PZ Divergence is an indicator that was designed based on a price action strategy. The system has medium popularity among people who download it for demo usage. The last version is 14.4. Let’s take a closer look at it.

Vendor transparency

The vendor doesn’t have a high level of transparency because we don’t have a money-back guarantee, backtest reports, and many other features and requirements.

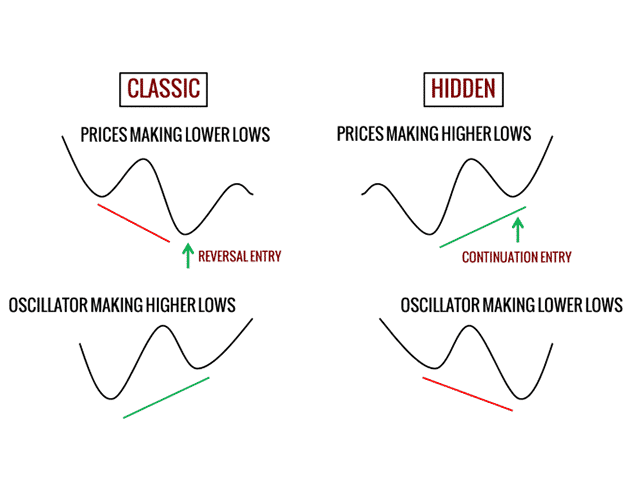

How PZ Divergence works

For answering this question, we systemized the data

- The indicator shows when it’s the right time to open an order in the buy or sell discretion. We have to trade the signal automatically.

- It “finds and scans for regular and hidden divergences automatically using your favorite oscillator.”

- We can rely on a user manual.

- The system is easy to work with.

- It supports many oscillators.

- The indicator checks breakout events.

- It informs us where we have to place SL and TP levels.

- We can use configuration oscillator parameters.

- The system is featured by performance statistics.

- There are various notifications inbuilt.

- The system can be loaded on the same chart with various oscillators at the same time.

- It supports the following inbuilt indicators RSI, CCI, MACD, OSMA, Stochastic, Momentum, Awesome Oscillator, Accelerator Oscillator, Williams Percent Range, Relative Vigor Index, Rate of Change.

- “Since divergences can expand quite a bit, especially in the Forex market, this indicator implements a twist: it waits for a donchian breakout to confirm the divergence before signaling the trade. The end result is an otherwise repainting indicator with a very reliable trading signal.”

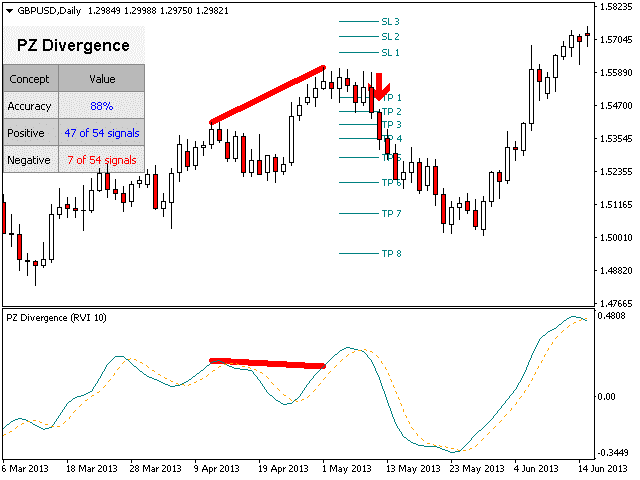

- The explanation charts show that the indicator works with divergence oscillators.

- The indicator places various SL and TP levels.

Timeframe, currency pairs, deposit

- The system works on the MT4 or MT5 terminal.

- The indicator works with all time frames and all currency pairs.

Trading approach

The system checks where the price is going. This strategy is called Price Acton.

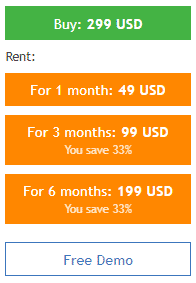

Pricing and refund

The system is available for $299. There’s a one-month rent for $49, three-month rent for $99, and six-month for $199. We can download a demo copy of it for checking on a terminal. The lifetime offer costs two-three times higher than it should be.

