

Traders who neglect this point often regret it later.

Why does it happen?

Beginners rely too much on technical analysis. As efficient as it is, this analysis alone is not enough.

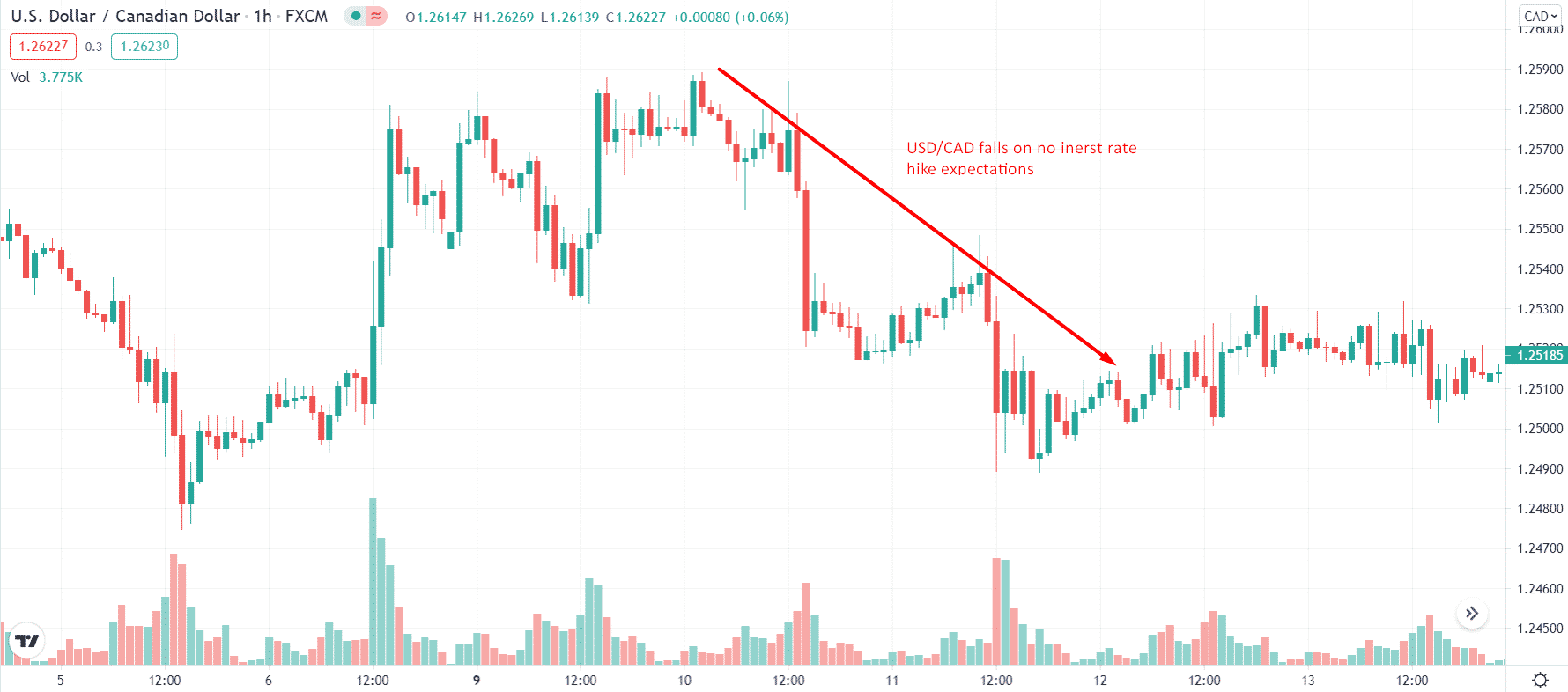

Fundamental events such as consumer price index, interest rate, NFP report, etc., have the potential to change the market direction. In fact, a fundamental setup can entirely fail any technical setup.

How to avoid the mistake?

Keep an eye on critical events such as employment reports, inflation reports, interest rates, recession, etc. All these factors control the market movements.

For example, if the interest rate is going higher and the US increases its interest rate, then the US dollar appreciates. However, if the US lowers the interest rate, the value of USD depreciates.

Once you get an understanding of these factors, predicting market fluctuations won’t be complex.

Secondly, use an economic calendar to stay updated on important dates and releases.

Tip. 3 Learn technical analysis

In the last point, we have emphasized fundamental analysis. However, that doesn’t mean you can neglect technical analysis. In fact, technical analysis is a beginner’s best friend in trading.

