A greedy strategy is a unique approach to the marketplace that suggests trading positions by tracking gaps between candle formations. Executing profitable trades using the gap concept is common among financial investors to generate trade ideas, so it makes sense that the method will suit fine on crypto assets.

However, it is mandatory to understand any trading concept while using that approach to determine profitable trading positions. This article describes the greedy crypto strategy and lists the top five tips to use that concept effectively.

What is the greedy crypto strategy?

It is a trading approach that suggests trading positions by comparing the price difference between the current opening price and the high/low prices of the previous price candle.

- When the opening price of the current candle is higher than the high of the last candle, this method indicates bullish momentum.

- When the opening price of the current candle is lower than the previous candle’s low, it indicates bearish momentum.

So this strategy takes advantage of the gaps in either direction to generate trade ideas. This strategy suggests complete trade setups that you can modify when implementing the concept in live trading according to your desire. You can use this concept most effectively by following some specific guidelines.

Top five tips for using the greedy crypto strategy

When implementing any trading concept in live trading, it is better to follow specific guidelines to get the best results. This part will list the top five professional tips to use this greedy strategy concept in crypto trading.

Tip 1. When entering buy trades

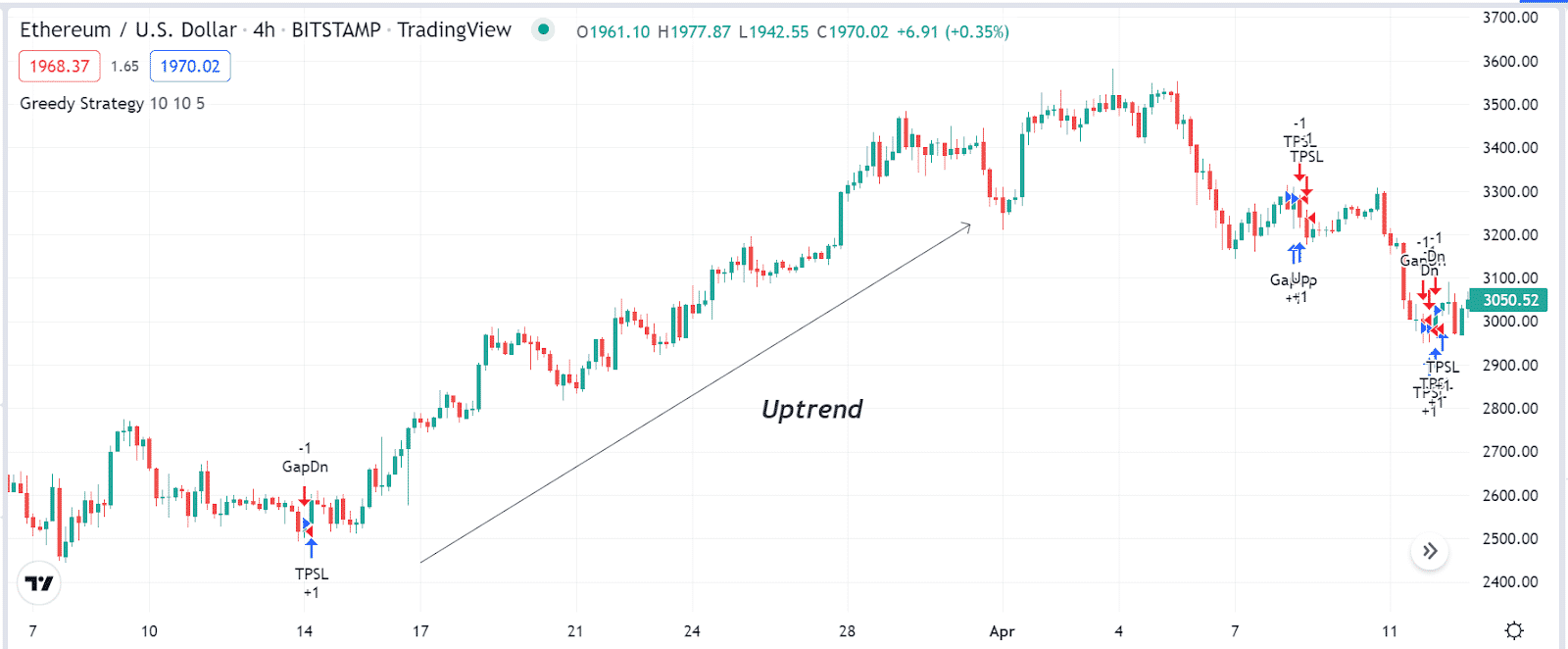

This trading method automatically detects potential buy positions when the price movements create a “bullish gap” in the asset price. You may find this type of trading position in bullish trends, and this method suggests stop-loss and take-profit levels based on the default value.

