AVIA uses copy trading services to provide their signals to traders. They use a semi-automated strategy to trade the markets. There are four different risk management packages that market participants can choose according to their liking. We will see if the account managers are proficient in trading the market and keeping their drawdown promises.

Vendor transparency

The company states their address as 00-1000 5th St, Miami Beach, 33139 and 1400-330 Bay St, Toronto, M5H 2S8. They are not transparent about the experience of the traders who are offering the program.

How AVIA works

The company has the following features:

- There are multiple packages from which traders can choose.

- They monitor all the trades opened by the algorithm.

- Accounts that allow hedging and micro-lots are supported.

- A 30-day free trial is available for traders.

Time frames, currency pairs, deposit

The company doesn’t provide information on the strategy and the currency pair. From the Myfxbook records, we can see that they trade on multiple currency pairs. Traders can choose to follow their service for a minimum of $3000.

Trading approach

There is no information on the strategy. However, through the Myfxbook record, we can see that there might be some grid and martingale involved as there is a considerable drop in the equity curve as the algorithm trades. The providers do cut off losses at some point as the loss becomes high. The average trade duration of 2 days conforms to a swing trading approach.

Pricing and refund

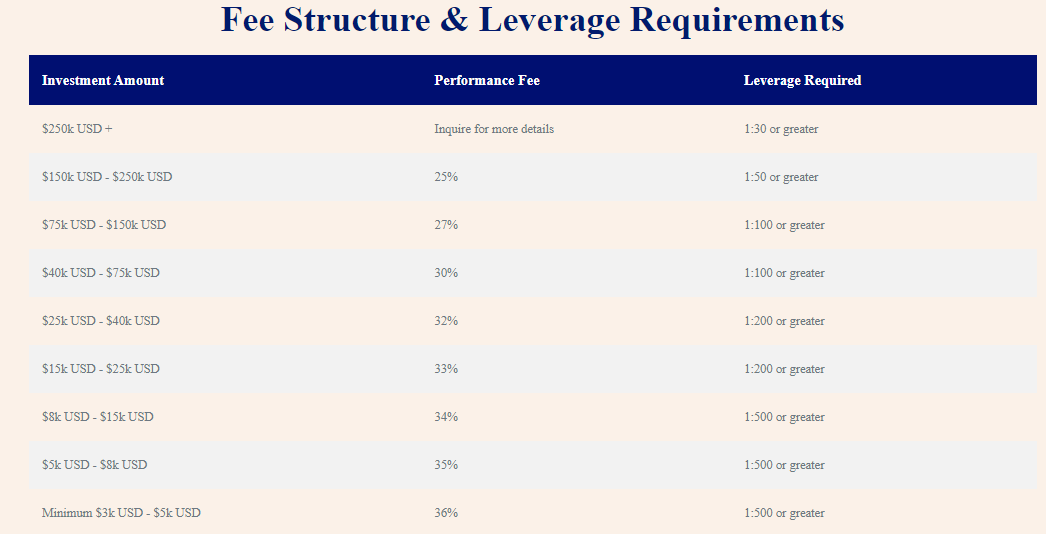

The company charges a performance fee for copy trading, which starts from 36% for account value of $3000 and can get low up to 25% for portfolios with an equity of $350k. The leverage requirement decreases as the balance increases.

It is clear that the account managers want traders to invest more money as they offer low costs for the higher account balance.

Trading results

There are no backtesting results provided by the company, which is a poor approach. They should have shared the historical records for their algorithm so we could know what kind of drawdown it could reach in the future. This type of approach raises many red flags.

