Price action is a general trading approach. As a trader, one needs to learn about the various aspects of price action. Knowing the different patterns and movements of an asset’s price helps form a perfect strategy. If you’re looking for tips to master price action, you’ve come to the right place.

What is price action?

Price action generally refers to the price movement of an asset when plotted over time. The term price action is usually used in technical analysis to interpret price movements. It forms the basis for all technical analysis of a stock, commodity, or other financial markets.

It focuses significantly on the price history, up and down movement of an asset over the period. This article will reveal the top five tips to master the price action that beginners and intermediate traders can adopt.

Tip 1. Learn fewer patterns

Most of the beginners of price action trading begin their learning journey haphazardly. A price pattern is formed by the distinctive formations created by the movement of an asset price. They serve as a foundation of technical analysis. However, all the price patterns have variable factors, contexts, and different time frames. Therefore, it is impossible to remember all of the chart patterns as it has an exhaustive list.

A trader should learn a few but basic chart patterns. Unfortunately, many of the traders know an overwhelming number of ways, hence disregard the important ones.

Why does it happen?

Traders new to price action trading don’t know where to start from. They may have a lot of educational material but don’t have a set plan. As a result, they prioritize learning new price patterns but don’t prioritize identifying the important and relevant ways.

How to avoid the mistake?

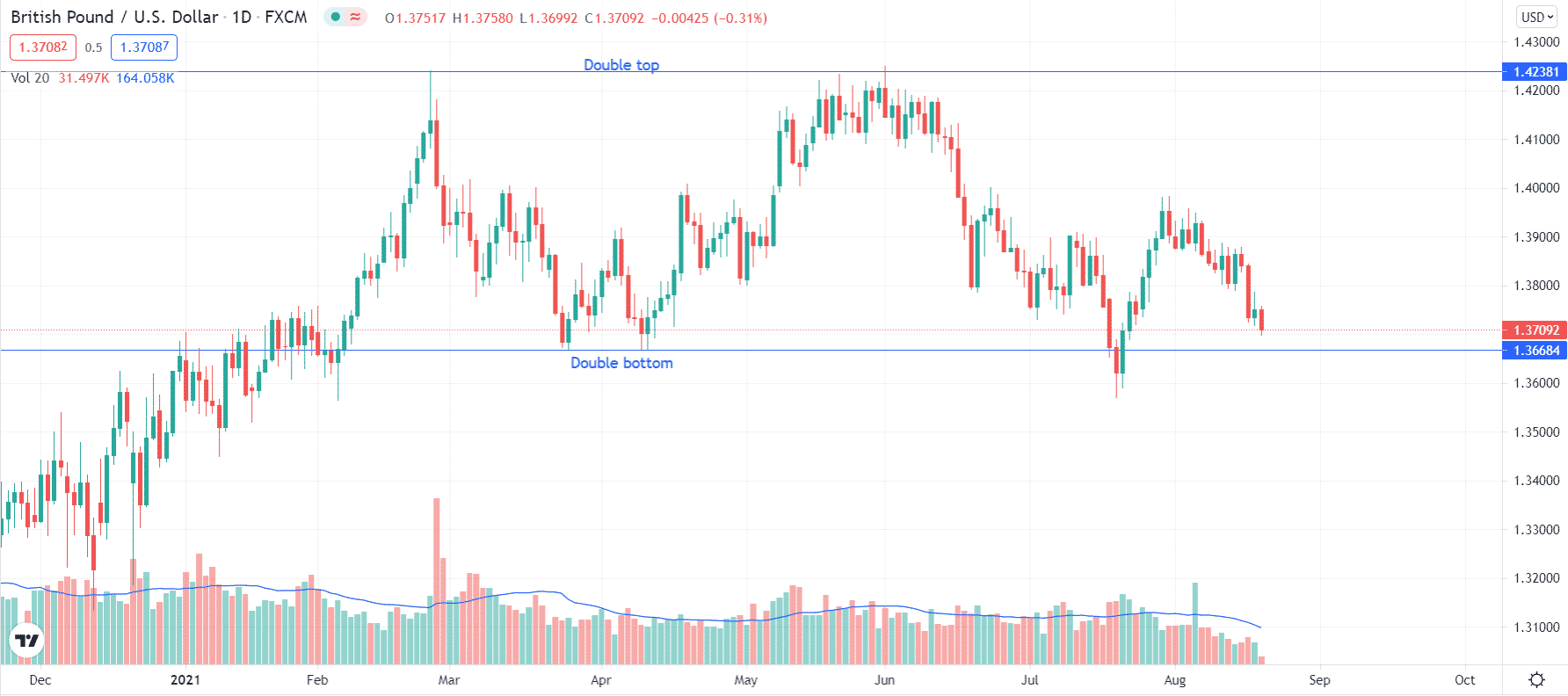

Traders need to map out an organized learning plan. This is done by choosing the most common trading patterns. Learning fewer patterns will save traders a lot of time and effort. Using the most common classical patterns like a double top and double bottom is easy to understand. You can then expand your learning to other similar patterns triple top, triple bottom, engulfing patterns, etc.

