Volatility Factor 2.0 is said to generate 10-15+ pips for every trade it completes. This is made possible by its supposedly potent algorithm that has gone through many real-world tests and has passed each one. But can traders trust these claims? The answer to this question is provided in this Volatility Factor 2.0 review.

Vendor transparency

Volatility Factor 2.0 is one of the many EAs designed by FXautomater. There are claims that its developers have over 15 years experience in Forex. However, the names and profiles of these professionals are not introduced. The company’s physical location and contact details are unavailable too.

How Volatility Factor 2.0 works

Volatility Factor 2.0 is a program that runs on the MT4 platform and is utilized in monitoring and trading using algorithms. The main characteristics of the system are listed below:

- Advanced money management systems

- Has 3 intelligent built-in protection systems

- Trades all accounts-micro, mini, and standard

- Operates will all MT4 brokers and any NFA-regulated broker

- Unique broker spy module and an advanced news filter are available

- Has an advanced high-impact news filter

- Operates with 4 and 5 digits after decimal point

Timeframe, currency pairs, deposit

We have noted that this robot is created to work on the 15-minute timeframe. With relation to currency pairs, the system supports 4 major symbols: USDCHF, GBPUSD, USDJPY, and EURUSD. The least amount you can begin trading with is $100-$500. However, the recommended capital is $1,000-$5,000.

Trading approach

The approach used is called Volatility-based trading. The robot particularly trades in the direction of the market. The vendor believes that this enables it to reduce risk and put the trader at the center of the action. However, we later realized that grid is also incorporated.

Pricing and refund

The owner is selling Volatility Factor 2.0 at a discounted price of $227. This offer comes with one real account, unlimited demo accounts, and a 60-day money-back guarantee.

Trading results

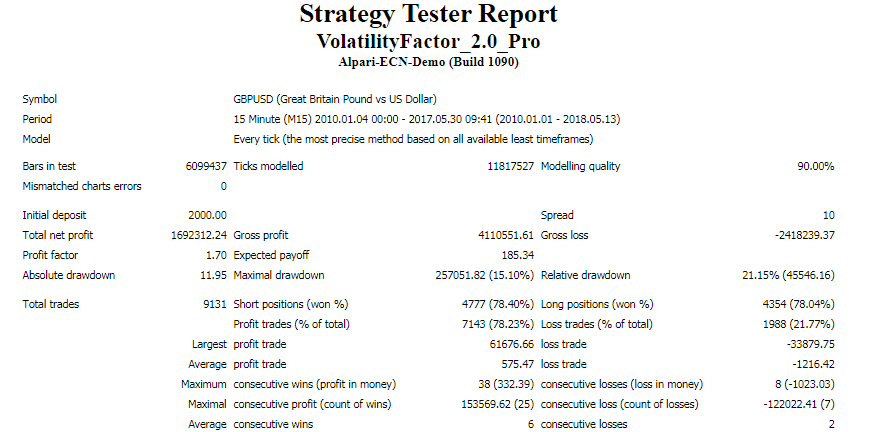

The backtest report is provided below:

The robot was tested from January 2010 to May 2017. It was deposited at $2,000 and $1,692,312.24 profit was generated. It should be noted that such a gain is hard to attain in real market conditions within a 7-year span. It means that the EA would be making about $20,000 per month.

The profit factor which is 1.7 is average. The relative drawdown (21.7%) was high and risky. The system performed 9131 trades. The winning rates for short and long positions were 78.4% and 78.04% respectively. These results are not that impressive. The average profit trade ($575.47) was twice lower than the average loss trade (-$1,216.42). Such a trend is not always good because it puts the capital at risk.

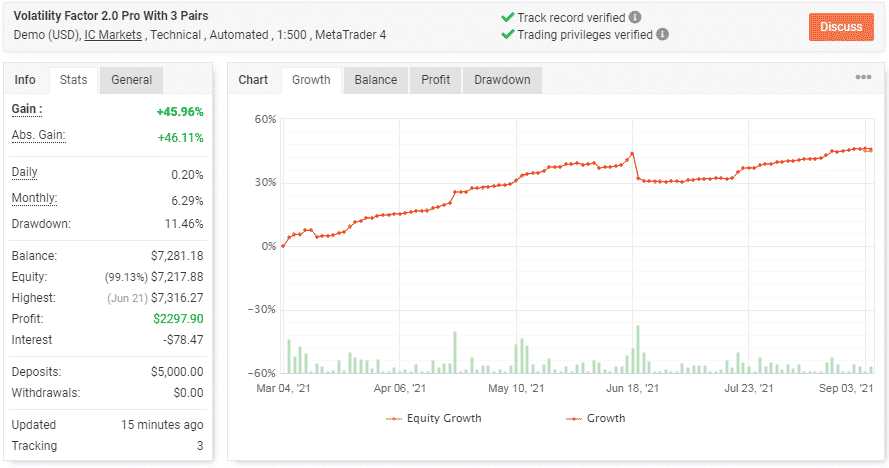

The following are the live trading results:

