The concept of trailing stop aligns with the principle of cutting losses short and letting profits run. Depending on your trading style, you may or may not use this tactic. The trailing stop is particularly suitable for swing traders. Since swing traders trade less often, they are looking to maximize profits when they do trade.

While you can use a fixed risk-reward ratio such as two or greater, trailing stop is better for developing consistency and trading discipline. If you find yourself permanently closing your trades before reaching the desired targets, consider trailing your stops instead.

Three best trailing stop methods

In this article, you will learn about the three best trailing stop methodologies to manage your trades. Traders use these techniques to varying degrees. Whether you are a discretionary or algorithmic trader, you will benefit from learning the following trailing stop methods.

№1. An arbitrary number of pips

The easiest way to trail stop loss is through the use of an arbitrary number of pips. Usually, you would set a stop loss to your trade upon entry. You can use the same number of pips for your initial stop as for your trailing stop when you do. In other trading strategies, particularly related to automated trading, traders do not use it at all.

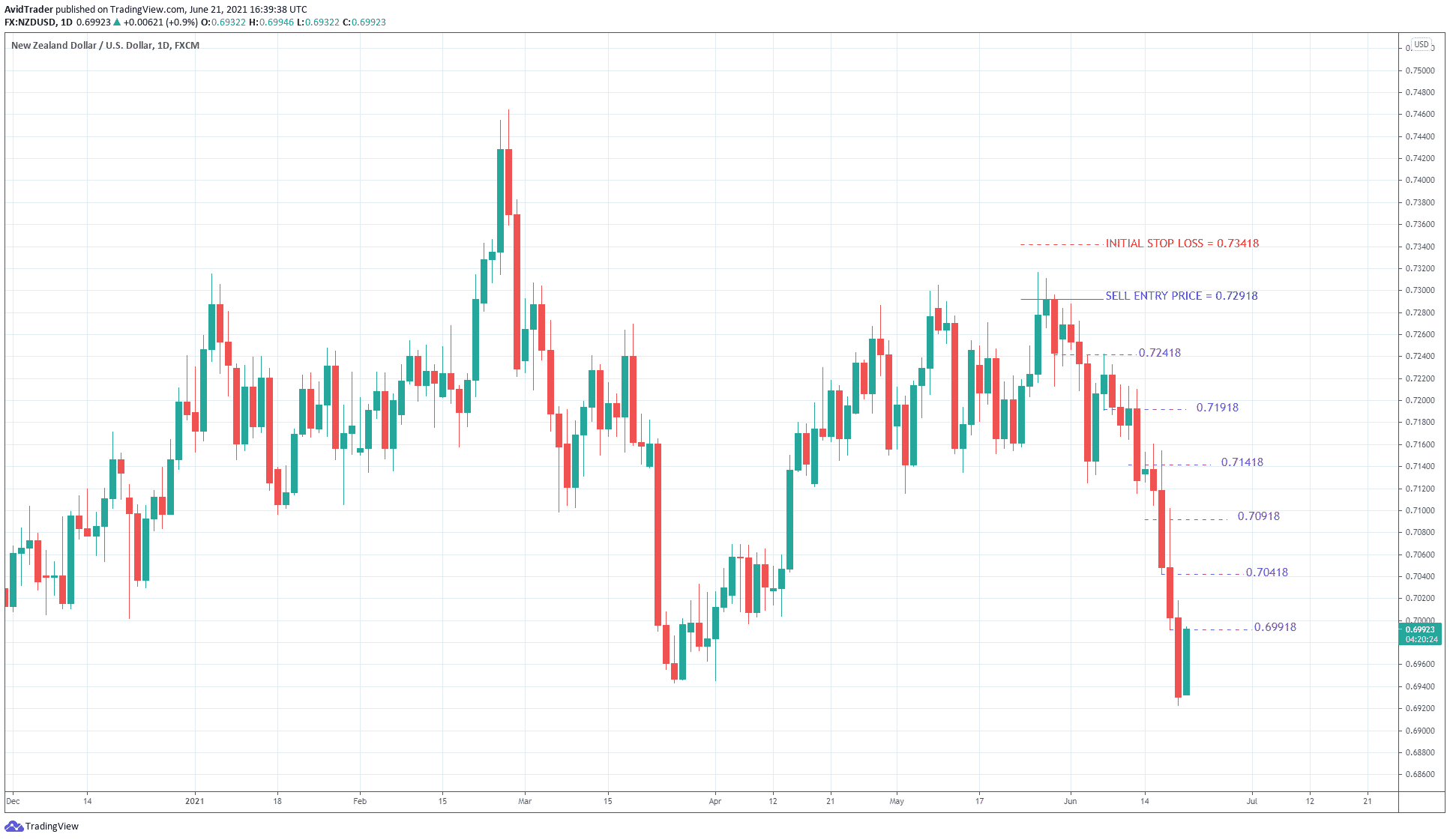

Refer to the above NZD/USD daily chart for illustration.

- Granting you opened a sell trade at 0.72918, you would trail the stop loss as shown in the visual.

- It means you would adjust the stop loss six times before the price finally closes the trade.

- The above example uses 50 pips as the threshold for stop-loss adjustment.

