Happy Power EA is based on a neural network that develops the algorithm as it trades. The expert advisor trades on EURCHF with a grid strategy that shows promising results. It has, however, some weak sides, which include exposing your portfolio to high risk.

Vendor Transparency

The vendor does not provide any information on his coding and trading experience. So after purchasing the product, we are at the mercy of an unknown person to deliver products who god knows may or may not work. They only provide an email and live chat service on the website for contact purposes.

How Happy Power works

Happy Power comes with the following features for traders:

- Support for all ECN brokers

- Detects four and five digit brokers automatically

- It installs easily and is fully automated

- It has a self-adaptive algorithm that constantly updates the robot

Time Frames, Currency Pairs, Deposit

The robot works on EURCHF at a time frame of 30 minutes. It is coded for both MT 4 and 5 versions. The recommended minimum deposit is $1000. The developer does not state the amount of leverage a trader should use. However, from the live records on Myfxbook, he uses 1:500. This is an extremely high value that can liquidate your $1000 portfolio in a matter of minutes if utilized to the full.

Trading Approach

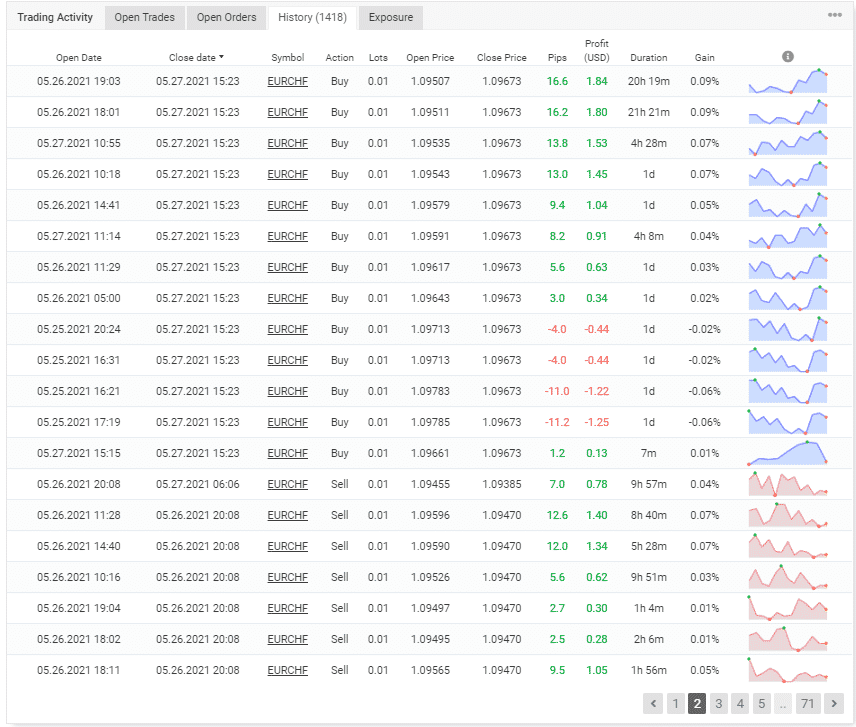

The developer doesn’t state what type of strategy the algorithm utilizes. However, using the trading history from the live records, we are able to deduce some conclusions. The robot maintains an average approach between day and swing trading with a mean trade duration of two days. It opens grid orders on EURCHF for the same lot size until the trade moves in the desired direction.

Pricing and Refund

The robot is available for 325 Euros and comes with ten other EAs from the same developer. Existing customers who have already purchased their full pack can get a discount of 30%. The package includes one license for unlimited demo and real accounts. There is a 30-day money-back guarantee if you’re not satisfied with the result.

