There is one type of trading strategy that many consider risk-free. That is triangular arbitrage, a form of forex arbitrage. This opportunity comes about due to market inefficiencies that surface now and then.

This trading method involves a threefold conversion of currencies. The aim is to catch a few points in a matter of seconds. Plus, you need a large capital to make a good income because each trade returns minimal gains in terms of points. Therefore, to use this method successfully, you must use an algorithm and a powerful computer to find and capitalize on these rare opportunities.

You might wonder if arbitrage is right for you. Because of the challenging requirements, this strategy is often out of reach for ordinary traders. If you know how to code an expert advisor and someone can provide capital, you might be able to break into this unique business.

Let’s learn how to implement the arbitrage strategy. You will know the risks you must face to succeed in this business.

What is triangular arbitrage?

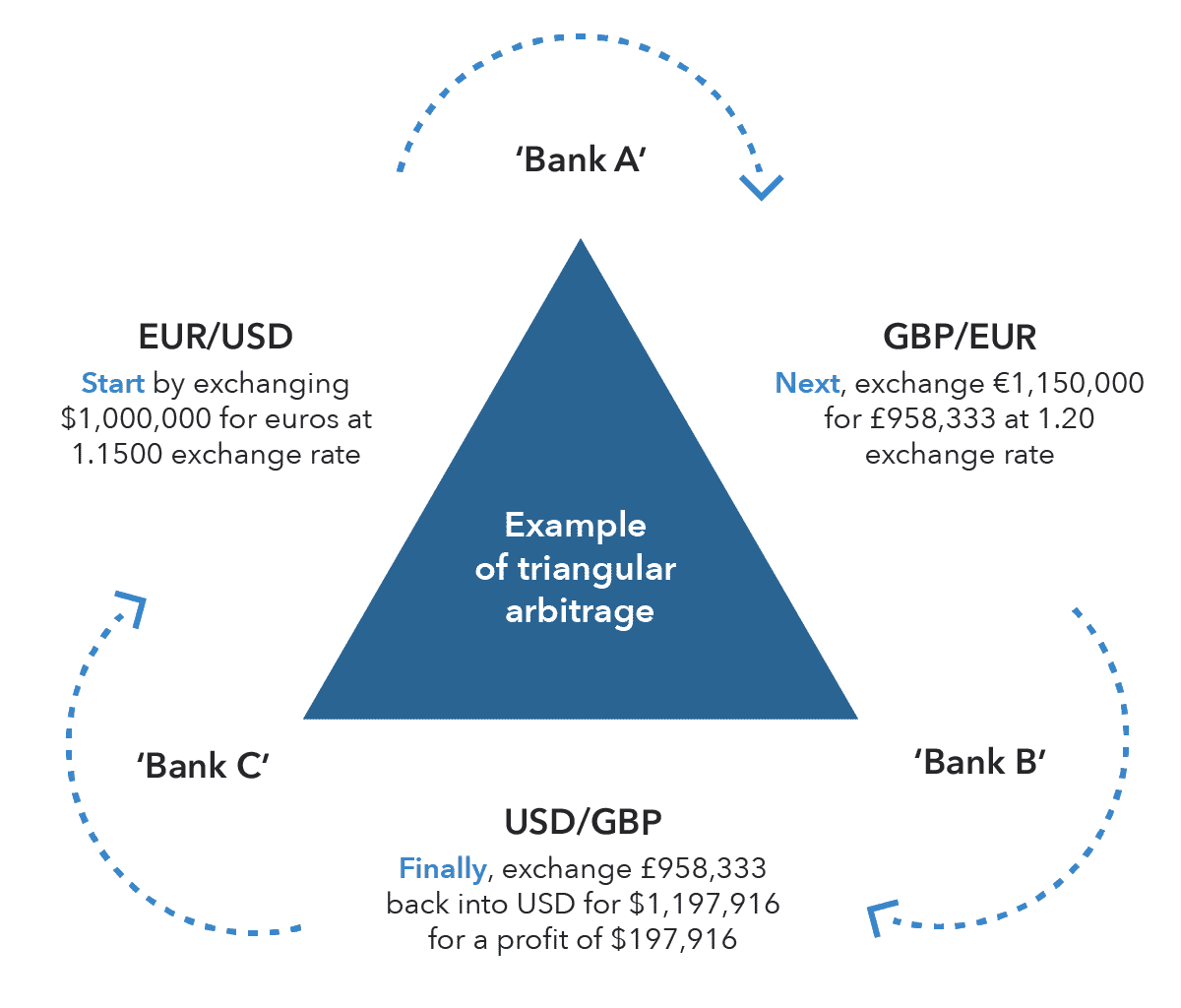

A form of arbitrage, triangular arbitrage involves three currencies. It occurs when there is an imbalance in the exchange rates of the three currencies. To generate profits, the trader has to make three conversions from the first to the second to the third and back to the first currency.