- The first time you gain 50 pips (for 0.72418), you would move the stop loss down to the entry price (at 0.72918).

- At this point, the trade is at breakeven. Wherever the market goes next, you will not lose any more money.

This trailing stop approach is a bit demanding if you do it manually. However, if you use an expert advisor, the process is automatic, and you do not need to monitor the trade. If you are using the MetaTrader platform, you may run the trailing stop process on autopilot, but you need to define the number of points instead of pips.

№ 2. An arbitrary number of candles

The difficulty of implementing this trailing stop strategy is average. The moment your trade is starting to gain pips, close monitoring is needed on your end. With this method, you need to decide the number of candles whose highest or lowest point you will select as a stop loss location. Making this decision is not easy at all, as you will soon see. You can select to use one, two, three, or four candles, but what is your basis?

You need to perform trial and error, after which the manual backtesting is in order.

- Select one or two charts, and then test how many candles are ideal in most situations.

- As market behavior is constantly changing, the final number of candles you choose will not work all the time.

- Just use this number of candles for a time. Then use a journal to record all trades, probably in a demo account, to know which number is doing well using live market data.

In the future, you can change the number of candles to reflect what works best in demo trading. As you can see, the number of candles is not arbitrary at all. In the beginning, you have to use a random number of candles until you discover which number works more often.

