Falcor Forex Robot claims to redefine the automated method of FX trading with its unique approach. The FX EA boasts earnings of $132,307 in the last 30 days and $114,605 in January, 2022. As per the vendor, this ATS uses price action and no-lag indicators that work in real-time to ensure accurate trades and big returns. Monthly performance results are present for the system and the pricing is not very high. However, there are downsides like no verified trading results, backtests, and there is lack of vendor transparency.

Vendor transparency

Forex Robot Trader is the company behind the development and marketing of this FX robot. Don Steinitz is the founder of the company. He and his team of expert developers and traders have created this ATS and many other products like Vader, Odin, etc. There is not much info present on the developer team. We could not find company details like the founding year, reputation, location address, phone number, etc. The lack of vendor info makes us suspect the system is lacking in vendor transparency.

How Falcor Forex Robot works

As per the vendor info, this FX EA is easy to use for traders of any skill level. On purchase and loading of the software, it identifies accurate entry points, opens, and manages the orders automatically. You can use it independently or with other FX EAs. You can also use it with your manual trading.

Some of the key features of the ATS that the vendor focuses on are:

- It helps you to trade skillfully without any hassle.

- It monitors the market 24/7 ensuring you do not miss out on profitable orders.

- The FX EA can work on multiple currency pairs at the same time.

- This MT4 tool uses a new trading logic to generate high returns.

- You can use full-size, mini, and micro-lots as the system is built to adapt to the size of your account.

Timeframe, currency pairs, deposit

Other than the mention of the software working on multiple currency pairs at a time, we could not find much info on the system. The vendor does not divulge details on the timeframe, currency pairs, deposit, leverage, etc.

Trading approach

According to the info present on the official site, price action is the main approach used. It trades frequently and keeps open positions always. We could not find further explanation of the approach. Further, the vendor does not provide strategy tests for the EA, which makes it difficult to evaluate the efficacy of the FX EA.

Pricing and refund

To purchase this FX EA, you need to pay $79. A 60% discount has been applied to the original price of $199. There are no details present on the features you get with the software package. When compared to the price of other competitor systems, we find the price of this ATS is cheap. However, the lack of a money-back assurance makes us suspect the reliability of the EA.

Trading results

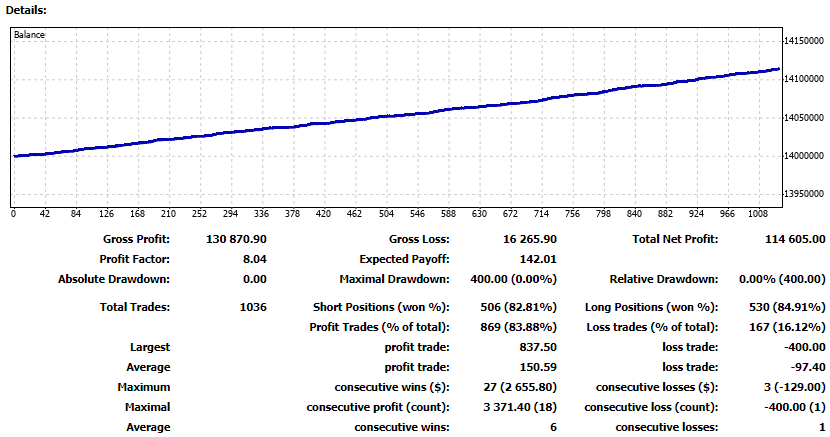

Monthly performance reports are provided for the FX EAon the official site. Here is a screenshot of the monthly report of the FX robot.

From the above stats, we can see the system has achieved a total net profit of 114,605 and a profit factor of 8.04. For a total of 1036 trades, the profitability was 83.88% and no drawdown is present for the account. The results show decent profit without any risk involved. But we prefer trading results verified by a reputed third-party site like Myfxbook, FXStat, and FXBLue. The lack of verified results raises doubts regarding the reliability of the system.

People say that Falcor Forex Robot is…

A doubtful EA. As per the review of one of the users on the Forex Peace Army site, the system has shown profits in demo settings. But the results are not as high as found in the performance reports. Another user complains that the service is a scam as the support is very poor.

Verdict

| Pros | Cons |

| It is a fully automated software | Strategy explanation is vague |

| Price is affordable | No verified real trading results |

| Absence of vendor transparency |

Falcor Forex Conclusion

Falcor Forex Robot claims to identify the highly profitable trades effectively with its unique approach. The vendor provides monthly performance reports to prove the claims of high profits. But the reports are not verified by a third-party site like Myfxbook, FXBlue, etc. Further, there are other downsides we noticed in the system like the vague strategy explanation, lack of backtests, and absence of vendor transparency.