Trading Results

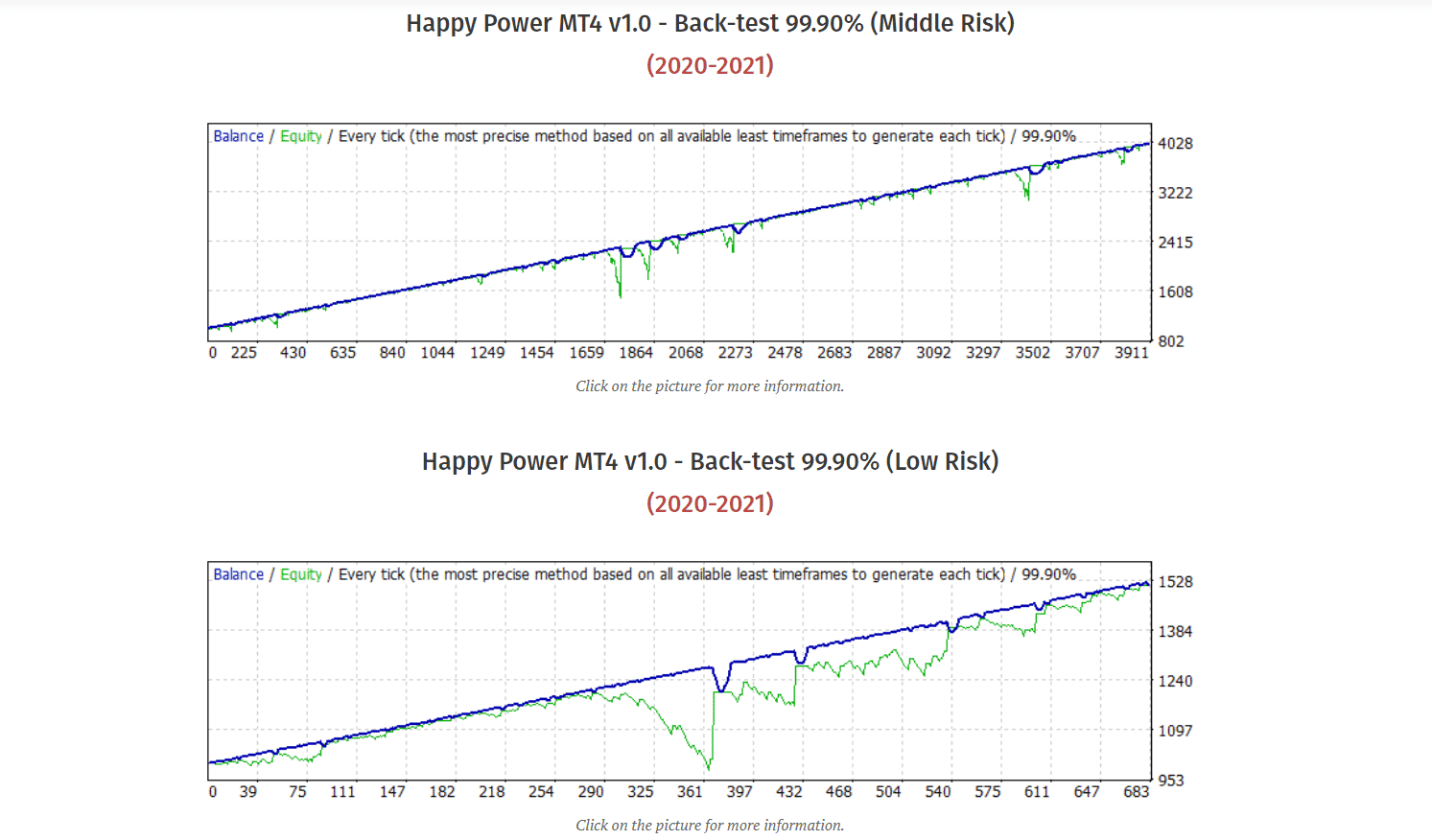

Backtesting results are available for the low, medium, and high-risk settings. The respective relative drawdowns are 19.57%, 35.61%, and 39.17%, respectively. Total net profits are also proportional to the risk. An initial deposit of $1000 shows an average return of 51.2% low risk, 299.7% medium risk, and 496.5% high-risk accounts. The winning rate and profit increase from low to high risk, which points out that there are more grid orders to avoid loss on risky portfolios.

