Robinhood FX EA works on EURUSD only and requires a minimum trading balance of $200. The robot works with all types of brokers and comes with live account results that can be used for analysis. Let us observe all the positive and negative points of the system to see if it can be profitable for us.

Vendor transparency

The company only provides their email id and phone number. The code of +48 suggests that they reside in the country of Poland. They are not transparent in giving any other information on their whereabouts and strategy, which is quite suspicious.

How Robinhood FX EA works

The EA has the following features:

- Works with brokers of all sorts.

- Trades on the MT 4 platform.

- Can be purchased with multiple subscription packages.

- Uses a fixed stop loss for trading.

- Does not use risky martingale strategy.

- Has backtesting and live trading records available.

- Can use auto money management.

Time frames, currency pairs, deposit

The EA works on EURUSD at the H1 time frame. The developer recommends using a minimum balance of $200. There is no information on the leverage traders should use.

Trading approach

The developers are not transparent about the strategy of the system. They only state that it uses a stop loss and money management within. The EA does not use the martingale strategy as per the statement. From the statement on FXBlue, we can see that the algorithm does employ grid strategies on the account. The average trade length of 21.2 hours points that the EA uses a day trading approach to the trades.

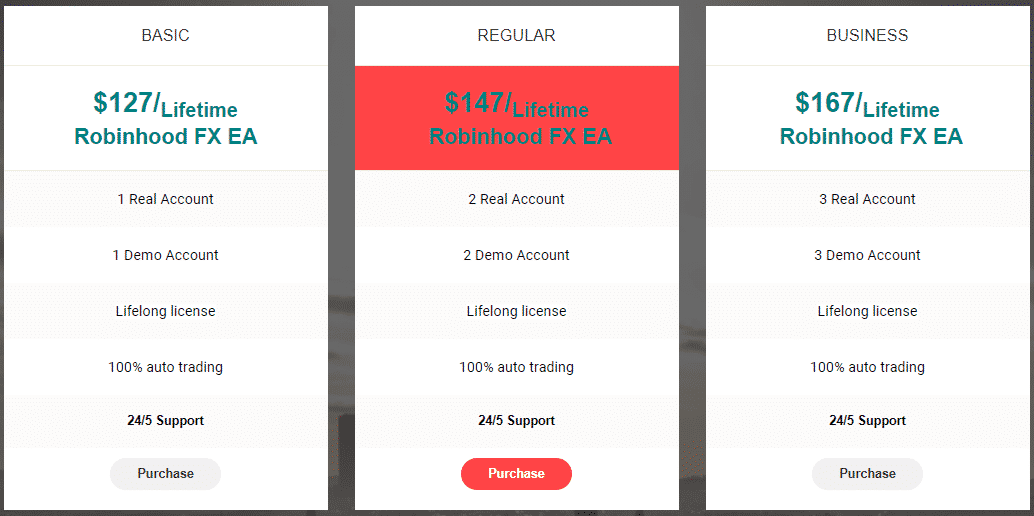

Pricing and refund

The EA is available with a license for a demo and live account for $127. Traders can also purchase the key for 2 and 3 accounts at an asking price of $147 and $167, respectively.