It is the study of historical data to recognize patterns that will help you predict future market trends.

Why does it happen?

Traders fail when they start depending too much on statistical and mathematical indicators. Indicators are not always correct.

If you start trusting indicators to the extent that you start believing the results absolutely, you won’t be able to prepare for unexpected events.

How to avoid the mistake?

First of all, direct your focus towards support/resistance and supply/demand levels. Minor support or resistance provides an analytical understanding and possible trading opportunities.

On the other hand, major support/resistance levels are responsible for trend reversals. Therefore, a beginner needs to keep up with all this information to stay ahead of the market movements.

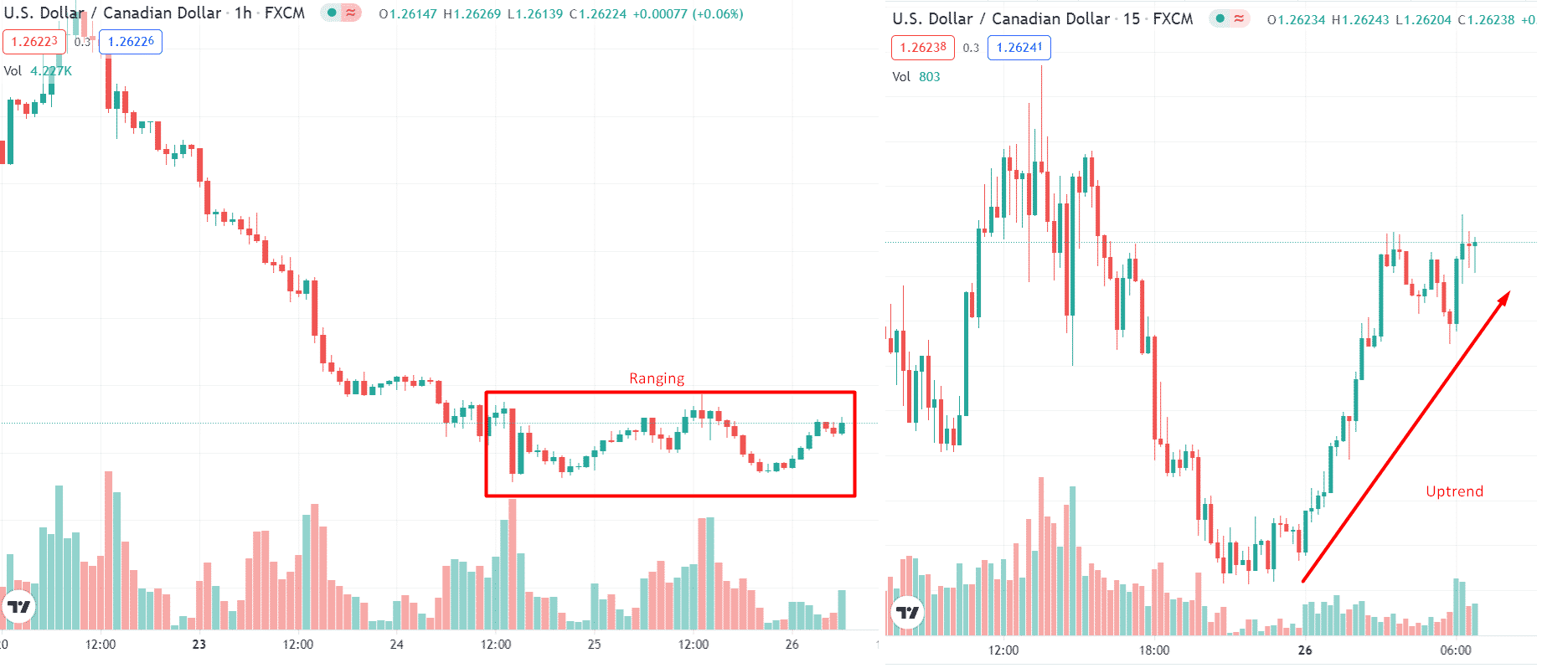

Second of all, you must check your currency pair through different time frames to test reliability. If different time frames align, you can trust technical analysis and proceed further.

Tip 4. Learn tested trading systems

Rather than building a trading system of their own, beginners should learn a tested trading system. Novice traders with their meager knowledge and little experience are less likely to build effective systems.

