Forex GDB is a provider of live FX signals. Besides providing the signals, the vendor also adds a detailed chart analysis and the reason for the sell/buy order. As per the vendor, the company believes in providing quality trades rather than quantity.

For this review, we have analyzed the significant aspects of this provider like its approach, track record, support, etc. While the vendor provides trading results, they show a high drawdown. Furthermore, we could not find an explanation of the strategy or adequate support options. Our first conclusion of this service is that it is not a trustworthy provider.

Vendor transparency

As per the vendor info, the company was started in 2015 by a group of professionals providing top-quality features. The members have work knowledge in various monetary institutions and FX brokers occupying posts like Fund Manager, FX dealer, and more.

In addition to the FX signals, the company also offers education courses in FX trading and analysis on the buy/sell decisions for FX pairs. There is no location address or phone number present for this vendor. For support, an online contact form and a Skype ID are present. We find the vendor and support info are inadequate, raising doubts regarding the reliability of this company.

How Forex GDP Works

According to the vendor, this service functions by providing a detailed breakdown with each of the signals. The alerts are sent after the analyst team of the company shares the approach and analytical logic behind each of them.

For signal measurement, the company provides them in points rather than pips with one pip making up 10 points or pipettes. An SL ranging from 10 pips to 100 pips and a TP starting from 30 pips to 600 pips are present for this service.

Timeframe, currency pairs, deposit

A daily time chart is used by the vendor. For the trading balance requirement, the vendor states that any account balance can be used provided proper money management is present. For instance, a balance of $1000 would need a lot size of 0.05. There is no info on the leverage or currency pairs this firm focuses on.

Trading approach

The vendor does not reveal the approach used which is disappointing. Other than the mention of the use of chart evaluation and providing procedural reasons for the currency pair buying or selling, the vendor does not divulge the strategy used. Furthermore, there are no strategy tester reports present to test the efficacy of the approach. The lack of info on the strategy and the absence of backtests raise a red flag for this provider.

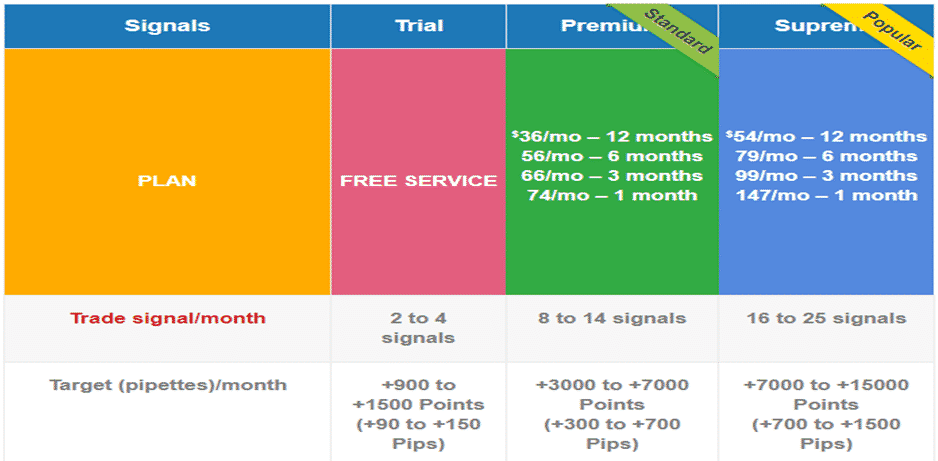

Pricing and refund

This vendor gives a free plan under which you get a maximum of 4 signals per month with a potential profit of more than 150 pips. SL, TP, entry price, and technical chart analysis with explanation for the buy/sell orders are provided. To use the free plan, you need to just register. Free users also get trade ideas, analysis of the market, and education courses for free along with support.

With the paid plan, you get signals that have more accuracy and varied signal types like Big Trade, Commodity, Jackpot entry, and more. The price ranges from $36/month for 12 months under the Premium plan and $54 per month for 12 months under the Supreme plan. There is no money-back assurance which makes us suspect this is an unreliable service.

