Forex signals can be the best option for seeking financial freedom through online trading without practical trading knowledge.

FX or foreign exchange is a marketplace with the highest liquidity and where trillions of dollars transactions occur regularly. So naturally, it becomes a place for hope and opportunity for any individual participants in financial trading. With the increasing demand, FX trading idea providers come to make some extra bucks.

However, you have to check on some facts before choosing any forex signal service. One of the critical factors in selecting an FX signal service is finding the most accessible platform to get the service.

Let’s discuss the working procedure of the signal service and the platform usually used to deliver calls.

How does a forex signal work?

You need to know the definition of FX call to understand how the service works and how to participate. Forex calls or trading ideas come from signal providers — professionals or experts who can anticipate the market and create trading calls by applying technical and fundamental analyses.

Later on, signals, trade suggestions, or future price predictions the signal provider generates come to clients in various ways, such as email, texts, etc. When the signal reaches the clients, then the implementation comes up. After receiving the call, clients can follow it by applying it to their trading account or ignore it completely. It goes for manual trading calls.

On the other hand, an individual’s trading account duplicates the signal suppliers for copy trading. It doesn’t enable any human intervention. The analysis of trading concepts depends on technical analysis, price action, technical patterns, and historical price movement of the asset. This sort of trading involves taking duplicate orders from recommendations. Typically copy trading permits you to change attributes of orders equivalent to lot size, profit target, spread, and so on.

In some cases, sensible traders follow these services to get the trade ideas and match them with their trading strategy. They enter the market once each call and strategy counsel a similar future direction. To be a prospering trader needs timing and patience; having multiple profit targets or tight trade management concepts will increase your profitability.

Best platforms for obtaining signals

FX signal suppliers use many platforms to send their calls or good commercialism suggestions. The most straightforward platforms to follow FX calls are MT4 integration, SMS, Telegram (TG), email, etc. During this part, we’ll list the procedure and best platforms for getting FX calls.

MT4 integration

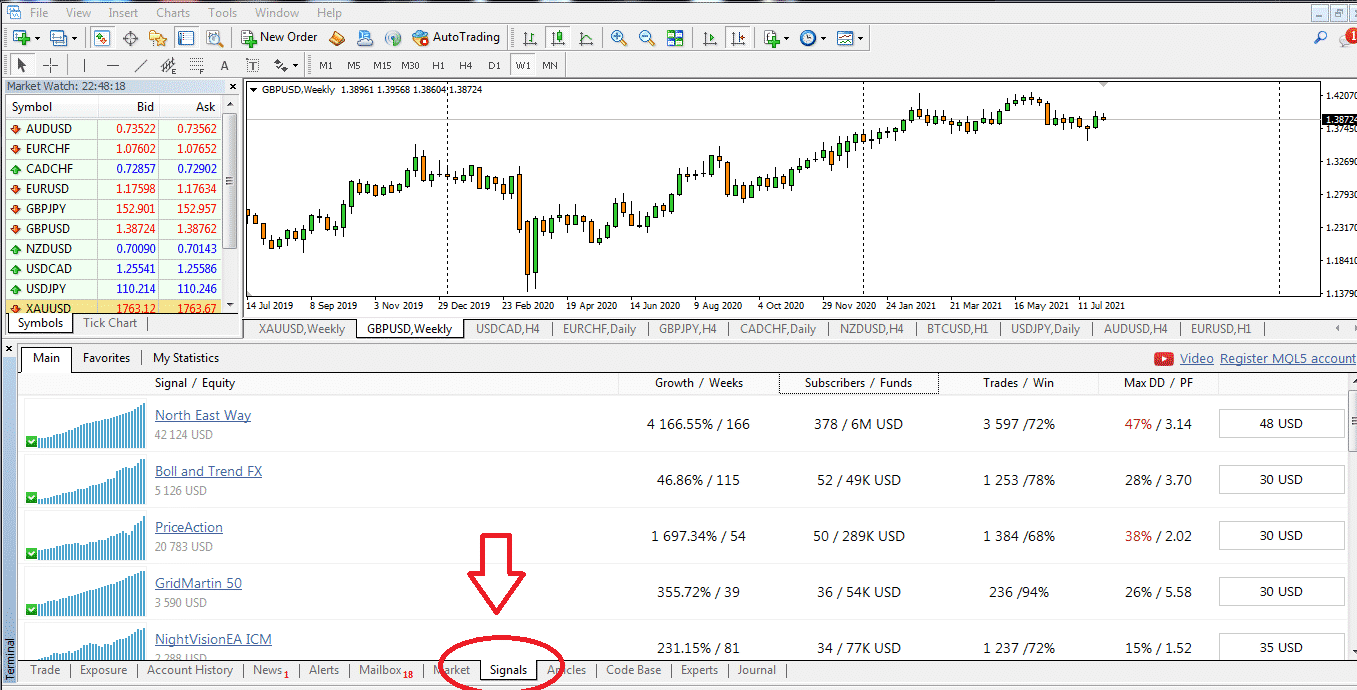

If you are an FX market participant and execute your trades from the MT4 or MT5 platform, you can copy signals without visiting any website. Check the terminal window at your MetaTrader 4 platform, click on the call option.