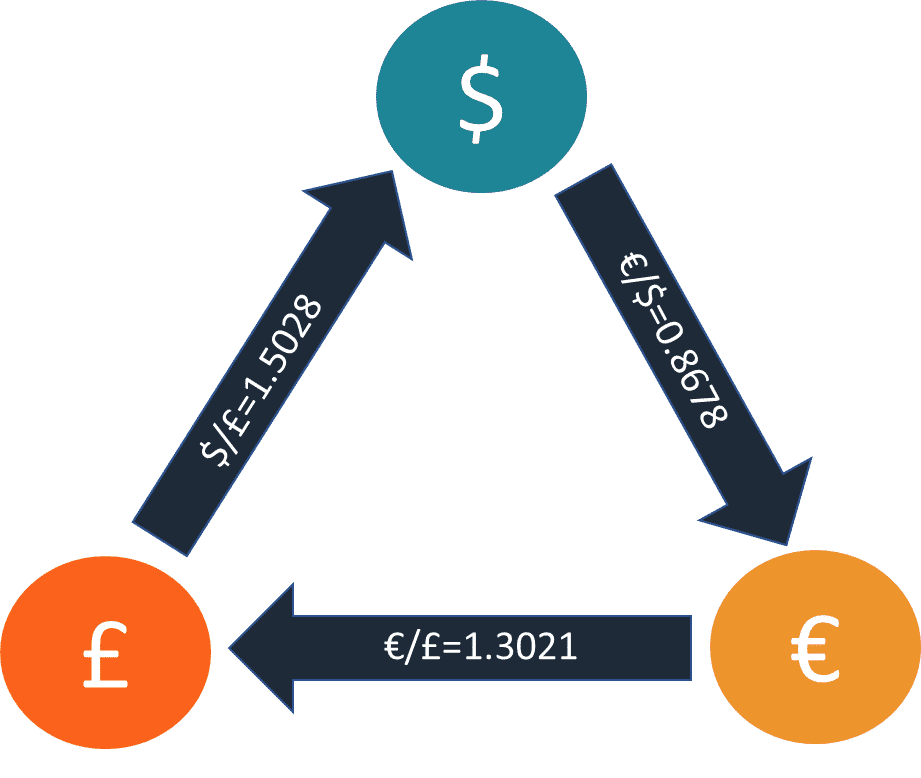

To form a three-pair arbitrage, take any three currencies, e.g., EUR, USD, and JPY. You can form three currency pairs from these currencies: EUR/USD, USD/JPY, and EUR/JPY. Refer to the diagram below.

To make a profit through arbitrage, take one currency as the first currency. Let us take EUR as the arbitrary currency. Convert EUR first to JPY, then JPY to USD, and then USD back to EUR. This would involve buying or selling the three currency pairs EUR/USD, USD/JPY, and EUR/JPY in a specific order.

How to trade triangular arbitrage?

To trade the triangular arbitrage, you have to take five steps.

Step 1. Find an opportunity

This type of opportunity happens when the price of one pair does not match the cross rate of two other pairs. To understand how this works, use the equation shown below.

A/B x B/C x C/A = 1

- A/B is the first pair in the above formula

- B/C and C/A are the cross pairs

Multiply the prevailing prices of the three currency pairs and check the result. If the result is not equal to one, then you are seeing an arbitrage.

Step 2. Get the difference

Once you find an opportunity, confirm it by recalculation. Then get the difference of the exchange rate of the first pair and the cross rate of the other two currency pairs.

Step 3. Make the first conversion

From step two, you must have found the difference and have assessed if you can generate a profit if you take the opportunity and factor in trading fees. If that is the case, then you can do the first conversion. Using the first image above, this could mean buying the USD/JPY pair.

Step 4. Perform the second conversion

Do the second conversion right away. From the same example above, this could entail buying or selling the USD/JPY pair.

Step 5. Carry out the third conversion

Complete the transaction by doing the third and final conversion. This could mean buying or selling the EUR/USD pair. Now you have come full circle. All these conversions should lead to an increase in your account balance. If not, you could be breakeven or, worse, have lost in the process.

Sample triangular arbitrage

Let’s take a hypothetical situation with Jason to illustrate how to carry out the three-pair arbitrage in more detail. Perhaps Jason has 100,000 USD ready for trading. Then he sees the following scenario.

