Automated trading systems have preprogrammed rules for trades, which your computer will execute once they are outlined in the software.

If you look up Jim Simons in the reference lists, he was well-known for using auto systems to earn a fortune. He founded Renaissance technologies managing about $55 billion. Traders with years of experience want their software and their platform to remain in sync at all times.

Let’s check the advantages and disadvantages of auto trading systems and how you can profit from futures trading using them.

What is an automated trading system?

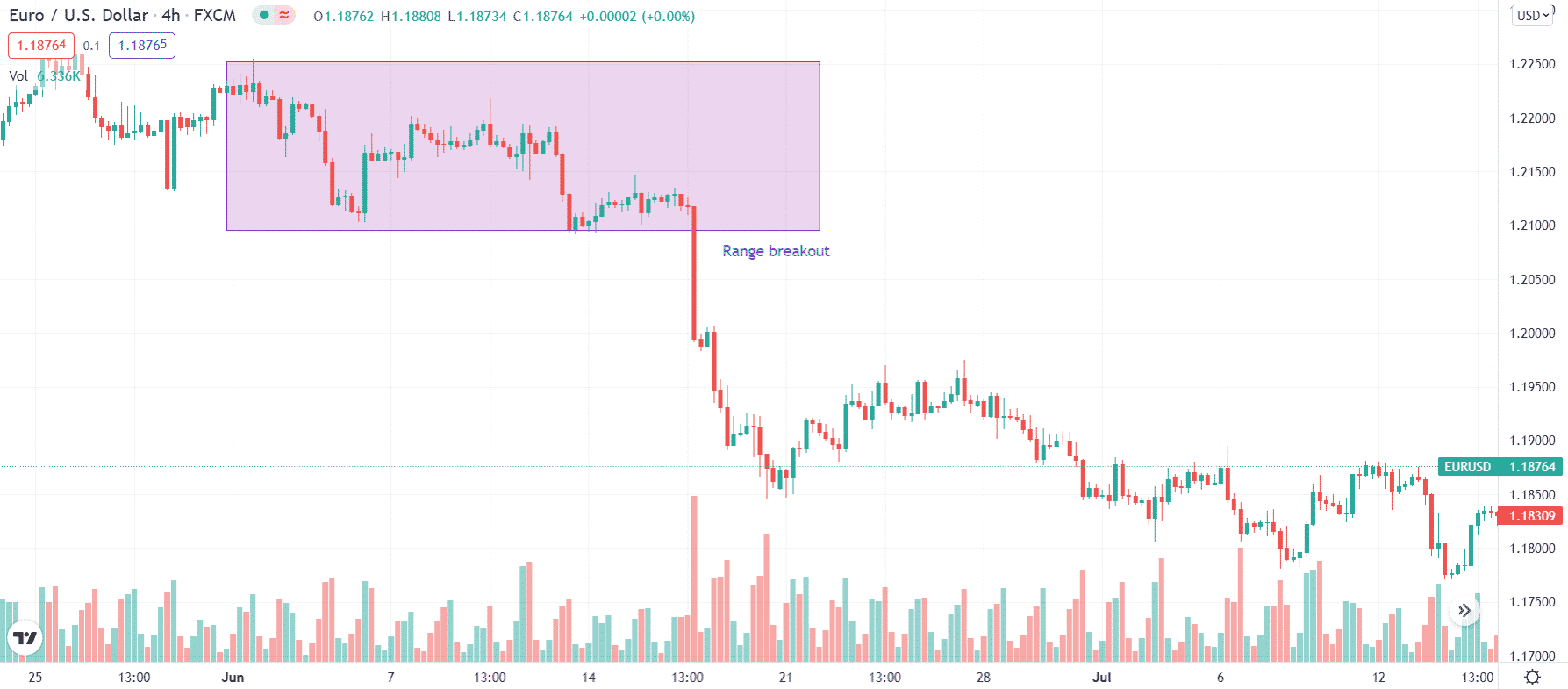

Developers use such software to track daily market algorithms by using computer programs. Automating your futures trades is the best solution for those who lack the time or resources to monitor, formulate and implement their trading plans.