The figure above shows the signal option at the terminal window of the MT4 platform.

You can see the list of service providers worldwide with performances with different parameters and statistics. You can also check on:

- Growth rate

- Number of followers

- Total funds under the signal service providers

- Winning ratio

- The subscription fee, etc.

Some providers allow you to modify the parameters of your trades. In this method, you don’t need to do any manual entry or exit. You have to pay fees as the service providers offer to get it. The service provider will handle all trades.

You can also become a signal service provider by using MetaTrader 4. Right-click on the account option of the navigator window. Later on, you can register yourself as a service provider or user.

The figure above shows the option in MetaTrader 4 regarding calls.

Telegram

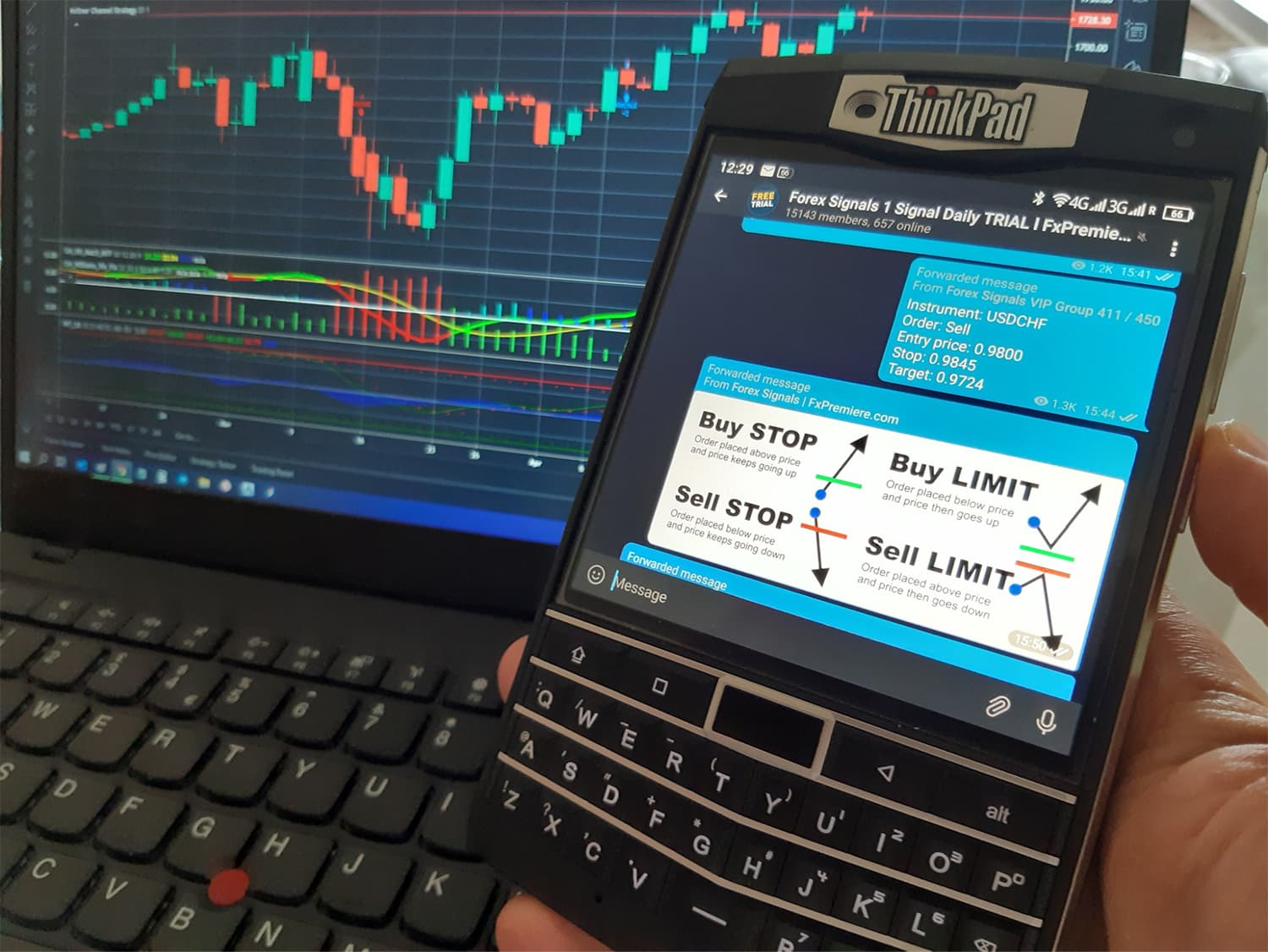

Some signal providers use TG apps to deliver trade suggestions to their clients. The signal service provider generates the trade idea by using their method. When they find a good setup or potentially profitable trading position, they share that trade idea with their clients through TG.

