A computerized exchange system has preprogrammed methods of entering and exiting that will be executed once the software outlines the rules. The reference lists contain a reference to Jim Simons, who earned a fortune by automating his business. Renaissance Technologies manages around $55 billion.

Suppose you knew that a foreign exchange executes trade instantly whenever the opportunity arises, is unemotional, logical, and constantly vigilant for profitable trades? Wouldn’t it be nice to hire that person immediately?

Software for computerized forex trading can give you all of these qualities. The purpose of this article is to explain how FX automated market-making software works and how to choose the best one.

What is the software that automates trading?

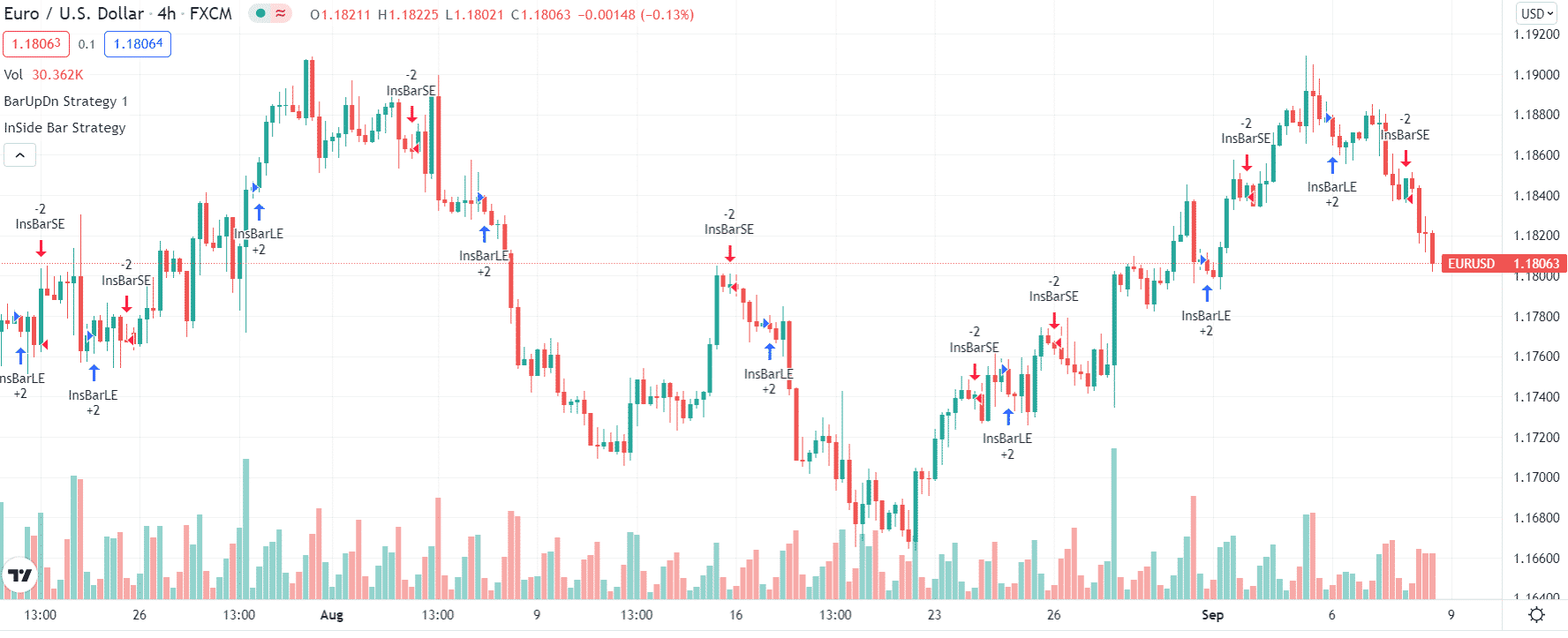

The computerized trading system is a sophisticated program with algorithmic rules for monitoring markets and trading in different conditions. Traders who use laptops to automate their trading can set specific guidelines for investing in particular assets. A trader can, for instance, choose to invest in small-cap stocks with recent price moves and a 50-day moving average.

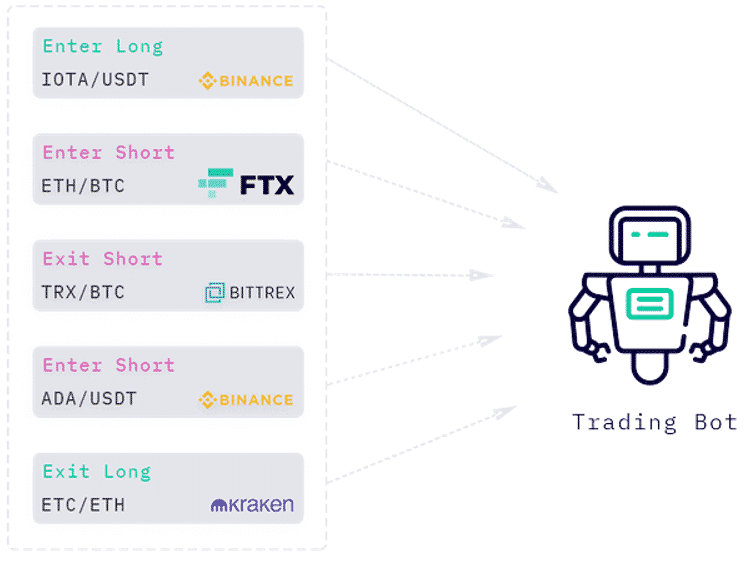

Moreover, traders can enter and exit positions according to their preferences and control their potential positions. Whenever they find assets meeting predetermined criteria, robotic trading systems execute trades immediately.