A better option is to learn the systems that have already been tried and tested. Not only will this save time but produce efficient results as well.

Why does it happen?

Traders try inventing their systems from scratch, which takes multiple days and months in backtesting and requires a lot of effort.

How to avoid the mistake?

Beginners should adopt a tested system that has verified results. You must look for a system that fellow traders have tried. It is even better if it has been both backtested and live tested.

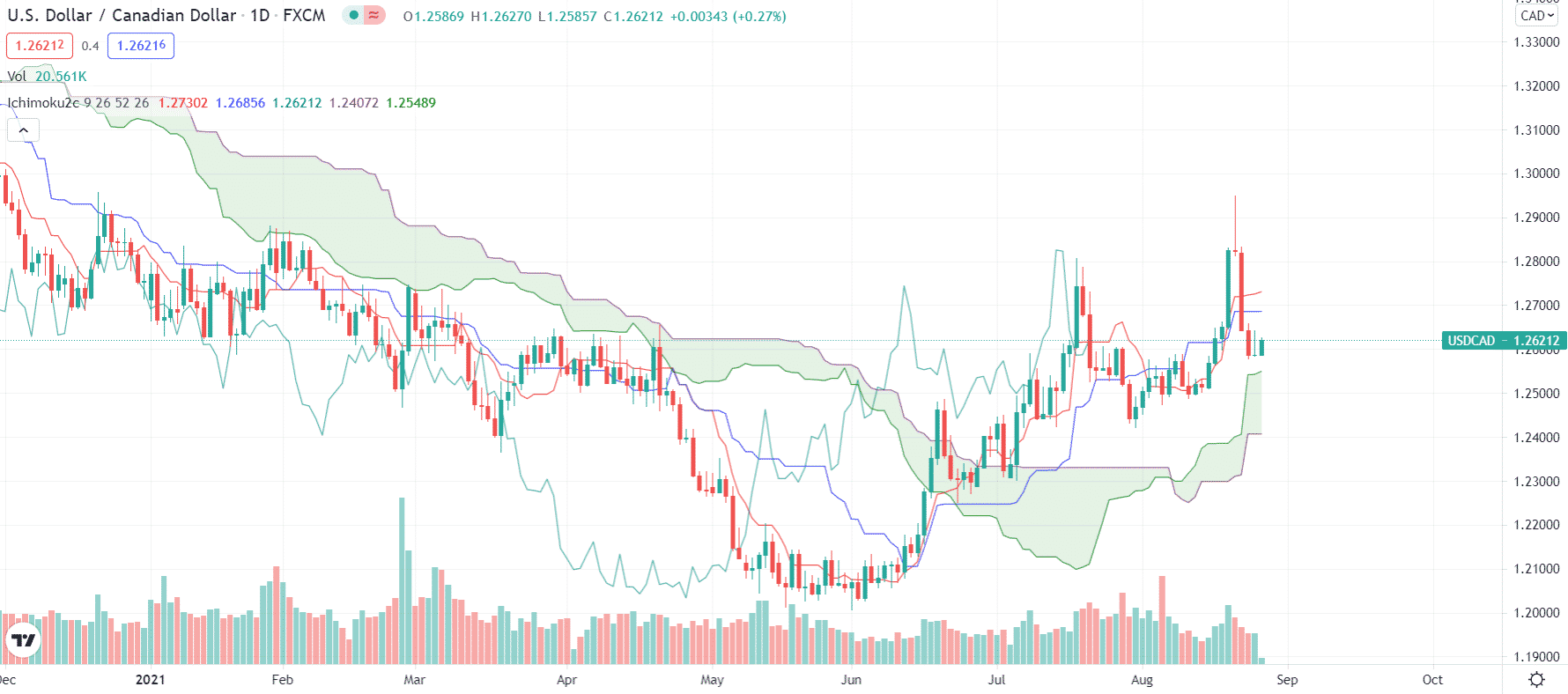

Systems such as Ichimoku are an excellent option for beginners.