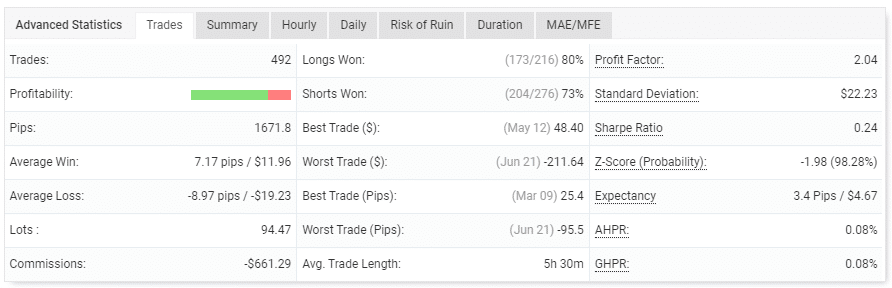

The account was deployed on March 4, 2021. A deposit of $5,000 was placed, and the robot has made a profit of $2,297.90. This is similar to a gain of 45.96%. The balance is $7,281.18. The daily profit is 0.20% while the monthly gain is 6.29%. The drawdown of 11.46% is still small. But if it augments, then the investment will be at risk.

The number of trades completed is 492. The profit factor is 2.04 and slightly higher than the value in the backtest report. The win rates for long and short trades are 80% and 73% respectively. The results for short positions were slightly lower compared to the backtest outcomes. Apparently, the EA struggled to make gains for short trades in the actual market.

The pips made are 1671.8. The average win is 7.17 pips when the average loss is -8.97 pips. The lots traded (94.47) are quite large and risky for the account.

From the trading history above, we can see that the EA applied grid and traded on long time frames. Sizes of lots used were also big.

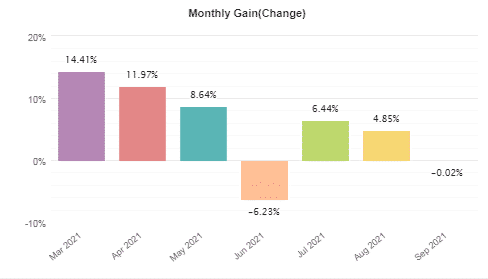

The profits have been dwindling since April till now. In fact, June recorded a loss of -6.23%.

People say that Volatility Factor 2.0 is…

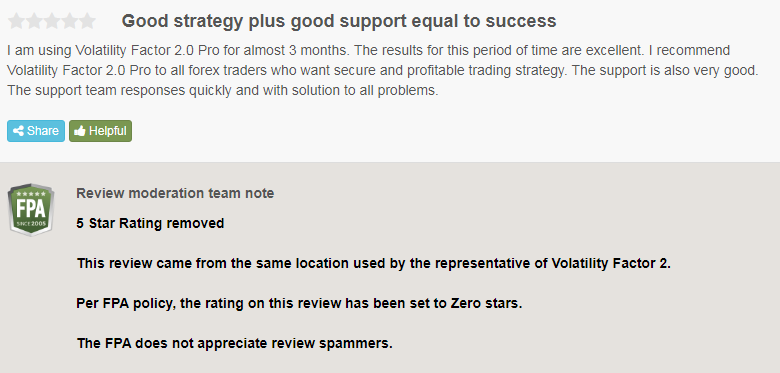

Excellent. There is only one customer review on FPA. This trader says that the system’s performance is excellent. Nonetheless, FPA notes that the feedback came from a similar location used by one of the EA’s representatives.

Verdict

Pros

- Backtest data is present

- Verified trading stats are provided

Cons

- Grid strategy on board

- Vendor transparency is insufficient

- Suspicious customer review

Volatility Factor 2.0 Conclusion

Traders should not trust this system. For one, the monthly profits made have been declining. Secondly, the grid approach used can cause significant losses. Lastly, the vendor’s move to mislead traders about the performance of the robot indicates that they are desperate to make sales at any cost.