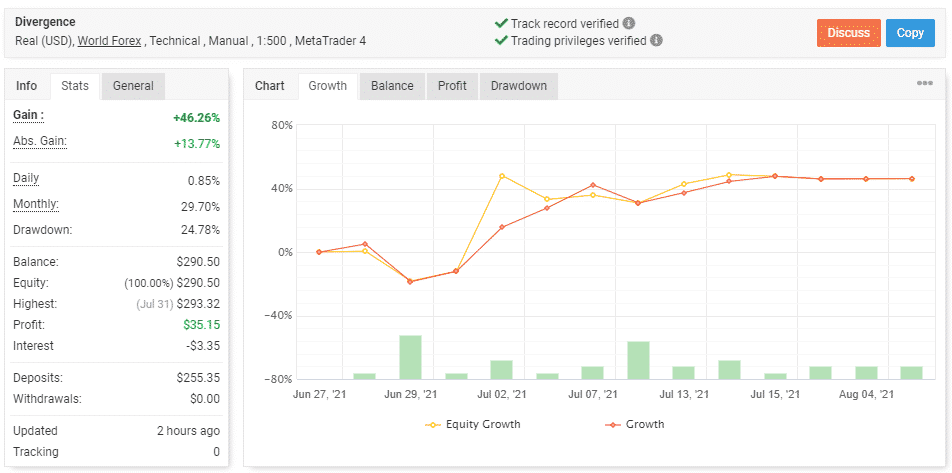

Trading results

As usual, the developer doesn’t provide backtest reports. It’s a huge con because we don’t know if the system was tested on real tick data and showed good results.

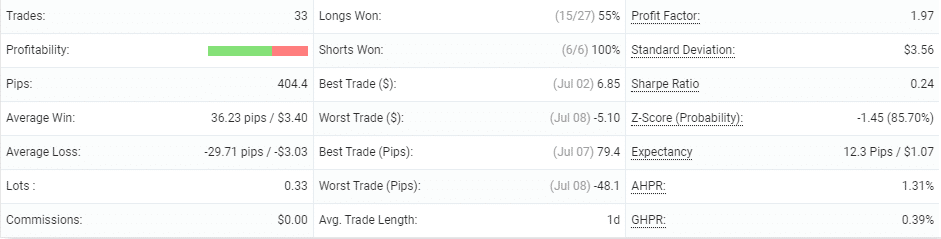

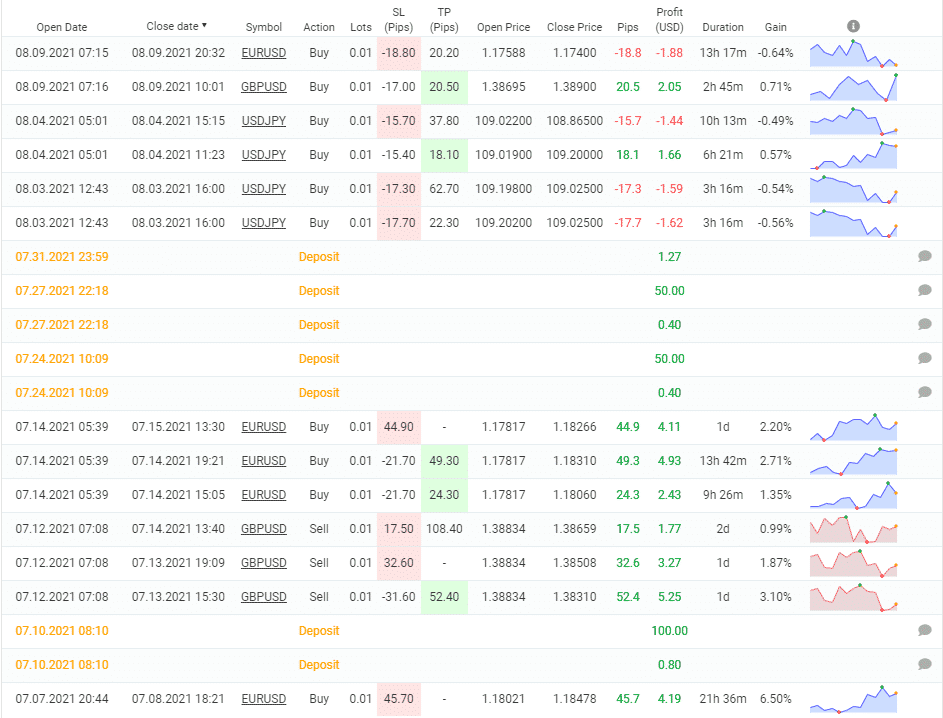

The system works on a real account on the World Forex broker with 1:500 leverage. We’ve never seen someone use this broker. The account has a verified track record. It was created on June 27, 2021, and deposited at $255.35. Since then, the absolute gain has amounted to 46.26%. An average monthly gain is 29.70%. It was 5% higher a week ago. The maximum drawdown is 24.78%.

The system executed 33 orders with 404.4 pips. An average win is 36.24 pips when an average loss is -29.71 pips. The win rate is 55% (15/27) for longs and 100% (6/6) for shorts. An average trade length is a day. The profit factor is 1.97.