Why does this happen?

The greedy trading method seeks to open positions when a rapid buy/sell pressure occurs in the asset price. Investors become more frugal, so the buy volume increases, and a gap occurs during price movement. Determining these gaps enables opening potentially profitable buy positions. You can use this concept independently or combine many other technical or fundamental market data to generate investing ideas.

How to avoid mistakes?

This indicator suggests or sets stop-loss and take-profit levels according to the default parameters. You can change the parameters according to your desire. Moreover, when seeking positions at shorter timeframes, it is better to check higher time frame charts as significant participants always track the long-term trends.

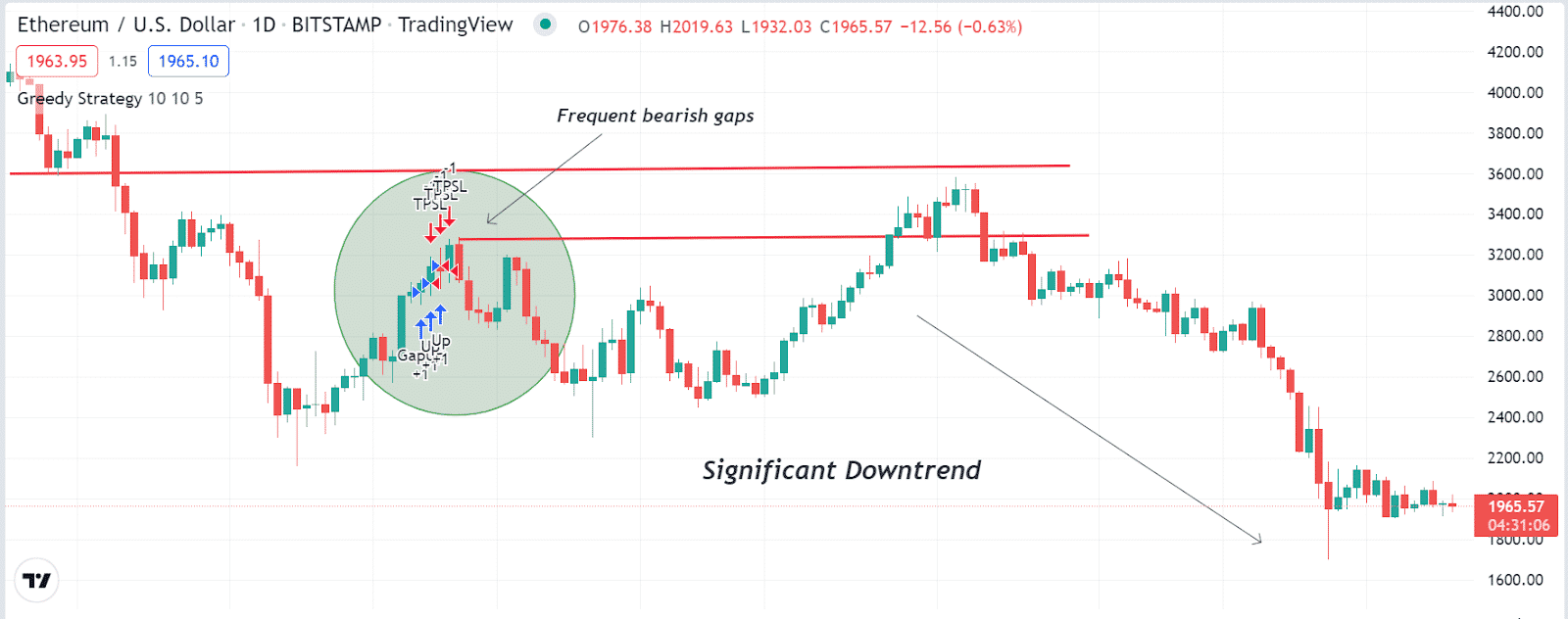

Tip 2. When entering sell trades

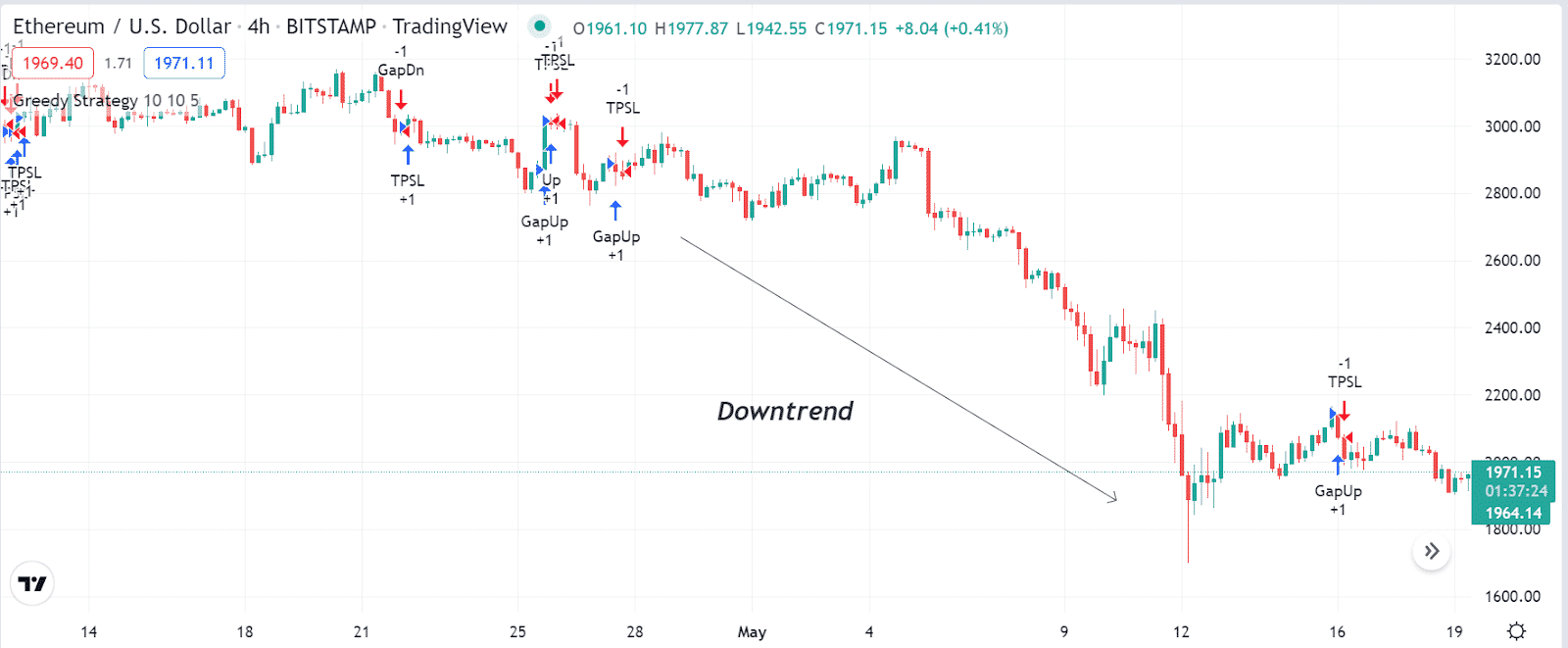

You spot the TPSL turns on the upside of price candles with a negative (-1) value when seeking to open sell positions. Therefore, the “bearish gap” occurs to go short on particular assets. You can find this type of trading opportunity during downtrends.

Why does this happen?

