Many decentralized finance platforms use automated market makers. They use them instead of traditional buyer-seller markets, leveraging liquidity pools to permit digital assets’ automated and permissionless trade. DeFi platforms reward users with LP tokens when they provide crypto assets, which can be staked and yielded.

These pools constitute one of the main elements of the DeFi ecosystem. Their applications are automated market makers (AMM), borrow-lend protocols, yield farming, synthetic assets, blockchain insurance, and blockchain gaming.

Let’s find liquidity provider (LP) tokens and distinguish the best one among them.

What is the LP token?

Decentralized exchanges offer LP tokens that operate on an AMP protocol. A few DEXs supply LP tokens on their exchanges, including UniSwap, Sushi, and PancakeSwap.

Each LP token represents an individual’s contribution to the overall liquidity pool. Since the share of liquidity in the general pool is proportional to the number of LP tokens held.

In their simplest form, LP tokens work like this:

| The total value of liquidity pool / circulating supply of LP tokens = value of 1 LP token |

The technical properties of the LP token aren’t very different from those of other tokens on the same network. Uniswap and Sushiswap, two companies that operate on the Ethereum network, issue LP tokens that are ERC20 tokens. They can be traded, staked, and transferred across different protocols.

A provider that holds LP tokens has complete control over their locked volatility, just like they would with any other token. There are most certainly pools that allow providers to redeem their LP tokens whenever they like, but they sometimes charge a minor penalty for early redemptions.

Providers of liquidity typically earn money in two ways. First, those who provide volatility on the DeFi platform earn fees for each transaction. Each LP gets a proportional share of the transaction fees, so your costs will increase as you stake more crypto assets.

Several pools offer rewards for participating in specific collections to encourage cryptocurrency holders to stake. You may want to consider these pools if you’re bullish on the ERC-20 token used on the protocol since rewards typically come in the form of ERC-20 tickets.

Top five LP tokens to trade and invest

You can use LP tokens as a means of proof that you have lent crypto assets to DeFi pools and that to retrieve your assets, you need to burn those tokens. However, in certain situations, the LP tokens can also provide users with new access layers or yield farming possibilities within a DeFi platform. Some of the world’s most popular DeFi platforms use LP tokens as follows.

DeversiFi (DVF)

What is it about?

The Drum announces that DeversiFi has appointed Threepipe as its retained digital agency partner.

Most special aspect

With a transaction volume of more than a million transactions per second, DeversiFi is a non-custodial, decentralized exchange. The layer-2 scaling engines in StarkWar’s system allow it to achieve up to 9,000 TPS. Furthermore, due to its high speed, it offers pooled liquidity pooling and charges almost nothing.

DeversiFi StarkEx smart contracts can accept cryptocurrencies from private and public wallets. Traders use the smart contract to conduct off-chain trades and ensure balance on the blockchain. NEC, the native token for the protocol, is used for carrying out the activities.

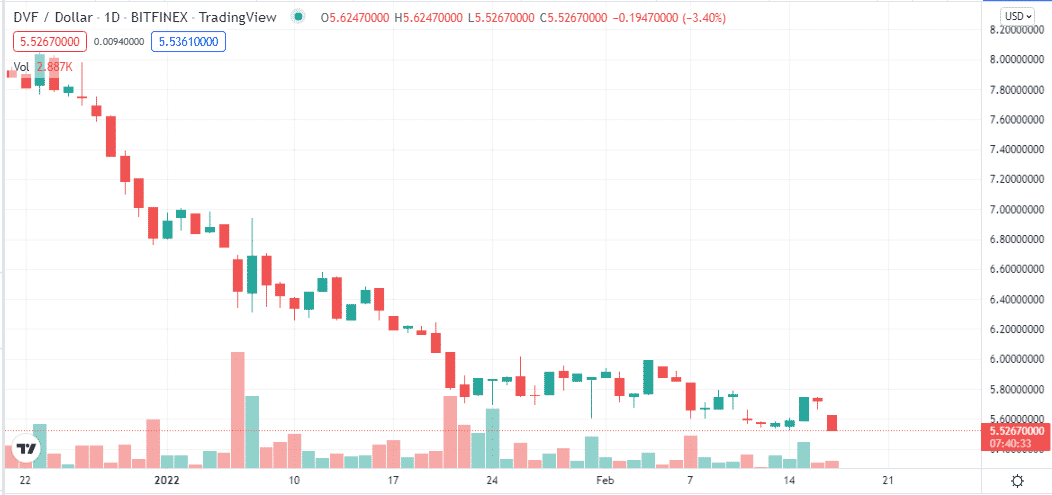

Price-performance

DeversiFi’s price has increased by 2.22% over 2021.

