Aeron (Scalper+Grid) is said to be a reliable automatic trading system. The devs claim the EA can deliver maximum and stable profits with minimal risks. But can a system that uses a combination of scalping and grid strategies be trusted? Let’s find out in this review.

Vendor transparency

We don’t know who the developers of this product are. This is because the presentation doesn’t mention anything about them. Furthermore, there’s no info about the parent company, its whereabouts, or contact details.

How Aeron (Scalper+Grid) works

This expert advisor has the following features:

- It sets Takeprofit and Stoploss with each position.

- Equity risk management allows you to set the equity percentage you want to put at risk.

- It is fully automatic, and as your equity increases, the EA automatically increases the lot size accordingly.

- It can make profit from stable and volatile markets.

- The system runs on the MT4 terminal.

- The EA requires you to keep your computer and internet on 24/5.

Timeframe, currency pairs, deposit

The recommended timeframe for Aeron is M1. The EA also works with several currency pairs, which include EURJPY, EURUSD, CADJPY, AUDCAS, and USDJPY. The vendor believes these pairs generate good profits. Nevertheless, the minimum deposit required to activate the robot is not indicated.

Trading approach

From its name, it is apparent that Aeron uses 2 strategies: scalping and grid. The first approach is featured by fairly short periods between opening and closing a trade. The second one capitalizes on price volatility by placing short and long positions at particular intervals below and above the base price.

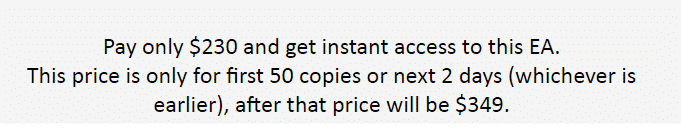

Pricing and refund

Paying a $230 amount grants you instant access to this robot. However, this is a discounted price. Once the first 50 copies are sold out, then the cost will drastically increase to $349. This price increase might even happen in the next 2 days. A money-back guarantee is not part of the package.

Trading results

Backtesting results are not available. We are not sure if the vendor tested the workability of this robot’s strategies or not.

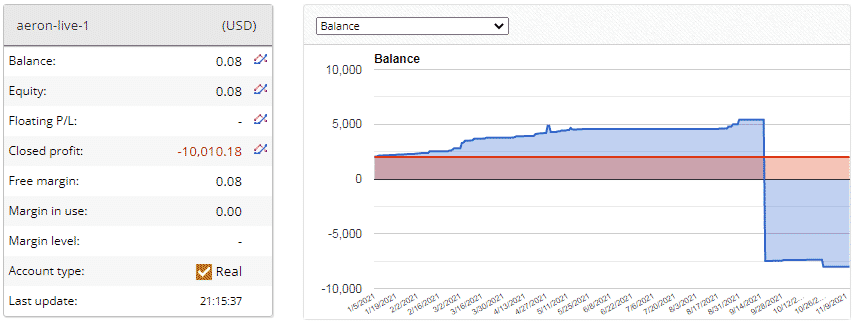

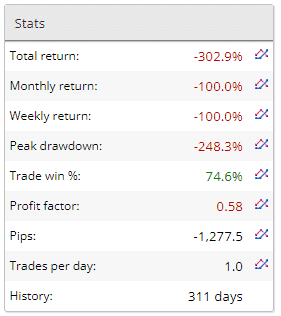

The EA has traded in this real account for the last 311 days. The initial deposit was $2000, but the algorithm has managed to erode the balance as now the balance is $0.08. So far, the account has reported a whopping loss of -$10,010.18.

The performance of the robot in the live market is really distressing. Since it began trading, the EA has accumulated a massive drawdown of -248.3%. This means that the approaches used are very risky. It is thus not surprising that losses are made on a weekly (-100%) and monthly basis (-100%). The only positive report is the 74.6% win rate attained.

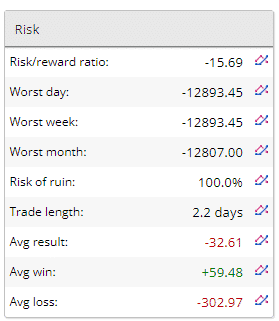

This account is hanging by a thread. It will crash at any moment. Both the worst day and week have recorded losses amounting to -$12893.45. The average loss (-$302.97), which is way higher than the average win ($59.48), also portrays Aeron as a loser EA.

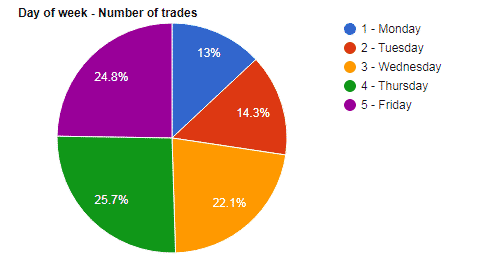

Most of the trades conducted weekly are executed on Thursday — 25.7%.

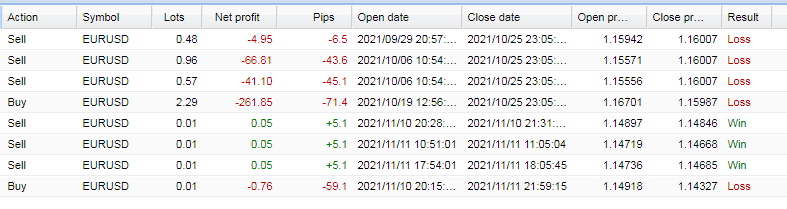

The system mainly traded the EURUSD pair using both martingale and grid strategies. It suffered some huge losses as a result.

People say that Aeron (Scalper+Grid) is…

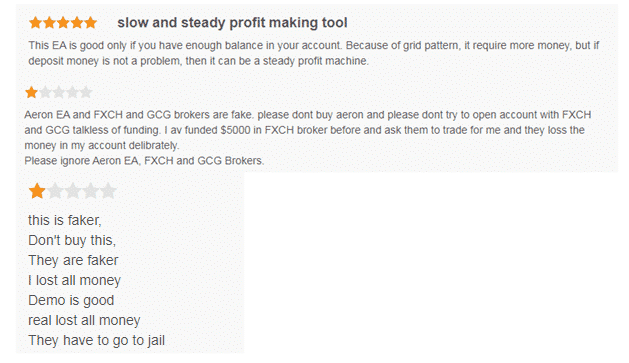

A loser. Aeron has 11 reviews on FPA, and most of them are negative. Although there is a trader who says that the EA can generate steady profits, others disagree. The unsatisfied customers disclose that they have lost a lot of money while using the tool.

Verdict

Pros

- Fully automated and supports many currency pairs

Cons

- Zero vendor transparency

- Dangerous strategies are used

- Negative feedback from clients

- Poor performance in the live market

Aeron (Scalper+Grid) Conclusion

The good thing about this robot is that it works with multiple currency pairs. The vendor has also disclosed the trading strategies used. This helps you to know how it identifies trading opportunities. But then again, the EA’s poor performance in the live market shows that the trading approaches are dangerous. So, you can lose a lot of money while using the EA like some of the customers who have purchased it.