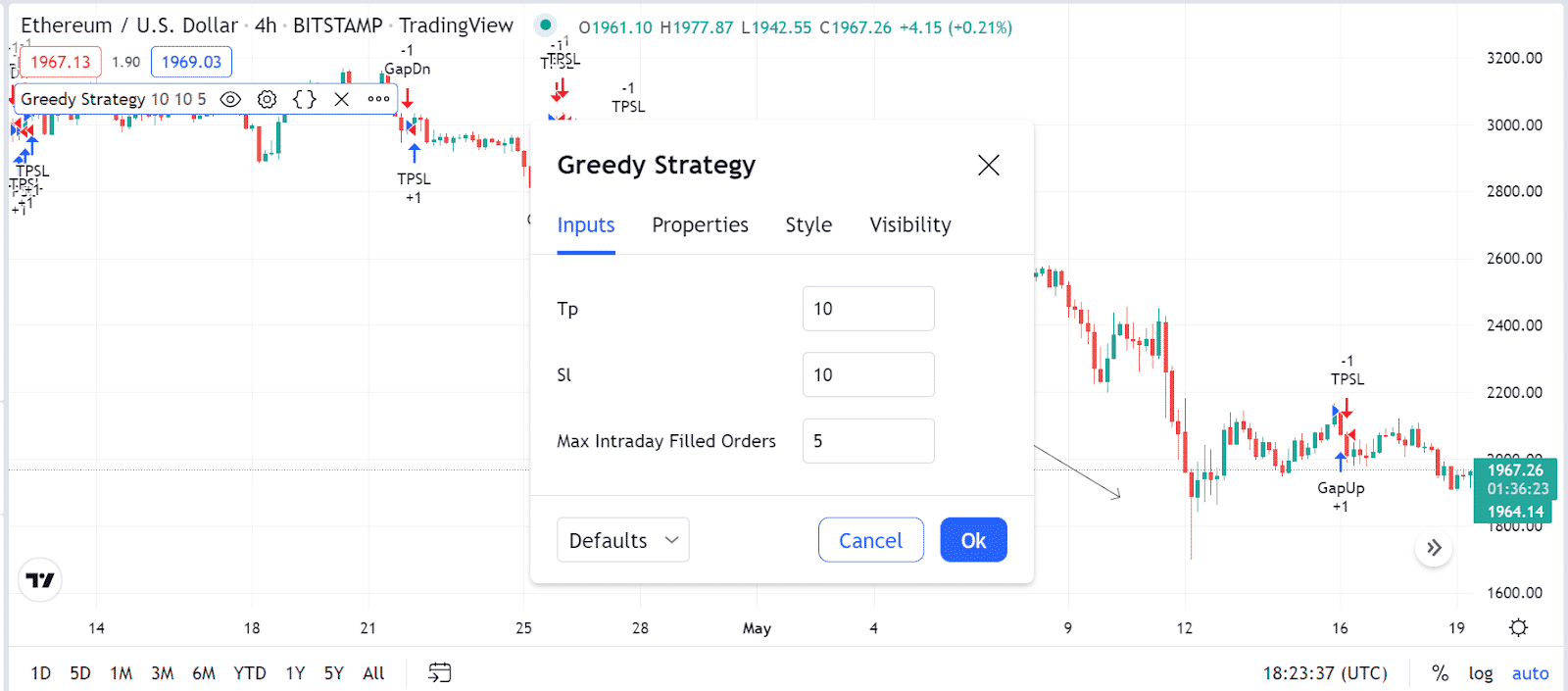

It occurs as increasing declining pressure creates a gap during the price movements. The greedy strategy automatically detects these gaps with its calculation. You can modify parameters as you wish to set them.

How to avoid mistakes?

This method usually follows the price movements and executes trades. It reveals how to modify the SL and TP levels for flexibility. You can set the parameters as you prefer from the settings section. Check the chart below for a better understanding.