Tip 2. Backtest analysis

Backtesting a price action pattern is an essential step for a trader to know whether a particular price action pattern is worth considering or not.

Backtesting also helps a trader to gain confidence in that strategy. But, again, this is a significant positive psychological step because faith helps control the negative emotional aspects of trading.

Why does it happen?

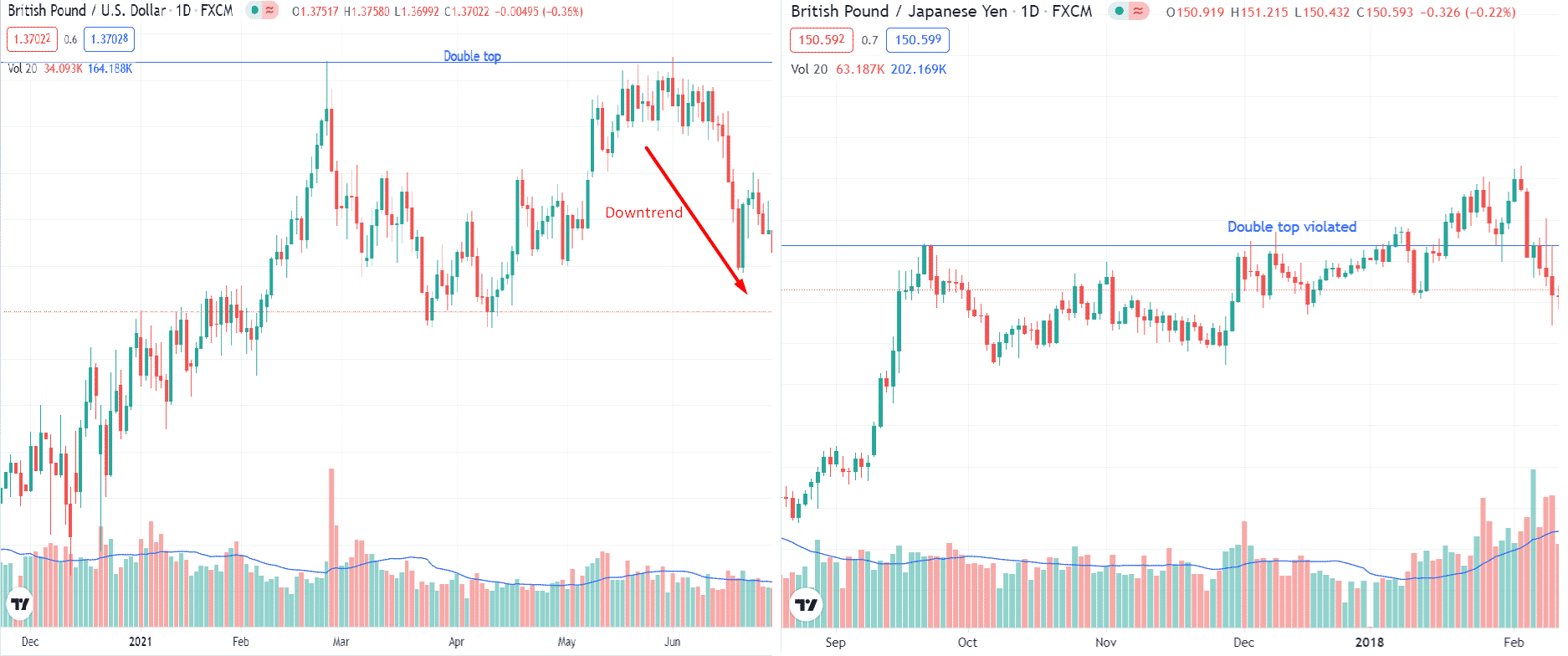

When traders do not have a plan to backtest their strategy, they cannot analyze the effectiveness of their system. For example, you may not know whether a double top/bottom pattern is effective in GBP/USD without backtesting, while it is not practical in GBP/JPY.

How to avoid the mistake?

Suppose you learned a double top pattern and you want to find the efficacy of the pattern. You have to then backtest the pattern on different currency pairs to find the results.