Computerized systems of trade have several apparent benefits.

A human being will not be able to monitor more than one stock or currency at a time as we all have only two eyes, right?

A trading system that automates can also track various markets and securities at a pace that would be unimaginable to a trader in flesh and blood. An algorithm can detect and execute a new trade within a fraction of a second when trends reversal is indicated. Market conditions determine the effectiveness of automation strategies. It is, however, necessary to understand when to use them, as they are not universal. In addition, the strategies included in these algorithms are often over-optimized and do not take actual market dynamics into account.

In deploying computer-driven strategies, it is essential to understand the specific market conditions in which they will be used. Additionally, overly optimized strategies are unable to make a difference in reality. Finally, no strategy can be foolproof, regardless of how much it has been backtested.

How does fully automatic forex trading software work?

The analysis of currency price charts is done in trading software by market analysts using automated software that calculates market trends. This software identifies potential currency pairs based on signals such as spread discrepancies, price trends, and news that affect the market.

For example, a software program may alert when it finds that a currency pair trade is profitable based on predetermined parameters.

Automated forex trading programs: how to choose

Trading requires various approaches and strategies to succeed, which is true of automated software systems. There are many exchange programs on the FX market, and some of them are excellent. A few good products lack comprehensive benefits and additional features, and others are not up to par. These features should be considered when choosing software for traders.

Performance

If a firm says it wins 95% of its trades, consumers should verify these claims. It is not uncommon for software companies to provide verified results to prove their products’ effectiveness. Even so, it may be wise to remember that past results are not necessarily indicative of future outcomes.

Fees and guarantees

Some financial firms charge commission and additional fees with the online fx trade system. It can hurt the gains and profitability of trades. So, make sure to read the fine print of the user agreement before using their services.

Companies may also offer return guarantees after purchase and during a stipulated period. Because of this, if you are dissatisfied with the system of automation, the firm will refund you for your purchase.

Take it for a test-drive

Investing in algorithm-based programs can be expensive, so ensure the company demonstrates how their software incorporates the current market, purchasing and selling currency pairs via video lectures and training lessons.

Also, the trader may request the screenshot or video walkthrough of account action with trade prices of buy and sell transactions and the time of execution and profits posted. Make sure you try the tutorial and training functions of the system when testing it out.

Top 3 best-automated trading software

Let’s review the top three automated trading software that can help you relieve some stress of manual trading.

Interactive Brokers API/FIX CTCI: best in stock trading

Brokering services are offered in 31 different countries by Interactive Brokers, a global trading firm. From currencies to bonds, the platform provides 120 different markets. JAVA, Python, and C++ are a few popular programming languages that the interactive brokers API supports. Trader workstation lets you connect your program directly.

WunderBit offering the best exchange rates

With WunderBit, you can tap into the real-world applications of crypto. Bitcoin can be safely bought and sold through it. Beginners and crypto experts alike can easily use WunderBit since it has been simplified to make it easy to use.

In addition to creating an exchange platform for BTC and cryptocurrency, WunderBit also provides a social trading platform for BTC payments and an over-the-counter payment processing facility.

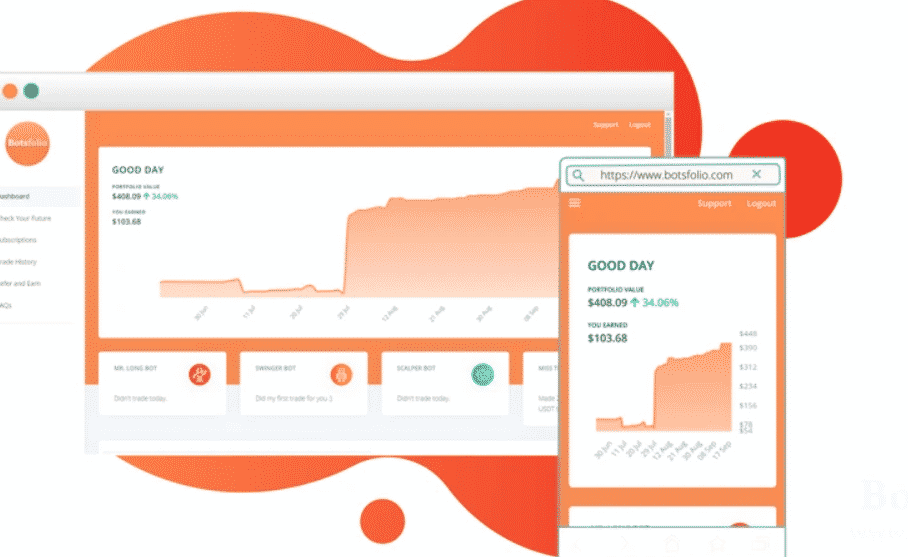

Invest in bots with Botsfolio

What if you were to invest only 5% of your net worth in the FX financial market and outperform all the best equity tycoons?

With Botsfolio, it’s easy. To get started with Botsfolio, answer a few questions to discover which investment amounts go into different cryptocurrency trading strategies, then link your foreign exchange account to Botsfolio in minutes, and you are done.

The Botsfolio dashboard displays the real-time activities of the FX market for your portfolio and tracking your trading activities.

Investing in forex software scams: be on the lookout

The automated FX software market is not immune to scams, but due diligence may lead to fewer scams. The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) are best for consumers seeking information about scams.

Final thoughts

Using a high-tech electronic trading system on your PC, anyone can become a novice at FX exchange, regardless of their level of expertise. In all markets, there are risks, but algorithm systems can reduce these risks or reduce the severity of losses.