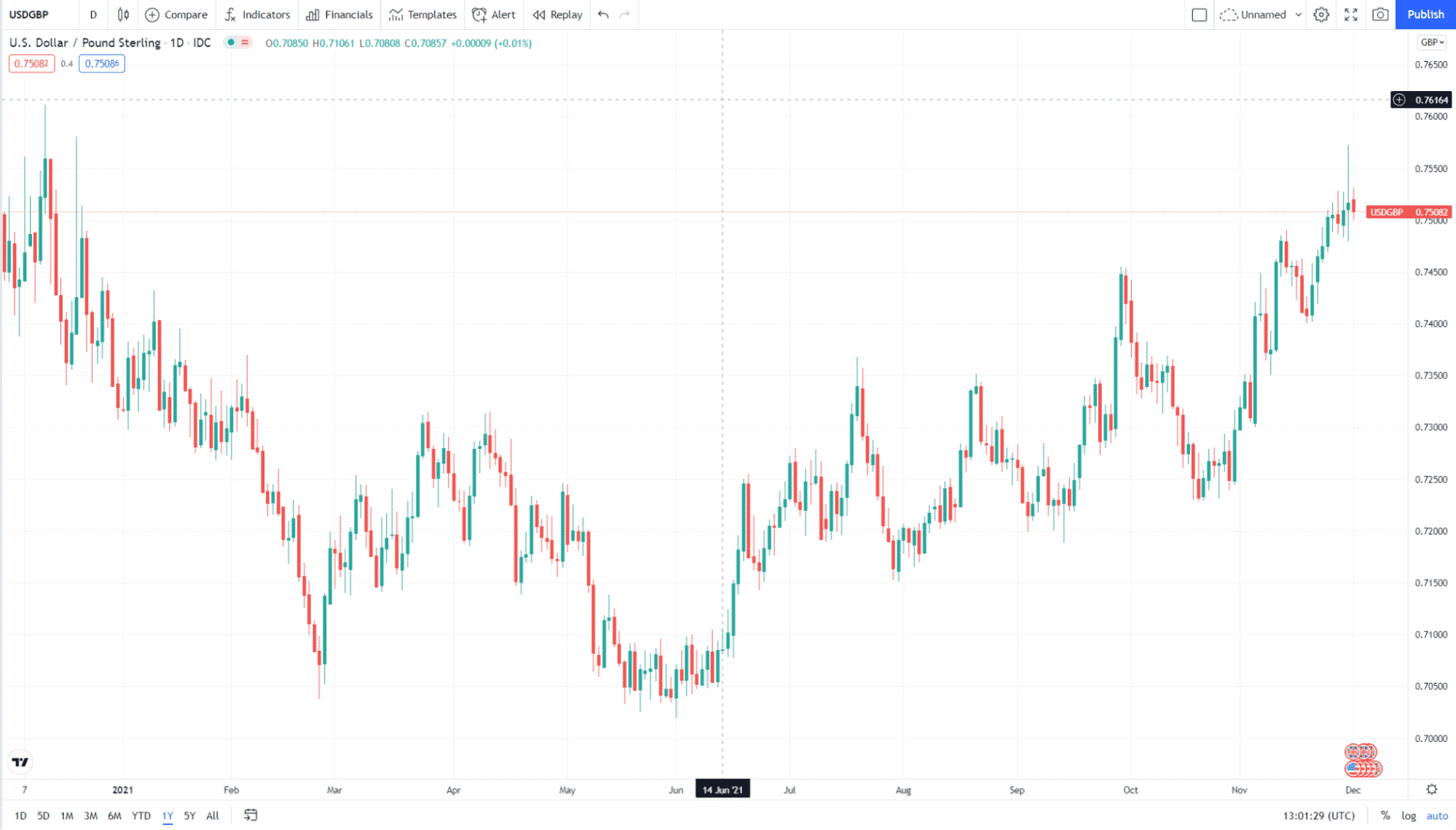

Using the formula A/B x B/C x C/A, Jason finds out that EUR/GBP exchange rate is undervalued. As you can see, the current rate of the pair is 1.3021. Let us compute the cross rate:

EUR/GBP = USD/GBP X EURUSD = 1.5028 x 0.8678 = 1.3041

Therefore, the current price and cross-rate are not the same, and the difference is 0.0020 or 20 pips.

To perform the three-pair arbitrage, do the transactions below:

- Buy EUR/USD: 100,000 USD x 0.8678 EUR/USD = 86,780 EUR

- Sell EUR/GBP: 86,780 EUR ÷ 1.3021 EUR/GBP = 64,646.2 GBP

- Sell GBP/USD: 64,646.2 GBP x 1.5028 USD/GBP = 100,155 USD

This transaction led to $155 ($100,155 – $100,000) of profit. This profit is not much if you think about it. The difference is only 20 pips, by the way. Still, Jason must have realized this profit in a matter of minutes. In this example, we have not accounted for the transaction fees. In real trading, the actual profit could be lower than $155.

How to manage risks?

Arbitrage should be a risk-free strategy, but it is not how it is in real trading. There are risks involved in this method. The first way to address them is to be aware of their existence. If you can mitigate or get around these risks, you can make real money in this business.

Here are some tips for managing risks in arbitrage trading:

- Execute trades as quickly as possible

You might need to use an expert advisor to find and execute opportunities. Otherwise, the discrepancy might have been corrected before you completed the transaction. You could suffer losses in this case.

- Trade with a large capital

Because the price differences are tiny, i.e., from a few points to a few pips, you need to trade huge volumes to realize a sizable profit.

- Use a broker that offers tight spreads

Transaction costs could eat up your potential profits. Therefore, you must work with brokers that provide small spreads.

Final thoughts

Arbitrage opportunities happen very rarely. Although the FX market has a degree of inefficiency, market anomalies are corrected very quickly. Therefore, arbitrage trades should be executed fast. To do that, you will need a trading program that scans the markets and automatically executes trades. When many people engage in this type of trading, the market becomes more efficient, offering lesser arbitrage trades to traders.