Tip 3. Forward test analysis

After the backtest analysis of a strategy, forward testing is essential for the traders. Forward testing evaluates the trading strategy’s performance solely based on post-optimization trading. This data is not included in the optimization sample. Instead, it provides validation of the strategy’s ability to yield profits in the live markets.

The forward test analysis proves to be a more accurate and efficient measurement of profit and risk levels. Traders who forward test their model establish a higher level of confidence that covers risking real money.

Why does it happen?

Investors that don’t test their learned techniques in the live market won’t know how certain patterns will perform in the live conditions. Traders don’t use forward test analysis as they think that backtesting is sufficient.

How to avoid the mistake?

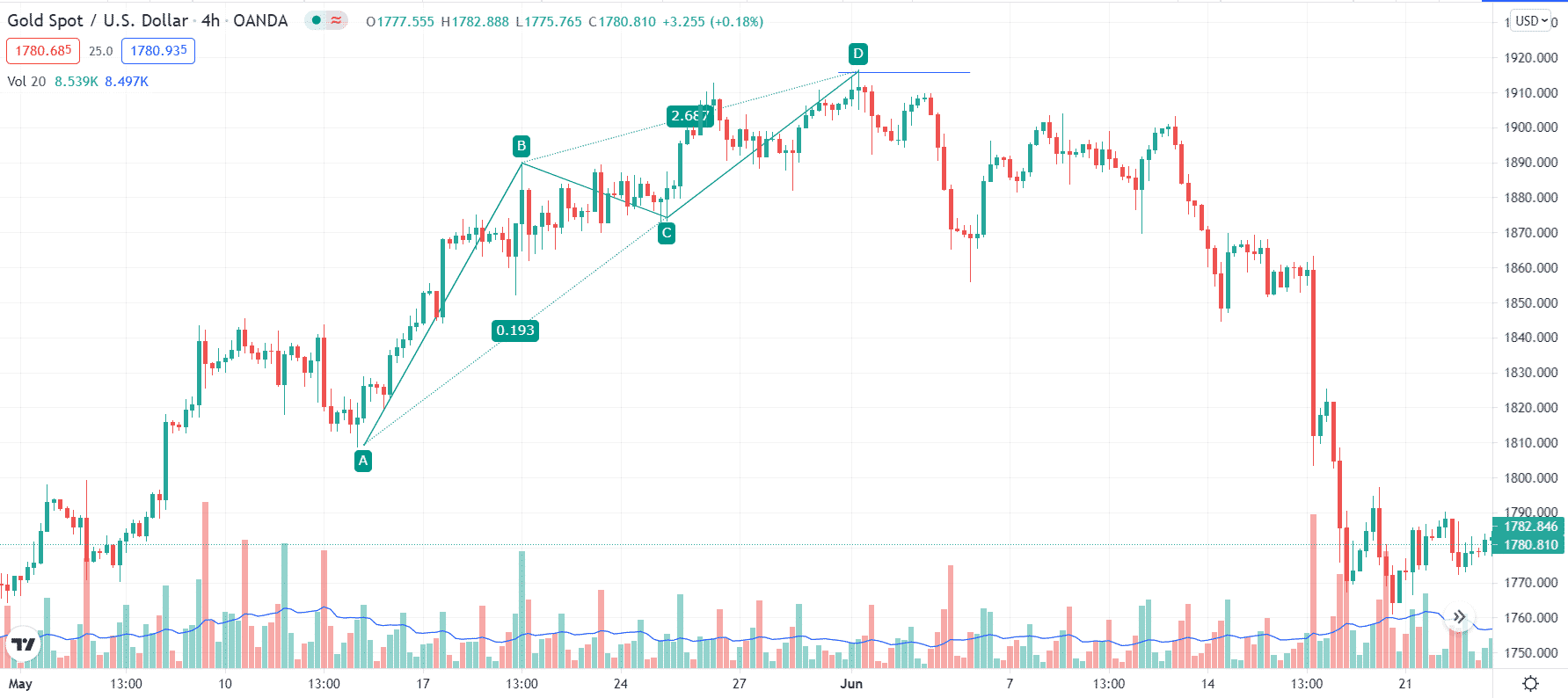

Traders should open a demo account and test the patterns like ABCD on trending currency pairs like GBP/JPY, XAU/USD, etc.