Tip 5. Avoid herd behavior

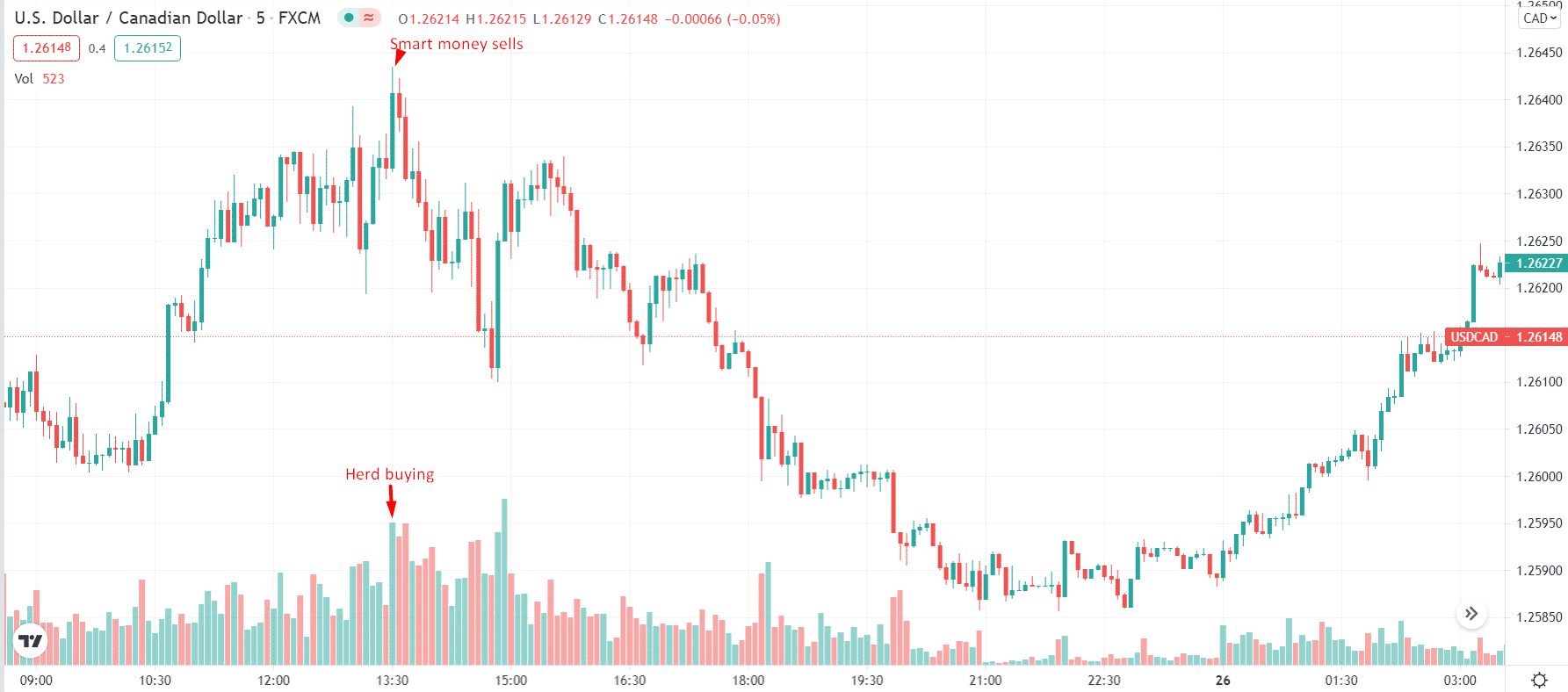

Herd behavior is when the majority of the traders start moving in the same direction. It is a phenomenon where people blindly follow the trend of the masses.

For instance, suppose the dollar is going strong, and the majority starts buying it. When the cumulative retail volume gets engaged in dollar buying, giant traders sell at the highest points. If the selling ratio exceeds the buying ratio, buyers will automatically bear losses.

Hence, traders that jump onto the bandwagon without much thought eventually end in hot waters.

Why does it happen?

Forex is an unexpected market where the market conditions can change in a flash. But, unfortunately, herd behavior makes this otherwise complicated affair look too simple to be true.

Invalidating your own opinion in the pursuit of the majority can lead you to disastrous results because the crowd is temperamental, and emotions don’t go well with trading.

How to avoid the mistake?

You need to align all of your analysis which includes all the steps mentioned above. Then, when you combine all the factors, you will make a rational decision based on research and study. Especially, try to learn the volume analysis that may help you avoid herd behavior.

Final thoughts

Forex trading could prove to be a game-changer for a lot of people. First, however, you must remember it’s not an easy road. Nevertheless, you can soon escalate the steps from a beginner to an expert trader with the right strategy and decisions.

Just stay calm, study the market intricacies, and never give up.