To generate signals for buying or selling, most auto trade setup identify trends, analyze market data, and apply mathematical/technical formulas. Every system you subscribe, activate, or deactivate in real-time, regardless of its hypothetical or live performance.

Advantages of automated systems

Utilizing software to monitor markets and trade opportunities on the financial market and execute trades has several benefits. These areas follow:

Minimizing emotions

If you are using algorithmic systems to trade, it could minimize your emotions. Traders tend to stick to their plans more efficiently when they keep their emotions in check.

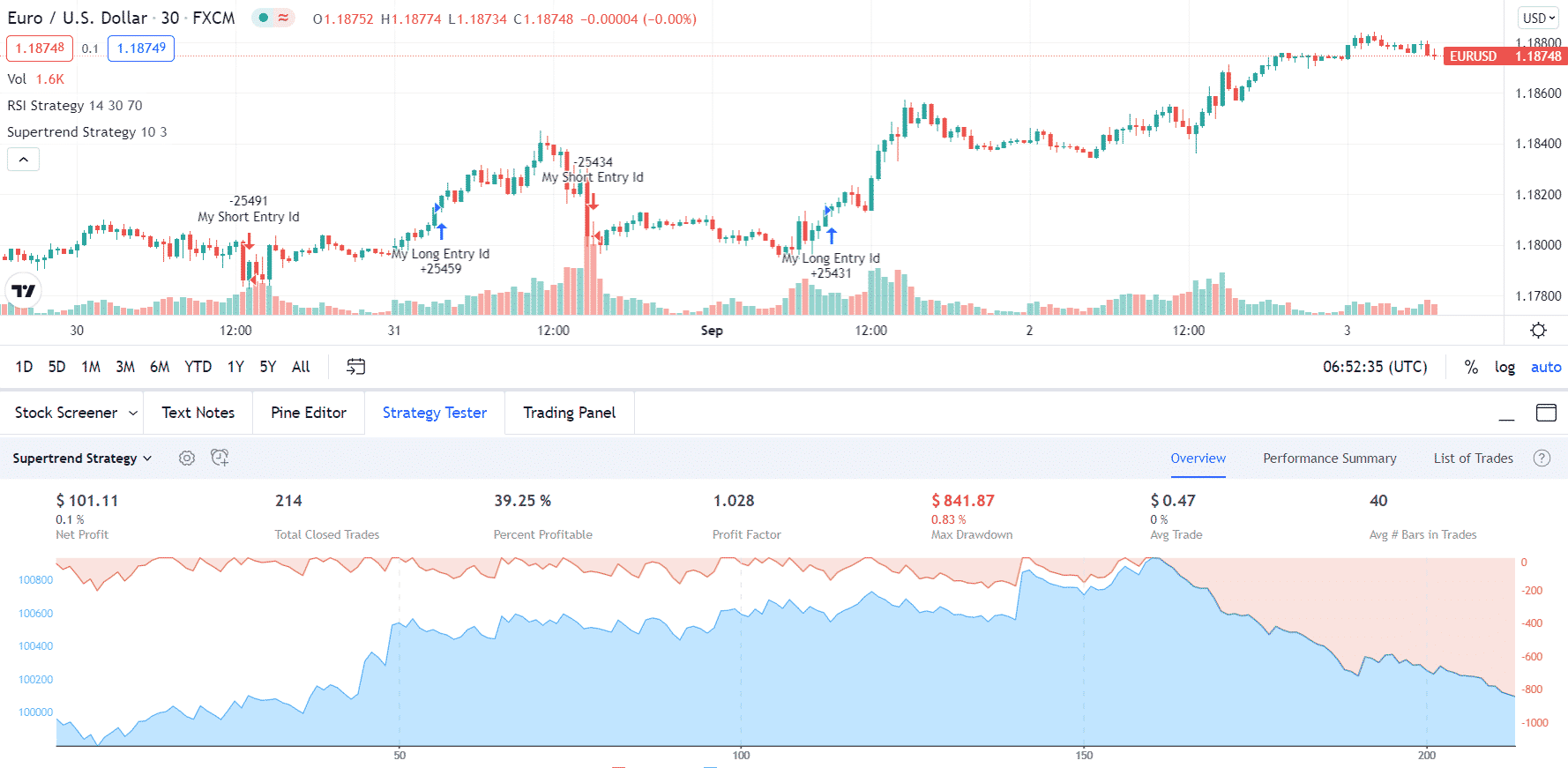

Performing backtests

By backtesting trading ideas, one can assess their performance and fine-tune them to achieve tremendous success. Backtesting is used to determine the viability of a trading strategy with the help of using historical data. In addition, it determines the system’s expectancy. Accordingly, you could say it is the amount of profit or loss a trader can expect from a unit of risk exposure.

Maintaining discipline

Because the trading plan is followed thoroughly, auto-setup ensures maintenance of discipline. In addition, it decreases the possibility of “pilot error.”

For example, A 100-share order would not be mistranslated into a 1000-share order.

The disadvantages of algorithmic systems

The disadvantages and challenges of auto trade setup can be significant. Traders should be aware of these.

Faulty mechanisms

According to the type of trading platform, market participants can place trade orders on computers instead of servers. A lost internet connection, for instance, might prevent an order from reaching the financial market.

One possible difference between orders entered through the order entry platform and orders generated by the strategy.

Observations