Tip 4. Multiple time frame analysis

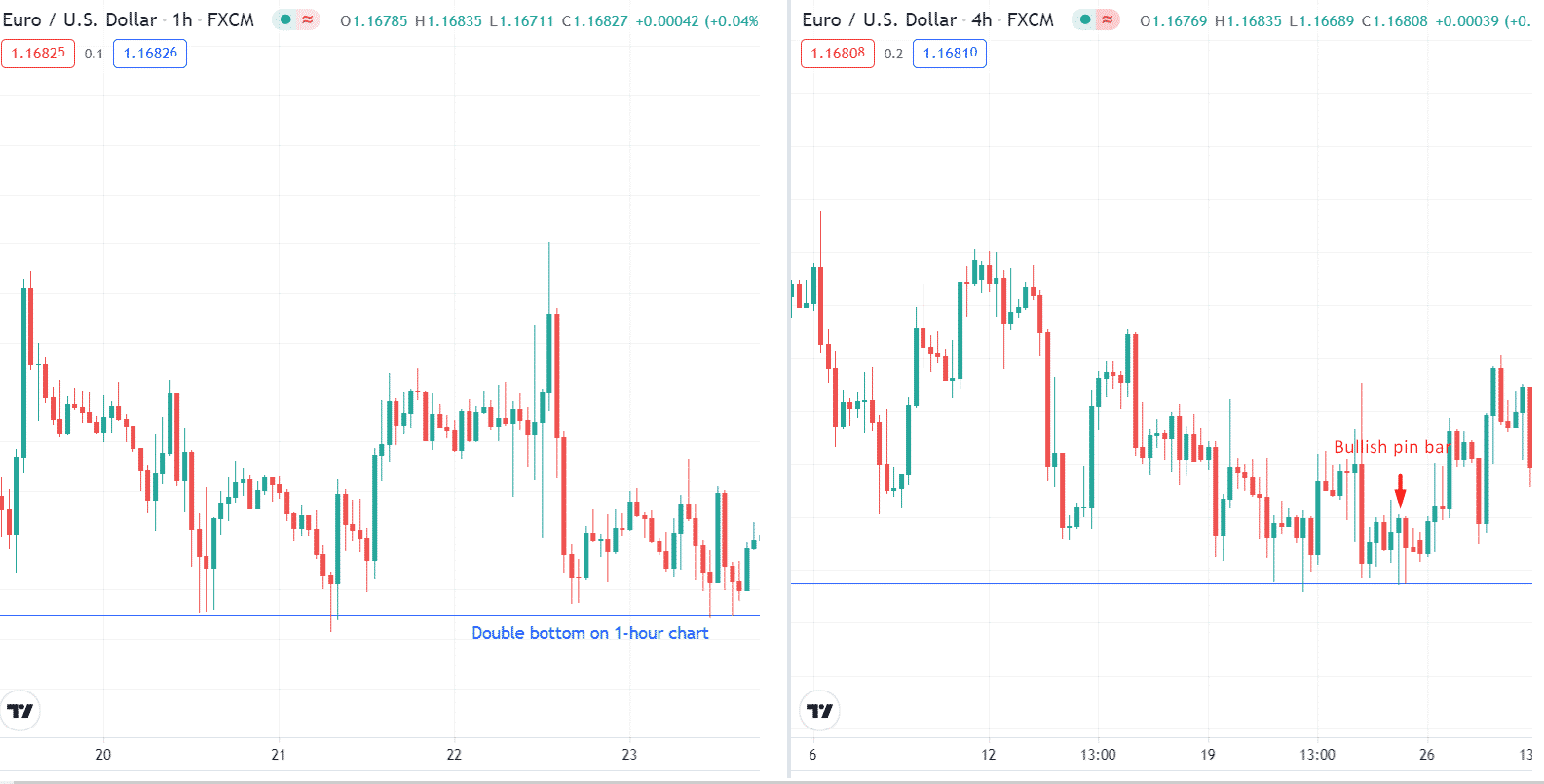

To be a successful trader, analyzing the same currency pair across different time frames is also essential. The process of viewing the same currency pair across different frequencies is known as the multiple time frame analysis. Traders are required to identify the best time frame to trade.

Many new or experienced traders fall prey to losses as they do not verify the pattern through different time frames.

Why does it happen?

Traders who don’t adopt correct time frames cannot find the optimal entry and exit points. Many traders don’t use the multiple time frame analysis because they are in a hurry to enter the trade. At least two and at most three time frames should be used at a time.

How to avoid the mistake?

Investors should use this analysis to determine the overall trend flow of an asset. These can help to identify the critical chart patterns. For example, you found a double bottom in the EUR/USD pair in a 1-hour chart. You have to then look at the 4-hour and daily charts whether the markets are ready to rise or provide a range-bound corrective price action.