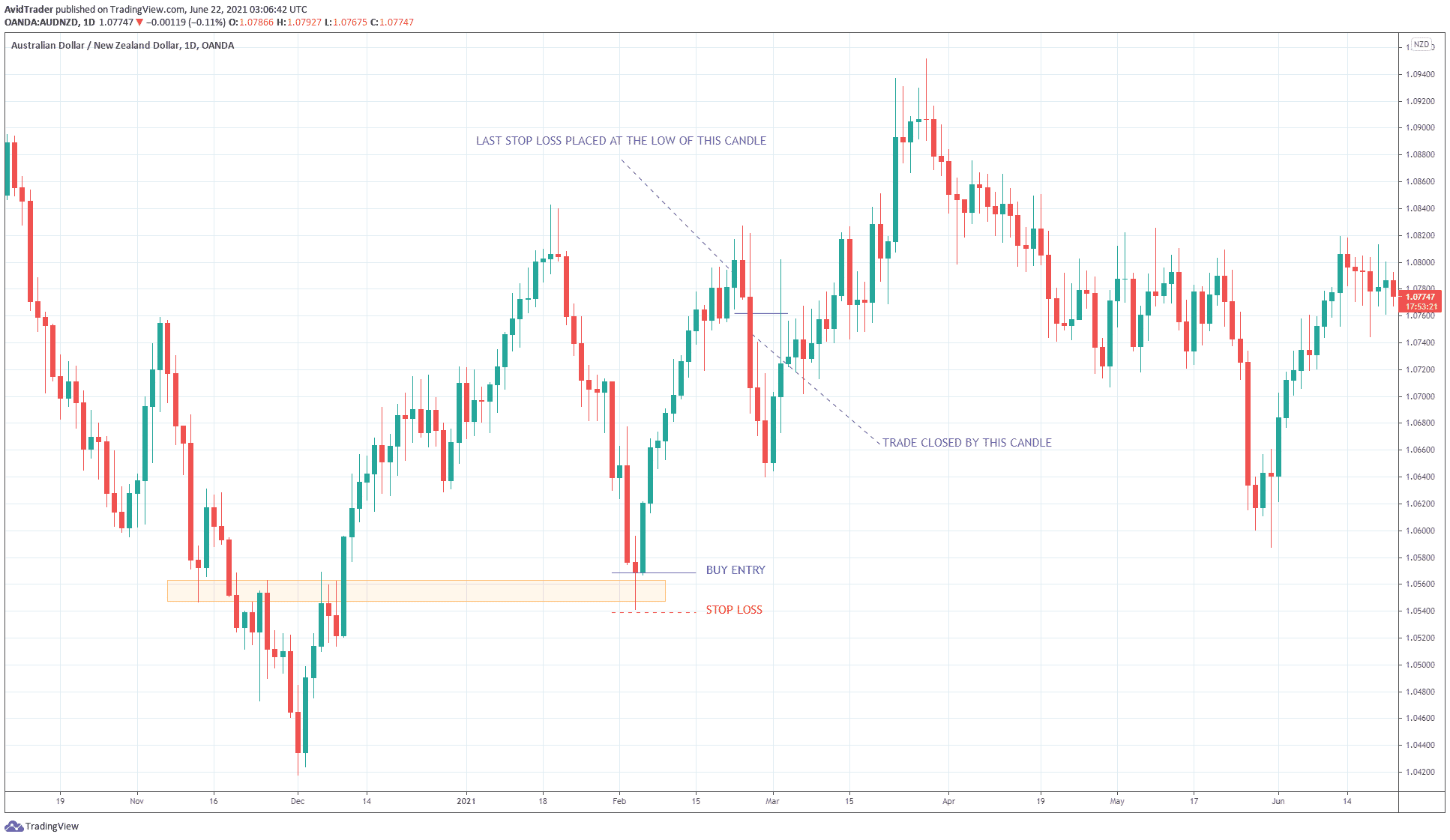

Now let us take the above AUD/NZD daily chart into consideration. The trader might have figured out the existence of support as drawn on the chart. Since a bullish pin bar occurred and rejected the support area, you could have taken a long trade. If you do, your entry and initial stop loss would typically go in the places shown in the graphic.

Let us use two candles for a trailing stop in this exercise.

- Here you will check at the close of every candle if you need to modify the stop loss.

- In the last option, you will monitor the number of pips gained, say, 50 pips, as often as you can.

- Referring to the above chart, when the second candle (a big bullish candle) closes, you would not adjust your stop loss yet. This is because the lowest low of the two candles is the same as your initial stop.

- After the third candle closes, which is also bullish, you can now put the stop loss at the low of the second candle.

- You would do this continuously until you get to the 15th candle. At the close of the 15th candle, your stop loss is at the low of the 14th candle.

- Finally, the big bearish 16th candle closes the trade by hitting the stop loss. You could have gained around 200 pips on this trade with this trail stop strategy.

№ 3. Recent swing points

The most commonly used trailing stop strategy among experienced traders is the recent swing point, either swing high or swing low. The reason is that swing points are self-explanatory, and trending markets leave such traces as they move forward.

For example, if a market is trending up, it will create higher highs with higher lows. Thus, if you place your stop loss at the swing lows, you sync with the market rhythm. Therefore, putting stop loss at swing points is a self-fulfilling prophecy among market participants.

Despite the seeming simplicity, trailing stop with swing points requires a strict set of rules to be effective. Essentially, you should use this strategy when you are trading with the trend. If you have correctly identified a trend change and entered early, you can ride the movement until the end.