Trading results

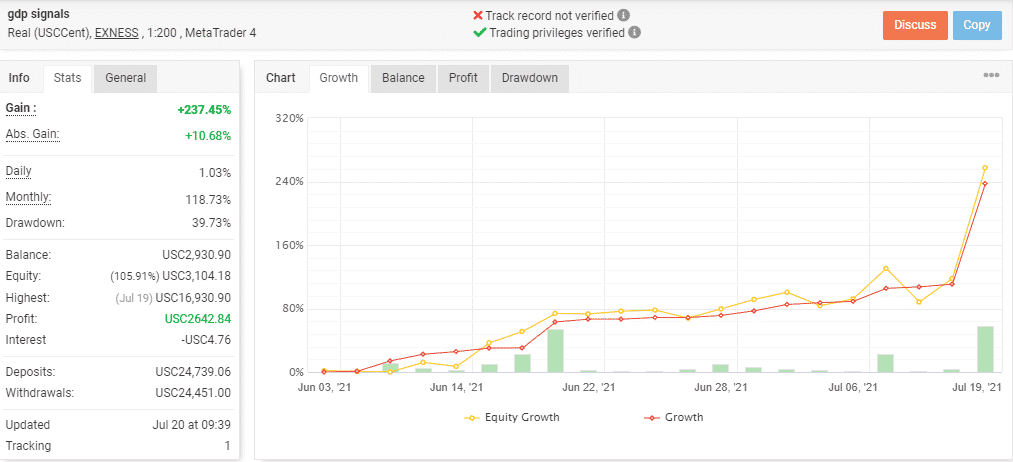

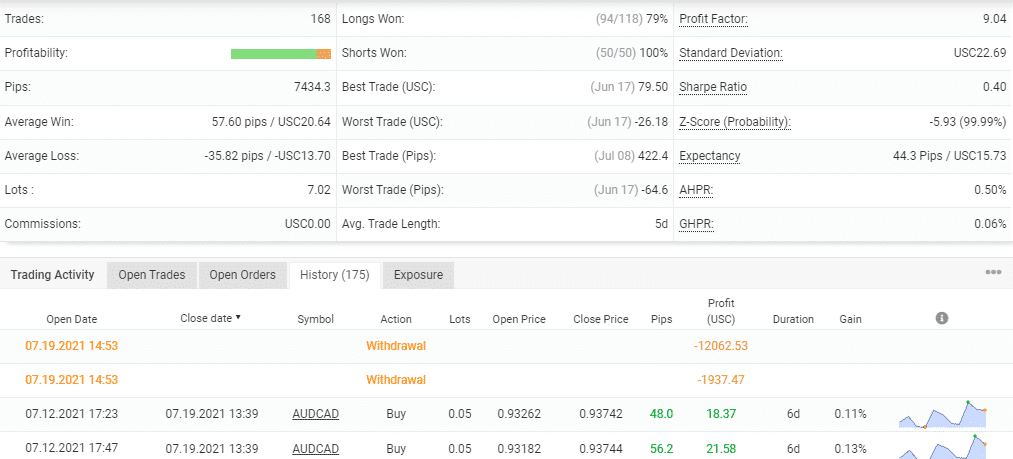

A few samples of the trading results are present in the results section of the site. The vendor also provides myfxbook verified results of one of its subscribers. Here is the real USCCent account using EXNESS broker and the leverage of 1:200 on the MT4 platform.

From the above screenshots, we can see the trading privileges are verified by the site but not the track record. The trading stats reveal a total profit of 237.45% and an absolute profit of 10.68%. The enormous difference between the two values indicates a risky approach. A daily profit of 1.03% and a monthly profit of 118.73% are present for the account. The drawdown is 39.73%, which is very high indicating an inefficient approach and poor performance.

This account started in June 2021 has ended in July 2021 with nearly all the deposited amount being withdrawn. A profit factor value of 9.04 is present for the account. The high profit percentage and profit factor values despite the high drawdown make us suspect manipulation of the data.

People say that Forex GDP is…

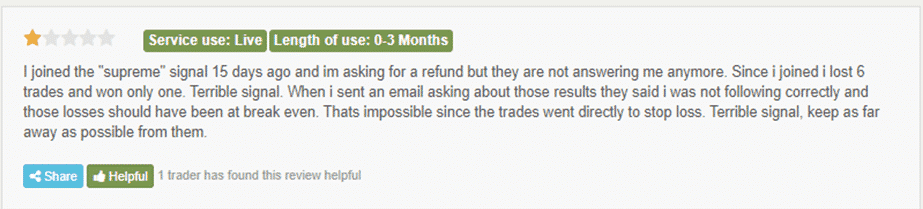

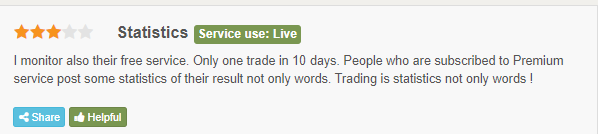

Unreliable. As per user feedback, the trades are not frequent and they are not profitable. Here are a few of the screenshots.

From the above feedback, it is clear that the users are not happy with the signals and the losses they generate. As seen in the verified trading result, the drawdown is very high which indicates a high-risk approach that can endanger your account.

Forex GDP Conclusion

Forex GDP fails to provide proof of its successful track record and trading method. The absence of strategy explanation, backtests, and fully verified trading results indicate this is not a dependable service. Furthermore, the poor feedback from users confirms that this is not a trustworthy company.