Tip 5. Learn relevant patterns

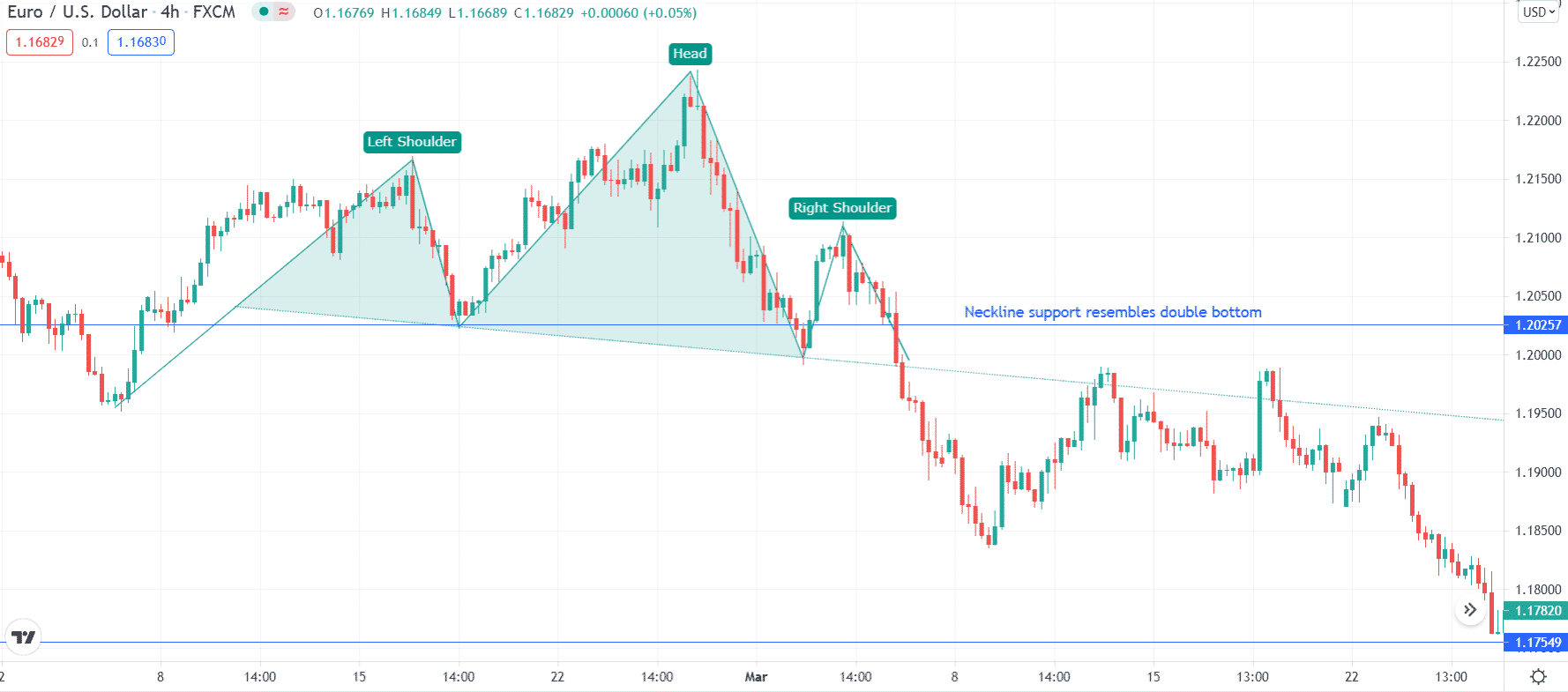

Once you are acquainted with the simple patterns like a double top, double bottom, ABCD, etc., your task is to move towards further complex patterns like XABCD, three drive patterns, cypher patterns, head and shoulder patterns, and many others.

Why does it happen?

Most beginners aren’t successful in identifying the relevant patterns. This proves to be their mistake in learning the ways. Most traders remain stuck with few trading patterns and do not know that a small effort can let them learn many similar patterns. This proves to be a considerably ineffective approach.

How to avoid the mistake?

As a trader, you need to expand your trading knowledge constantly. You can easily do that while learning price action trading.

For example, if you have learned the application of the ABCD pattern, now it’s straightforward to understand the XABCD pattern as it only includes one additional price wave. Similarly, if you know trading double top and double bottom, you can learn the head and shoulder pattern as it closely resembles.

Final thoughts

For a successful price action trader, one has to test his learnings according to different analyzing methods. In addition to this, it is required for the traders to learn a few but relevant chart patterns. The price action trading can let you reap benefits if you discover it correctly.