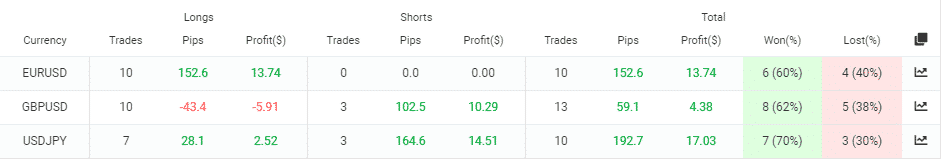

The advisor trades EURUSD, GBPUSD, and USDJPY currency pairs. GBPUSD with 13 closed orders is in trading activities. The most profitable is USDJPY – $17.03.

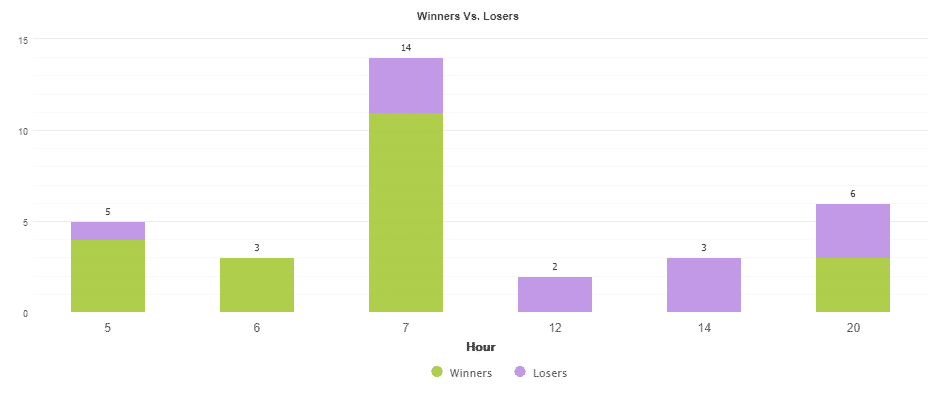

The robot opens orders mostly at 7 a.m.

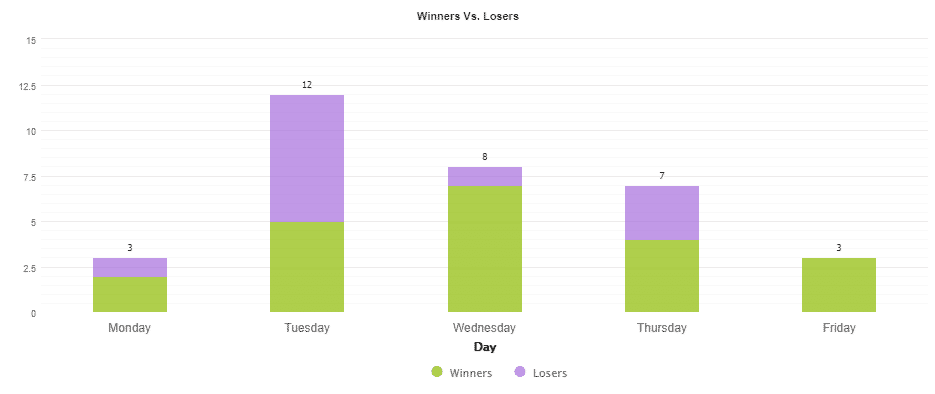

The most-traded day that is much ahead of others is Tuesday (12 orders).

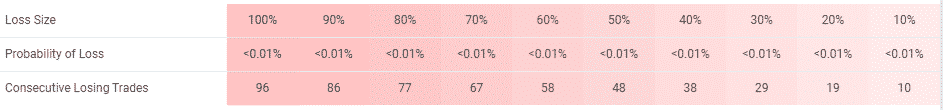

The system works with medium risks to the balance. Losing 10 orders triggers losing 10% of the account balance.

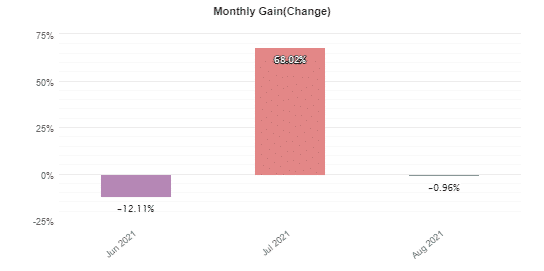

Trading results showed that the solution doesn’t work stable and predictable.

Monthly trading results are wild and unpredictable.

People say that PZ Divergence is…

Good. Anyway, we can form our vision based on a single comment that his friend could write.

Verdict

| Pros | Cons |

| Strategy details revealed | No risk advice given |

| Trading results shown | No backtest reports provided |

| Affordable rental options provided | Unpredictable trading activities |

| High pricing for a lifetime copy | |

| No client feedback shared |

PZ Divergence Conclusion

PZ Divergence is an indicator that shows when it’s the right time to open a trade based on data received from price action indicators. The presentation is quite short. The backtests aren’t provided. Real-account trading results are absolutely wild and dangerous. We’d like you not to use this s