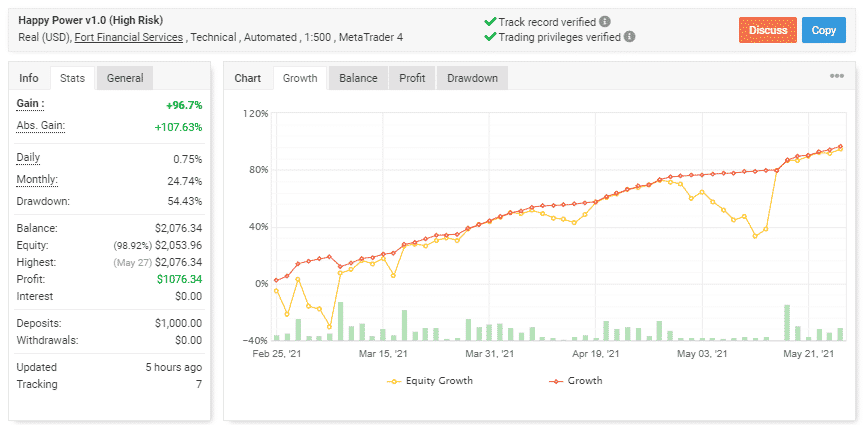

Live trading results are available for high-risk settings that show a gain of 96.7% from February 25, 2021, till now. While trading, the system had an average win rate of 76% coupled with a profit factor of 2.66. The drawdown on the account was extremely high, mounting up to 54.43%, depicting that the portfolio wipes off half of its total value at one point. The average win rate is $1.6, and the loss is -$1.93. These are following the backtest results with a little performance drop to say at least.

People say that Happy Power is…

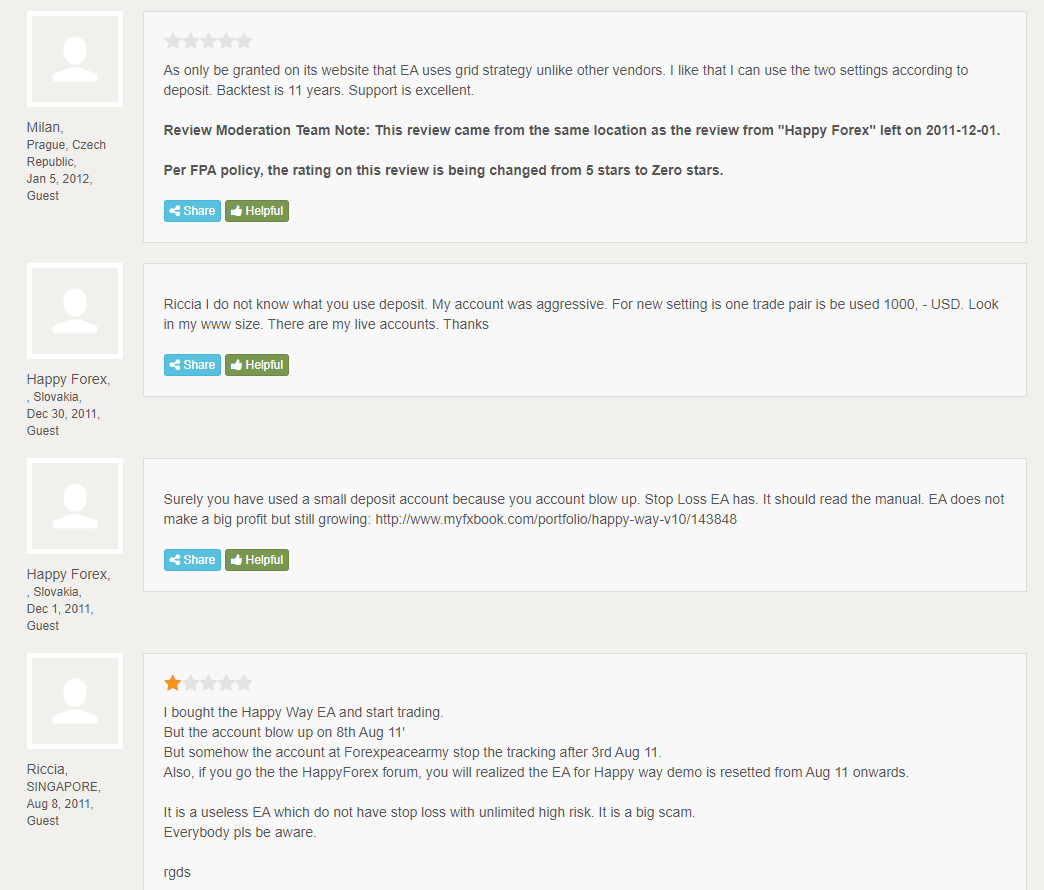

Risky. The reviews on Forex Peace Army show that traders are highly skeptical about the robot. They say that the account has a high chance of blowing up. A trader even says that it is a scam. It seems that Happy Forex also purchases reviews, as there is one comment that was removed due to location issues.

Verdict

| Pros | Cons |

| Verified live results | Poor customer reviews |

| A significant drawdown during trading | |

| No information on the whereabouts of the developer |

Happy Power

Happy Power uses the traditional grid trading system that is known to work for a short while. In the long term, if the market trends in the opposite direction, the system will fail terribly. Even now, the robot has a considerable drawdown, so it is not a good expert advisor.