Best FX Networks claims to provide profitable results with its efficient approach. It does not use methods like averaging or scalping for its approach. The FX robot is completely automated and comes with full-time support. As per the vendor, this Metatrader tool works on all broker accounts including ECN, STP, Cent, or Micro accounts. Backtesting results and verified real trading stats are present for the system. However, the sample size provided for the real trading is very small making it difficult to analyze the system properly. Further, the product does not come with a money-back guarantee which makes us doubt the system’s reliability.

Vendor transparency

As per the vendor info, this FX EA was created in 2020. It was tested on the market using the company funds. The team comprises software developers and experienced traders. There are no other details present like the location address, team member details, phone number, etc. The absence of info shows a lack of vendor transparency.

How Best FX Networks works

The key features of this FX robot that make it maintain a competitive edge over its competitors as per the vendor are:

- It uses an inbuilt magic number and easy parameters for setting up.

- You need not disconnect the robot during important news releases.

- It uses automatic risk adjustment.

- 24/7 support is provided by the vendor for all customers.

- Live verified accounts are present for the system.

Timeframe, currency pairs, deposit

We could not find info on the recommendations for the EA like the timeframe, leverage, currency pairs, deposit, etc.

Trading approach

Special algorithms are used for opening and closing orders that ensure profitable results, as per the vendor. The FX robot uses a combination of the best approaches to form a comprehensive method. According to the vendor, the main advantage of the FX robot is that it changes its approach based on comparing the predictions with the data that is continuously fed to the robot. By using technical and fundamental assessment, the EA identifies patterns undetected by other such systems and uses them to ensure accurate results.

Pricing and refund

A business ($129) package offering 1 real and 1 demo account, a Standard ($149) package offering 2 real and 2 demo accounts, and a Premium ($169) package offering 3 real and 3 demo accounts are the pricing packages present for this FX EA. Fully automated software, free upgrades, free support, and a lifelong license are common features provided for all the packages. There is no money-back offer which raises doubts about the dependability of the product. When compared with the price of competitor systems in the market, we find the price is not expensive.

Trading results

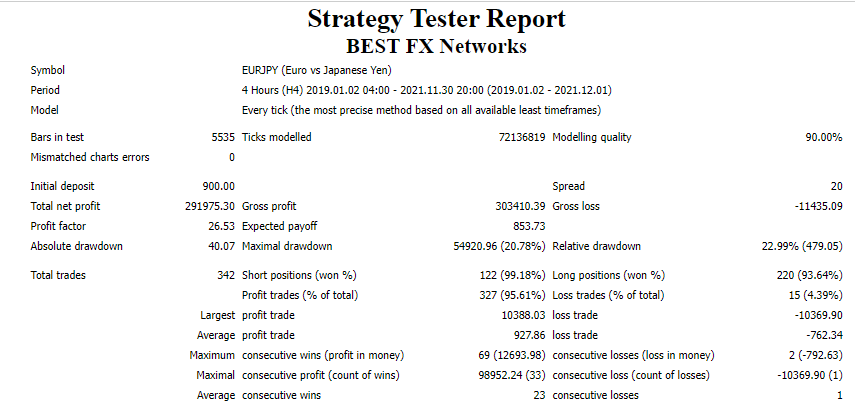

A backtesting result is present on the official site. Here is a screenshot of the strategy tester report:

From the above stats, we can see the backtesting was done on the EURJPY pair using the H4 timeframe. The backtest was done from 2019 to 2021. For an initial deposit of 900, the total net profit generated was 291975.30. A total of 342 trades were completed with profitability of 95.61% and a profit factor of 26.53. The maximum drawdown for the system was 20.78%. From the results, we can see that the profits were high and the drawdown low indicating an effective approach and performance.

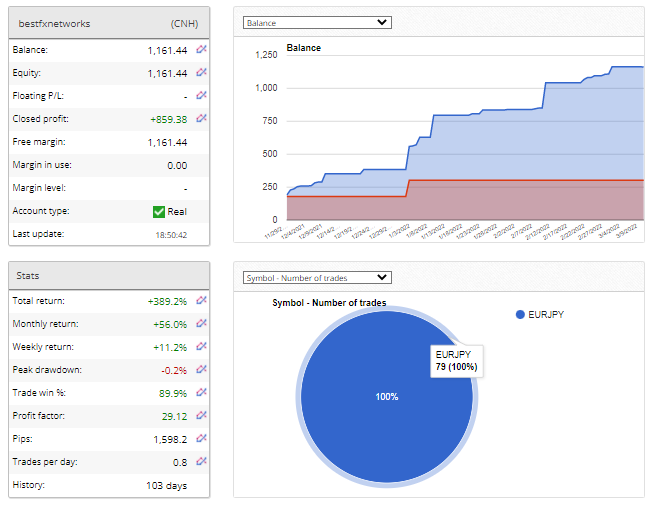

The vendor also provides real live trading results verified by the FXBlue site. Here is a screenshot of the CNH account that started in November 2021.

From the above account statement, we find the total return for the account is 389.2%. The monthly and weekly returns are 56% and 11.2% respectively. We can see the balance has grown steadily over the 103 days the account has been live. Profitability of 89.9% and a profit factor of 29.12 are present. The peak drawdown is 0.2%. From the results, we can see the account is performing well with low risk and high returns. However, the sample size is very small. Such a small sample size makes it difficult to predict the long-term performance.

People say that Best FX Networks is…

Neither a good nor bad system. This is because we cannot find user reviews for the FX robot on trusted review sites like Forexpeacearmy, Trustpilot, etc.

Verdict

| Pros | Cons |

| A fully automated system | Small sample size |

| Live verified results | Lack of vendor transparency |

| No refund policy |

Best FX Networks Conclusion

Best FX Networks claims to use effective money management and the best approaches for profitable returns. Our analysis reveals the FX EA has backtests and live trading results that show low risk and good performance. However, the sample size in real trading results is very small to assess the efficacy of the system. Further, the absence of vendor transparency and the lack of a refund are other downsides we found in this FX robot.