Tip 3. Detecting sideways

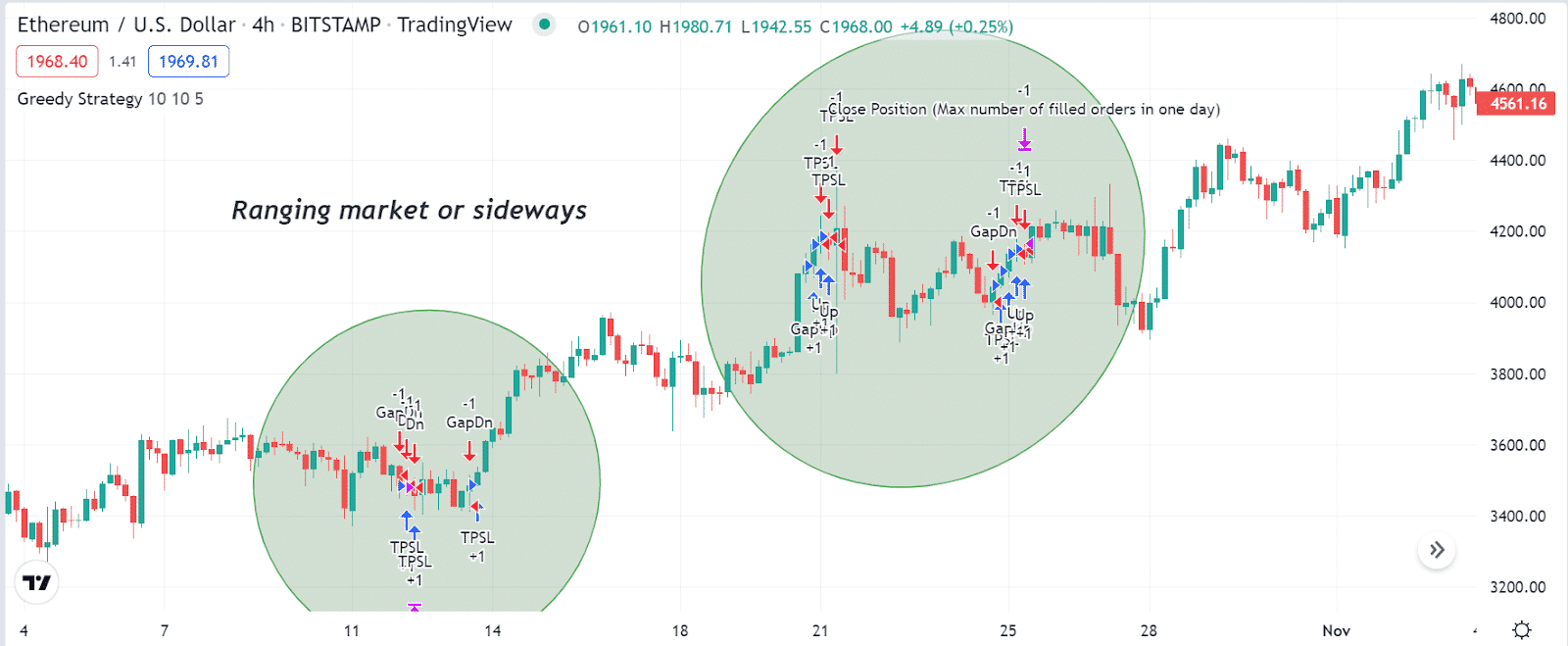

You can easily mark sideways using this trading approach. When different gaps frequently occur during the price movement, it indicates the price may move in a sideways or ranging market. Detecting sideways is essential as, in many cases, these consolidation phases occur before significant price movements or just before the price enters notable trends.

Why does this happen?

It is common in many other trading instruments such as currencies, stocks, etc. It occurs as a sideways or ranging market reflects the indecisions of participants. Usually, volume decreases in these phases. Meanwhile, significant pressure on the asset price creates gaps.

How to avoid mistakes?

You can use many other technical indicators or tools concepts alongside this greedy crypto strategy. It will suggest efficient trading ideas. Combining two or more concepts enables profitable trading opportunities.

Tip 4. Determine significant breakouts

You can use this strategy to identify significant breakout levels or trends if you have a prior understanding of support resistance levels. For example, the price may break below any support-resistance level. Meanwhile, the “bearish gap” occurs two or more times, and the price rejection from the breakout level indicates the price may enter a significant bearish trend.

Why does this happen?

When any specific type of gap frequently occurs reflects significant investors’ actions. This trading method detects those significant price changes during any particular period.

How to avoid mistakes?

When using this concept to detect long-term trends, conduct sufficient analysis of historical price movements. Moreover, only enter when any breakout occurs, or the price starts to move in any particular direction.