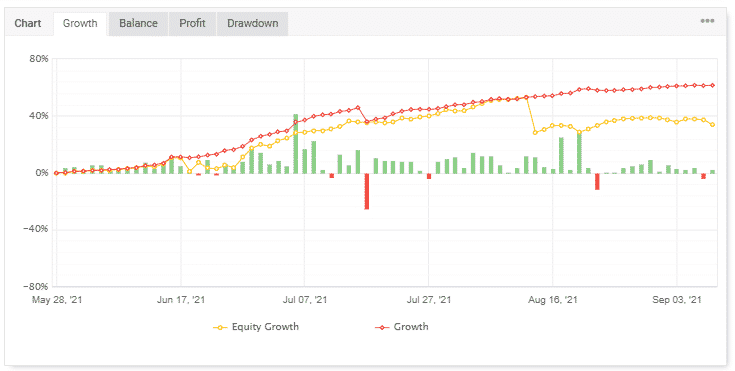

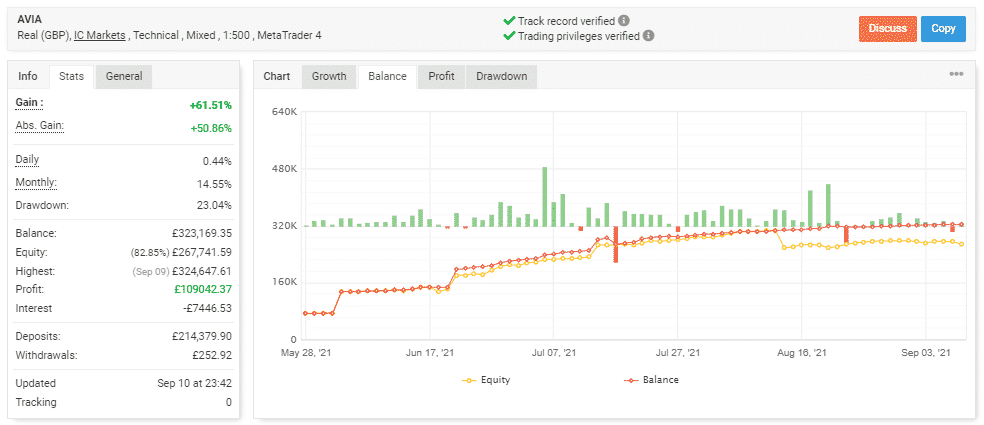

Verified trading records on Myfxbook show performance from May 28, 2021, till the current date for the conservative settings. The system made an average monthly gain of 14.55%, with a drawdown of 23.04%. This is a high drawdown value and far exceeds the safeguard value of 7% mentioned on the website. This means that the company is not keeping hold of its promises. Traders can easily take this as a breach of trust.

The winning rate stood at 77%, with a profit factor of 2.59. The best trade was 2206.28 Euros, while the worst was -5900.23 Euros. There were a total of 2792 trades. The developer made 214379 Euros in deposits and 252 Euros in withdrawals.

People say AVIA is…

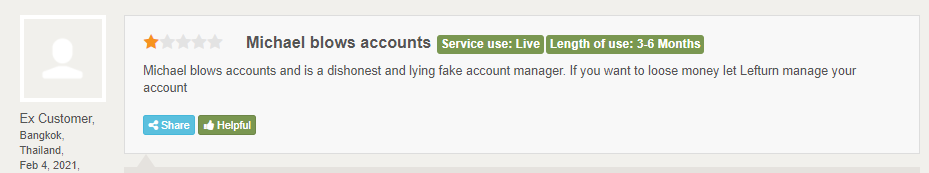

Not the company to be trusted. Customer reviews are giving Lefturn a rating of 4.73 for a total of 10 feedback. A reviewer states that the account manager Micheal keeps on blowing trading accounts of the traders. He says that he is a liar.

Don’t trust Lefturn

AVIA service failed and the devs decided to rebrand it into Alphi to start a new game and attract new traders. They think that making some changes on their website and adding new trading results will be enough. They are mistaken. If they want to be trusted they should be transparent with traders. Until now, we strongly advise you to stay away from AVIA (ALPHI).

Verdict

| Pros | Cons |

| Live records available on Myfxbook | No transparency on the developer |

| No respect of drawdown | |

| No information on the strategy |

AVIA Conclusion

AVIA is not a trustworthy service as the account managers fail to hold their promised value of drawdown. The company does not provide information on the strategy, which adds to the downside of the system. Lack of appropriate records states that the copy trading service is not to be trusted at all costs. There is a high chance to receive a margin call using AVIA.