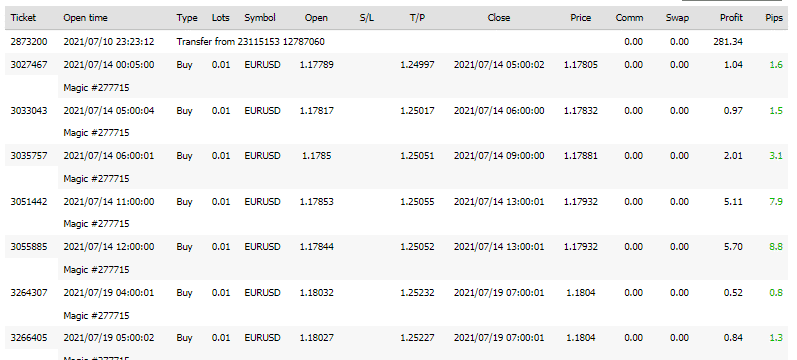

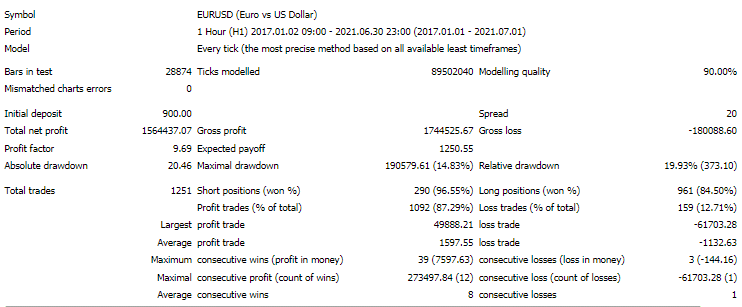

Trading results

Backtesting results are available for EURUSD. The relative drawdown was around 19.93%. The winning rate was 87.29%, with a profit factor of about 9.69. All the tests were done on the 60 minutes chart with a starting balance of $900. The robot tanked an average profit of $1564437.07 during this period. There were 1251 trades in total. The best trade was $49888.21, while the worst one was -$61703.28.

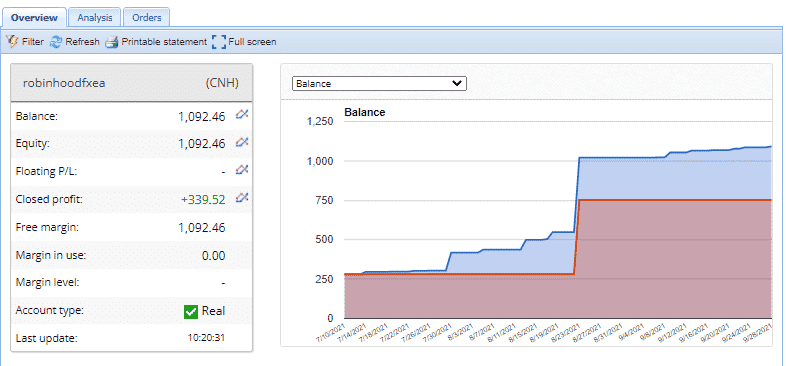

Verified trading records on FXBlue show performance from 10 July 2021 till the current date. The system made an average monthly gain of 32.5%, with an unknown value of drawdown.

The winning rate stood at 81.5%, with a profit factor of 2.33. The best trade was 44.69, while the worst was -33.28. There were a total of 66 trades. The developer made 753 in deposits. The currency utilized for trading is CNH.

People say Robinhood FX EA is…

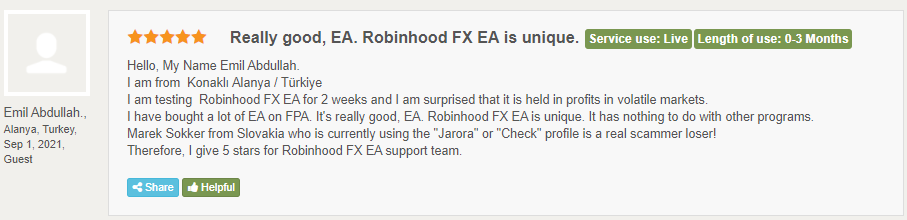

Good. There is a single review available at Forex Peace Army where it seems that the user has used the EA for a short duration. He still gives the system a five-star rating which is too early. Lack of customer reviews shows that not many people are interested in investing in a grid methodology system.

Verdict

| Pros | Cons |

| Live records available on FXBlue | Lack of vendor transparency |

| No indication of drawdown | |

| Undisclosed trading strategy |

Robinhood FX EA Conclusion

Robinhood FX EA uses a grid trading strategy, which can cause a good drawdown on an account. There is no recovery in this case, and the account can see reaching margin calls quickly. Therefore, traders should avoid trading with such a system unless they understand the risks.