DeversiFi price prediction 2022

According to predictions, the price of DeversiFi will reach a minimum of $7.62 by 2022. DVF’s average trading price is $7.91, and it can go up to a maximum of $9.17.

KeeperDAO (ROOK)

What is it about?

KeepingDAO is an Ethereum-based DeFi protocol. KeepingDAO acts as a decentralized underwriter for DeFi loans.

Most special aspect

KeeperDAO facilitates liquidity, rebalancing, margin trading, lending, and exchanges by incentivizing participation financially. You’re required to deposit at least 0.64 percent of your asset into a KeeperDAO pool. ETH, WETH, USDC, renBTC, and DAI are five LPs that KeeperDAO offers for farming ROOK tokens. These pools back KeeperDAO’s Keepers and JITU’s Flash Loans.

Price-performance

KeeperDAO’s price has declined by 2.96% over 2021.

KeeperDAO price prediction 2022

KeeperDAO will reach at least $140.88 in 2022. With an average trading price of $145.16, ROOK can go as high as $175.30.

Balancer (BAL)

What is it about?

A balancer is an AMM protocol that facilitates the creation of liquidity pools with multiple assets of unequal weights. For instance, BAL liquidity tokens, called balancer pool tokens (BPT), are ERC-20 tokens that accumulate across Ethereum DeFi’s broader ecosystem.

Most special aspect

Due to Balancer’s unique configuration, BPT tokens got secured by a basket of crypto assets. In addition, users can earn rewards from projects using Balancer pools by staking BPT tokens.

Price-performance

Balancer’s price grew by 4.35% over 2021.

Balancer price prediction 2022

According to forecasts, Balancer’s price will reach at least $22.56 in 2022. With an average trading price of $23.15, BAL can reach a maximum level of $25.91.

Kyber Network (KNC)

What is it about?

Kyber Network consolidates liquidity from token holders, market makers, and decentralized exchanges and pools it into a single collection on its network. Dynamic Market Maker (DMM) protocol LPs receive DMM LP tokens in exchange for their pool share.

Most special aspect

Interested parties can stake their DMM tokens in liquidity mining pools for the opportunity to earn KNC or MATIC, the governance tokens of Kyber and Polygon, in addition to protocol fees earned through staking.

Price-performance

Over the past year, Kyber Network’s price has increased by 13.00%.

Kyber Network price prediction 2022

KNC indicates a positive trend against USD as the Pandemic phenomenon recedes, topping the $5 mark as the price increases.

Bancor (BNT)

What is it about?

Blockchain technology, called Bancor, leverages pooled liquidity based on the Ethereum platform. The algorithmic trading system uses “Smart Tokens,” similar to Curve, Uniswap, and others, to maintain a constant ratio between tokens (e.g., ETH) and modifies their supply to generate liquidity and accurate prices. Its liquidity pool is known as the Bancor relay.

Most special aspect

Bancor introduces stablecoin to counteract the volatility in liquidity caused by the native token relying on BNT. In addition, it uses BNT to facilitate data transfers between other blockchains, with Ethereum and EOS chains now included. Therefore, it is possible to pair BNT tokens with Ethereum or EOS tokens and their stablecoin USDB. With Bancor, you can either pay 0.1 percent or 0.5 percent, whereas Uniswap charges a fixed price.

Price-performance

BNT lost 2.87% of its value in 2021.

Bancor price prediction 2022

By the end of 2022, BNT prices will be $4.08.

Final thoughts

With automated smart contracts-liquid pooling, DeFi has alleviated the escalating liquidity problem in the traditional cryptocurrency sector. It seems that the total locked value of DeFi is more than $8.75 billion, based on the DeFi pulse. Despite this, more protocols are offering liquidity solutions. This will allow DeFi to achieve its goal of self-banking.