In this way, clients get notifications of the trade idea that contains entry-exit positions for the target assets. Users can take manual entry by the suggestions of signal providers to modify the parameters of trades or completely ignore the call.

SMS

It is similar to the trading idea providers and users as the telegram terminal. In this case, the difference is users will get the call on their cell phones no matter while it is connected to the internet or not.

While using the TG app as a signal service terminal requires users to connect to the internet to receive the signal, SMS service allows offline delivery of signals.

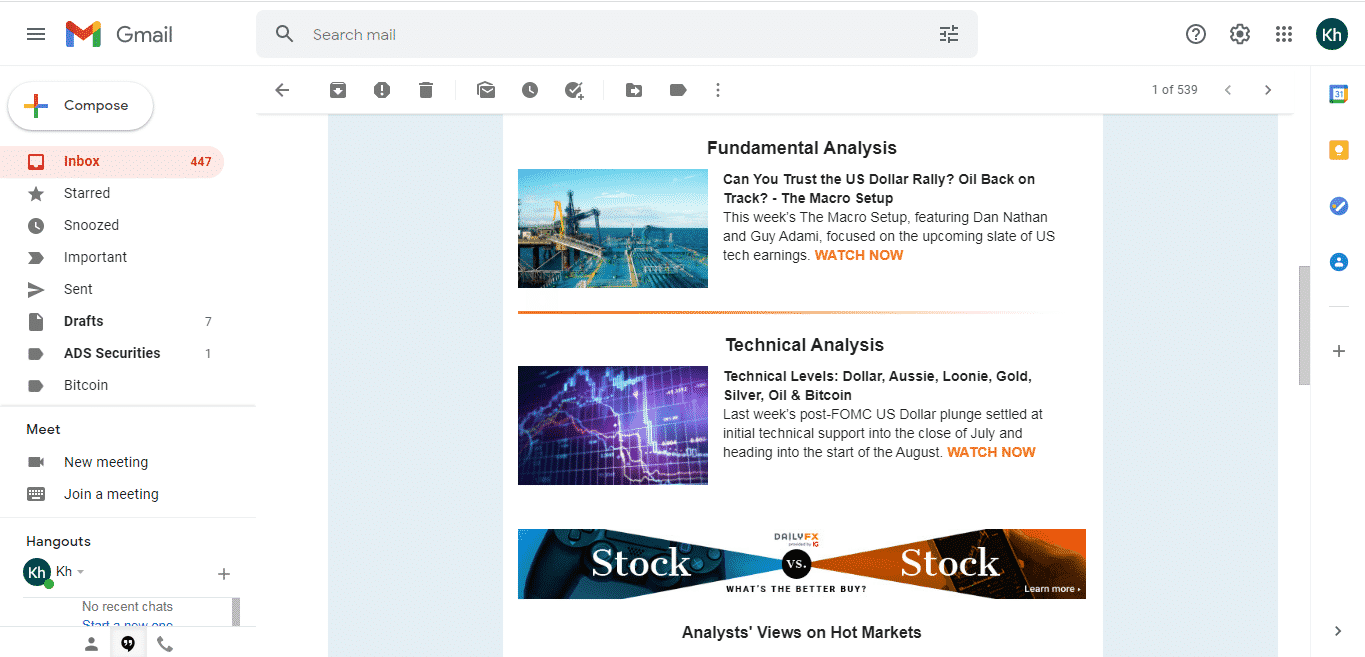

Using email as a terminal to provide calls or trade ideas is very common. Many brokers and websites offer free daily, weekly, monthly, or quarterly trade ideas, suggestions, and future views about the target assets to their users. You can also get paid signals by email if your providers use email as a medium to provide trading calls.

The figure above shows a business website that shares free analysis through Gmail.

Signal vs. copy trading comparison

The primary difference between call and copy trading is human intervention. Signal services provide signals by analyzing the asset price movement fundamentally and technically both. In most cases, experts or professionals provide services, and novice traders follow them.

Somehow, signal service is limited: scammers are everywhere; check the profile and portfolio carefully before following the signal service. The other drawbacks involve signal services such as timing, trade management, profit target, regulations, etc.

On the other hand, copy trading doesn’t allow any user intervention. Trades execute automatically at the user account, like the major account. Users can modify the parameters. The signal provider uses algorithms besides historical price movement, price action, and technical patterns.

Final thoughts

Finally, now you are aware of the working procedure of the FX signal services and how to get these services from various channels. We don’t recommend following any call service blindly as it may harm your trading skill, and you may end up losing your entire fund. Better develop skills and gather more knowledge about the FX market.