However, you should monitor auto systems constantly, even if you can turn them on and leave them. Using algorithmic trading systems can lead to various technical issues, including system crashes and connection issues.

Optimizing too much

Testing the auto trade algorithm is only one aspect of backtesting. On paper, traders can create highly sophisticated systems that do very well, but they don’t work. A trading plan that is over-optimized while in an actual trade ends up unreliable.

By analyzing historical results, one can adjust a strategy in such a way as to produce exceptional results. Investing strategies that do not generate good profits or experience drawdowns cannot be considered viable. A nearly perfect plan could be produced by adjusting parameters, but it would fail when applied to real markets.

How to participate in the futures market with an auto-setup?

Commodities futures are a way for swing traders or day traders to earn good money. Since commodities come in a plethora of varieties, actively trading and monitoring them all is extremely difficult. However, a few options exist for solving the problem.

An active trading strategy should be based on two to three of the most viable commodities. It’s probably a good idea to do this anyway since margin requirements for commodity futures trading are often very high.

Sounds good; however, if we do not live in the same time zone as the commodity we are trading, we will still have some difficulty unless we are willing to stay up late or get up early. So, what would you think if you could turn on the computer and let the software trade futures for you?

The algorithmic trading system does the heavy lifting

Can computers be programmed to trade for them, as some traders dream of doing? There is no doubt, but first, you need to take some precautions. Let’s begin by reviewing robotic futures trading in general.

