The time frame is an essential factor when you are an active participant in the financial market. The crypto marketplace is open 24/7 for individuals to make frequent transactions with a growing number of exchanges. Although the market is open nonstop, it affects the price when the global activity is high. So it is important to know the best time to get the best deals.

Novice crypto investors often enter the marketplace with some common confusion. This article contains the best time to trade cryptocurrencies alongside listing the top five tips to find the best trading ideas to make constant profits.

Why determining the best time is important?

The crypto market is a 24/7 market that allows making transactions anytime you want. The volume of crypto coins usually soars or dips according to participants’ actions globally. The global market reacts according to the region for particular crypto assets. For instance, Americans might react to business headlines, impacting specific crypto coins. Meanwhile, the Asian market might not have that much wave. Determining the facts of relative regions and cryptos can help you buy/sell crypto-assets at the fairest prices.

So this understanding of the volatility game is important when you decide to make money through frequent crypto trading. Usually, 8:00 am-4:00 pm is the peak hour in local time for cryptocurrencies, as during this period, the market gets the highest volatility. In addition, there might be huge movements due to global reaction in the “closed” period in local time depending on speculations and news/fundamental data. Many sources on the internet show live regional data through time converters.

Five top tips for day trading

When you seek to participate in the crypto marketplace, it is mandatory to follow particular guidelines while expecting to trade cryptocurrencies at the best prices. When starting cryptocurrencies, the five top tips for dealing with confusion are:

- Select a trading platform.

- Choose investment assets.

- Following specific crypto trading methods.

- Select time frame and timezones.

- Technical and fundamental analysis.

Tip 1. Select a trading platform

The trading platform is a vital factor to crypto investors. Usually, the crypto industry is a decentralized marketplace allowing P2P transactions. US-based traders use platforms under regulations, so you can consider it a significant factor. When expert crypto investors choose the platform, they look at preliminary information about the exchange, including fees, asset liquidity, exchange liquidity, etc. The price of digital assets oscillates according to volatility. So crypto day traders need to move fast to maximize profits. When choosing the best crypto exchange platforms requires considering several factors such as:

- Active years

If the exchange operates for more extended periods, it can signify creditability and stability.

- Supported assets

Investors always consider available cryptocurrencies of any exchange platform as more supported cryptos enable flexibility in trading.

- Deposit methods

Another essential factor of any crypto exchange platform in deposit methods. Many exchange platforms allow credit cards, PayPal, bank wire transfers, even gift cards as a deposit method.

- Liquidity

Highly liquid crypto exchange platforms usually enable buying/selling crypto assets almost immediately with a minimum difference in bid/ask prices.

- Fees

Fees are another vital factor while choosing the best crypto exchange platforms.

- User reviews

Crypto investors often check user feedback by visiting different communities to identify the best crypto exchange platforms.

Tip 2. Choose investment assets

Another vital factor of crypto trading is choosing crypto assets. Both liquidity and volatility are two major elements that enable crypto day traders to make quick profits. While buy-and-hold investors may scare of volatility, crypto day traders seek opportunities through the chaos of the price movements.

Three primary factors to consider while choosing any crypto-asset:

- Trading volume

Trading volume refers to the total number of any traded asset over a particular period. Higher volume requires high liquidity and the higher volume reflects the demand of assets over any specific time.

- Volatility

Expert crypto traders always check the volatility data to obtain unpredictability.

- Liquidity

Liquidity is another vital factor as it enables converting assets to fiat currency or other cryptos without affective the price.

Tip 3. Following specific crypto trading methods

There are many crypto trading strategies available for crypto day traders. Follow specific methods to generate constant profits from the marketplace.

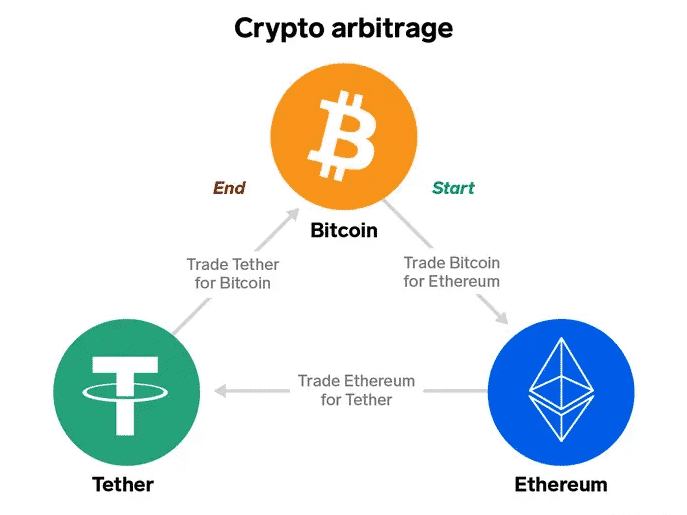

The top methods are arbitrage, long straddle, scalping, bot trading, range trading, etc.

Tip 4. Select time frame and timezones

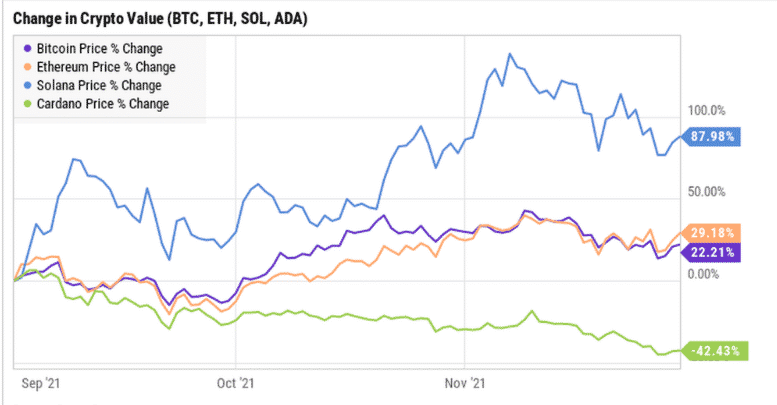

You can trade crypto all day long, but knowing the best time to buy crypto at a low price is essential to maximize profits. According to the last Oct and Nov data observation, the best time was in the morning; the earlier is, the better. Getting before the market starts means you will get opportunities of purchasing at a reasonable price as a more active market means a higher price.

Meanwhile, the best time of the week is on Thursday. More specifically, Thursday morning is the best time to buy crypto assets. The second top day is Monday, followed by every Friday and Saturday. Once the week finishes, the demand drops, so trading in these periods helps you avoid the rush.

Again, the crypto market is constantly changing. So the price usually rises during the first 10-days of any month. Then in the second half, it waves and shows some declining pressure as cell volume increases. Near the end of any month is the comparatively best time to purchase crypto assets. Many people get their paychecks during the middle of the month so that the price can rise for immediate purchase. It is better to wait for a week after payday to purchase crypto at a lower price.

Tip 5. Technical and fundamental analysis

It is a major part to analyze the market from several angles before entering any trade. Expert crypto traders usually conduct technical and fundamental analyses while making trade decisions like other financial traders. Conducting technical analysis involves using technical tools, indicators, chart patterns, etc.

Meanwhile, checking on fundamental data, including news, future blockchain projections, utility info, etc., is mandatory while making trade decisions. For example, when the circulating supply increases, the demand declines, so does the price.

Final thought

There may be no perfect time to buy cryptocurrencies that don’t mean we shouldn’t try. When the trend or a cycle goes on, you can positively generate profitable trade ideas.