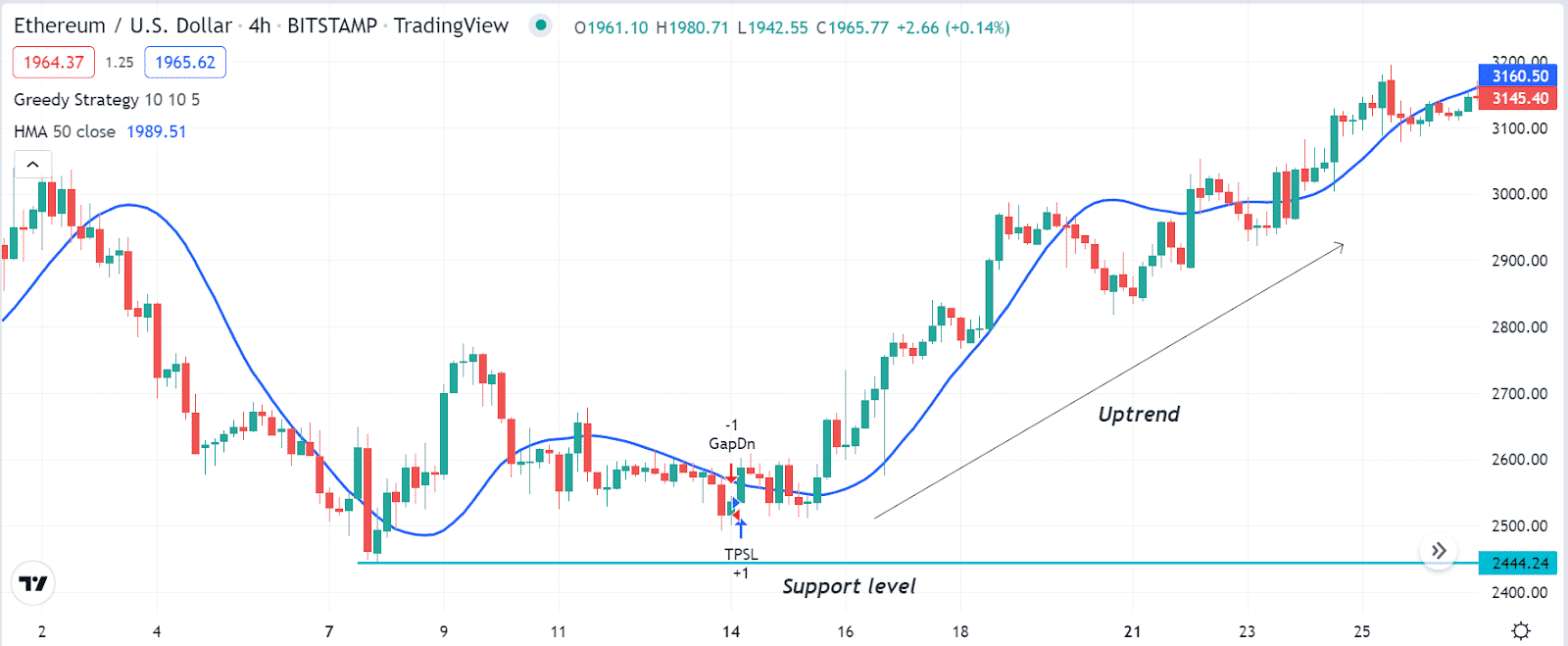

Tip 5. Combining HMA indicator

You can combine a Hull moving average line to generate trade ideas on crypto assets. For example, The greedy strategy detects a “bullish gap” and indicates a possible upcoming bullish momentum. Meanwhile, the price reaches above the HMA (50), and the HMA line slops on the upside, declaring sufficient bullish pressure on the asset price.

Why does this happen?

The “bullish gap” occurs for rapid buy volume during a particular period. Meanwhile, the HMA line confirms the increasing bullish pressure on the asset price. Combining both info, you can generate constantly profitable trade ideas.

How to avoid mistakes?

When using this concept to enter trades, we suggest entering trades only when technical tools predict a particular price direction and using proper trade and money management concepts when executing trades.

Final thought

Finally, we hope you find this article beneficial for crypto trading as it contains the top effective tips to use the concept of greedy strategy. We suggest mastering the concept by doing sufficient practice before executing any trade.