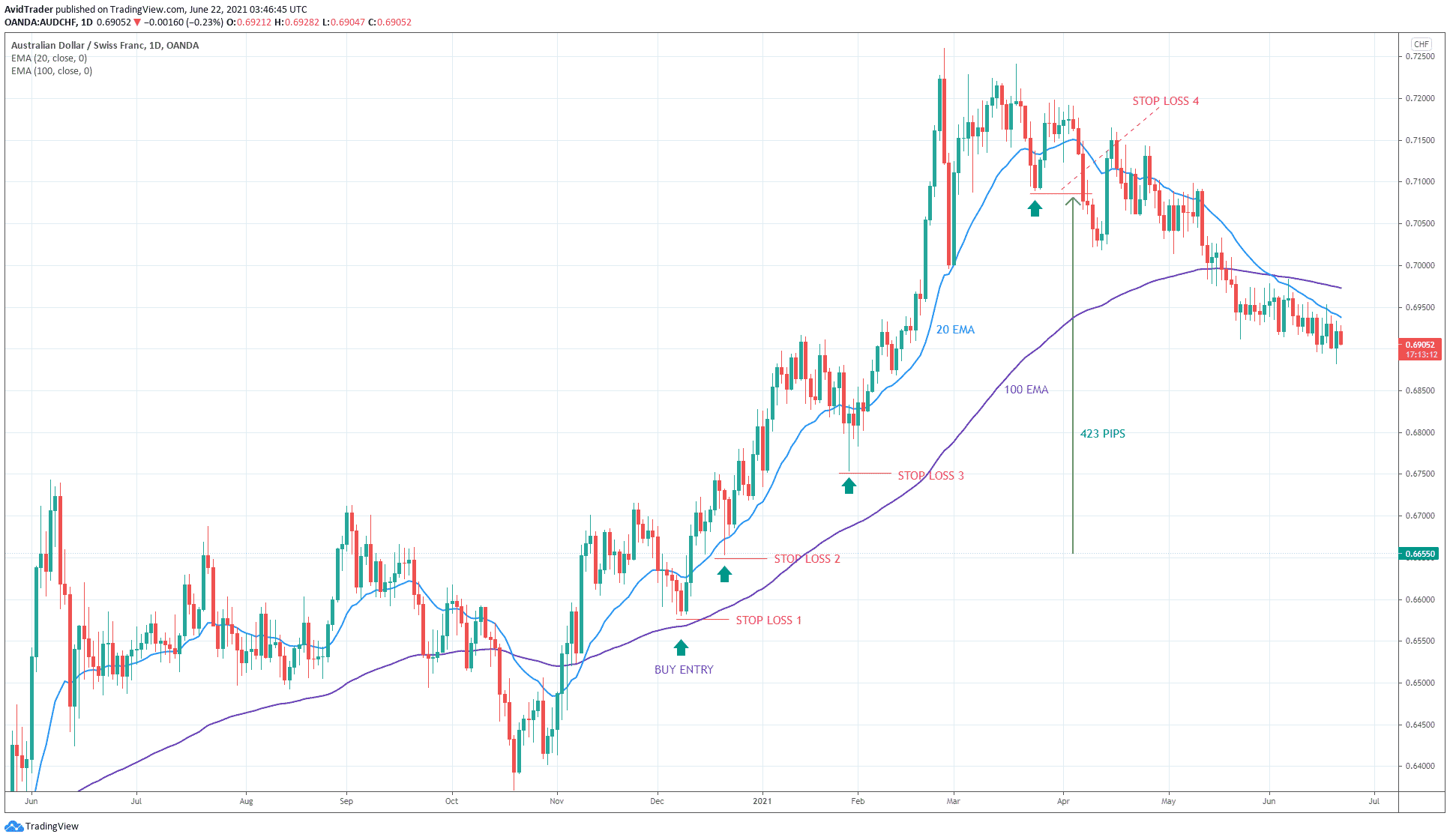

The above AUD/CHF daily chart shows a simple trend trading strategy familiar to many traders.

- After the price broke above the two MA’s, it started to retest from above.

- This retest formed an excellent entry point into the nascent uptrend.

- One possible entry in this situation is to place a buy stop at 0.66550, which is the high of a candle that fails to break out to the upside.

- After placing your order, you can set the initial stop loss at the recent swing low, which marks the end of the pullback.

With this trailing stop methodology, you do not have to check the number of pips gained now and then. Also, you do not need to look at the trade at the close of every candle. You only need to check from time to time if a new swing low has formed after a degree of pullback.

With this approach, you could have adjusted your stop-loss three times from entry throughout the trade’s lifetime. After the third stop-loss adjustment, the price finally hit your stop. This trade could have netted you 423 pips.

This number of pips is more than enough to make good money in currency trading. Plus, trade management, in this case, is less active. Stress-free trading is the name of the game.

Final thoughts

This article presents three of the most common ways to trail stops. Of course, there are other trailing stop methods out there, such as the true average range. Or some techniques that allow trading without any stop loss. Determine which way aligns well with your trading repertoire. Your trading plan should include this element. Then, build a complete and robust trading system that allows you to stay afloat regardless of market condition.