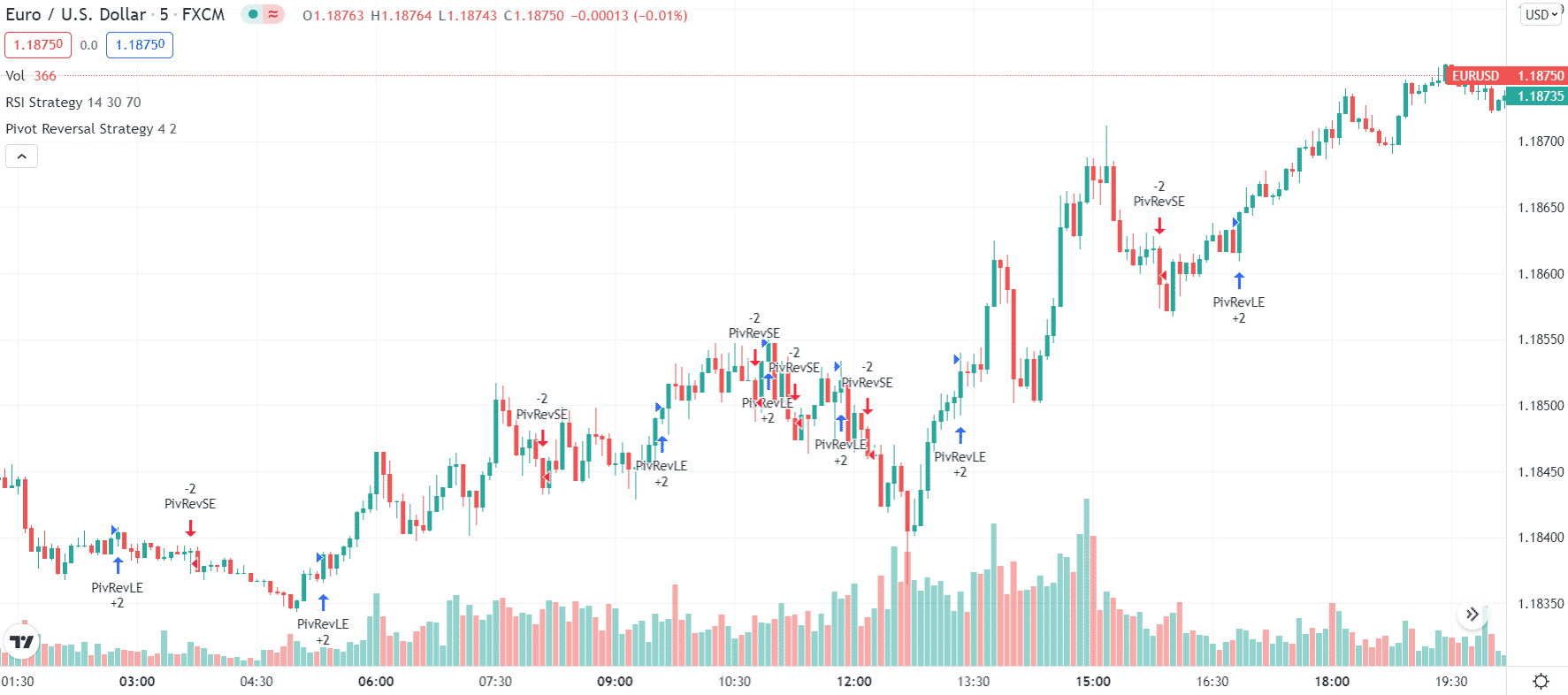

An electronic trading platform must do several things:

- Identification of the entry, initial stop, and target price for the commodity.

- Monitor and adjust the stops and targets for active trades.

- Ensures that trades executed by the broker are synchronized.

- Stop trading when it’s the right time.

It isn’t difficult to understand the first two. It is possible to find thousands of systems that promise to accomplish this. It is possible to determine how many firms can do this while providing consistently profitable results through tests, both historical backtesting and forward testing (or paper/demo trading).

Software is responsible for determining how automation is done and what restrictions apply.

For example, NinjaTrader and TradeStations, the two most popular robotic futures trading platforms that combine algo trading with charting. The initial setups are identified as part of both systems, making adjustments to stop being tracked. Usually, any weaknesses in the strategies are caused by coding issues.

If at some point, the system is generating any profits, it comes up with many scams. Let’s find out how we can avoid the scams.

Avoid the scams

Whenever you are considering your ideal system, do not be fooled by some overly optimistic marketing claims. The world is full of scammers. Specific systems offer profits for low prices. What are the ways to tell the difference between authentic and fake systems? Here are some valuable tips.

- Ask questions and scrutinize everything you must pay for before opening a trading account. In the event you do not, you might lose money.

- Ensure that you fully understand the algorithm system. Make sure you read the terms and conditions before making a commitment.

- Verify that the system can be tried without charge. Free trials are rare on scam websites.

Final thoughts

Despite their many advantages, automatic trading systems shouldn’t be viewed as a substitute for closely monitored trading. Keeping an eye on technology is crucial since technology failure does occur. A server-based platform can minimize the risk of mechanical failures to traders. Using robotic trading systems requires some prior experience and knowledge of trading.