Tioga robot uses the night scalping approach to ensure small but consistent profits. As per the developer, Ozkan Kara, it makes use of the mean reversion that occurs during the closing phase of the US session. The developer provides backtesting results and a live signal on the MQL5 site. He claims that the system does not use dangerous approaches. Our evaluation of the system reveals that the results are random due to the small sample size. Further, we find the pricing is expensive and does not come with a money-back assurance.

Vendor transparency

Ozkan Kara is the author of this FX EA. He is based in Turkey and has received a rating of 3.3 on the MQL5 site. With four years of experience in creating FX trading tools, he has created 2 products and 2 signals. To contact the developer, you have to use the messaging board on the MQL5 site as there are no other support methods present.

How Tioga works

As per the author, this FX robot trades for only a couple of hours between 21:00 and 22:59 London Time. It holds only a single position for each of the pairs it works on. The fully automated EA focuses on achieving consistent but small profits. There are not many details about the functionality of the system.

Timeframe, currency pairs, deposit

Although the author maintains that this ATS can work on all major currency pairs, the default pair it is designed to work on is the EURUSD pair. The FX EA uses the M5 timeframe and uses one chart for all currency pairs. A total of 11 currency pairs are mentioned as the favorite pairs of the author and they include, AUDUSD, CHFJPY, EURAUD, EURCHF, EURGBP, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPUSD, and USDCHF.

Other recommendations for the FX robot include a minimum account balance of $300, the use of ECN brokers, and leverage greater than 100. The developer claims that any leverage can be used.

Trading approach

The ATS uses the mean reversion method for making entries and can work clearly on VPS. It does not use risky approaches like the averaging, Martingale, and grid methods. Instead, the author claims that it uses a fixed SL for each position it holds.

Pricing and refund

This trading tool is available for $295. A few rental packages are present that include a one-month rental ($45), a 3-month rental ($95), and an annual rental ($195). A free demo is also present. There are no other details provided on the features you get with the packages. We could not find a money-back offer which raises doubts about the reliability of the system.

Trading results

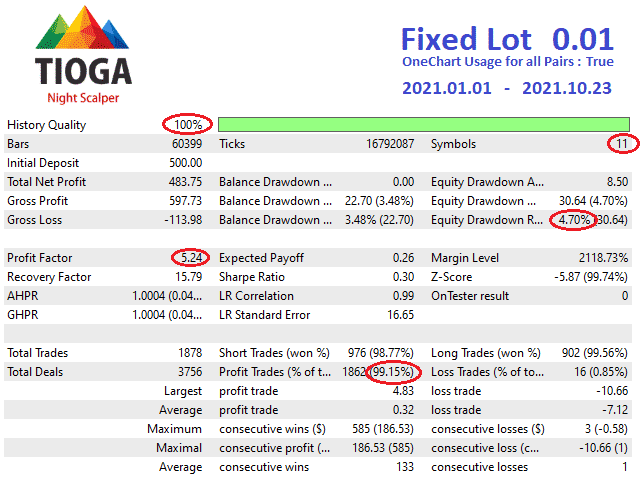

A couple of backtesting results are present on the MQL5 site. Shown above is one of the strategy tests that used a fixed lot of 0.01. From the above report, we can see the history quality was 100%. For an initial deposit of $500, the account had generated a total net profit of $483.75 for trading done from January to October 2021. For a total of 1878 trades, the profitability was 99.15% and the profit factor was 5.24. The drawdown value is 4.70%. From the high profits and low drawdown, we find that the system used a low-risk approach.

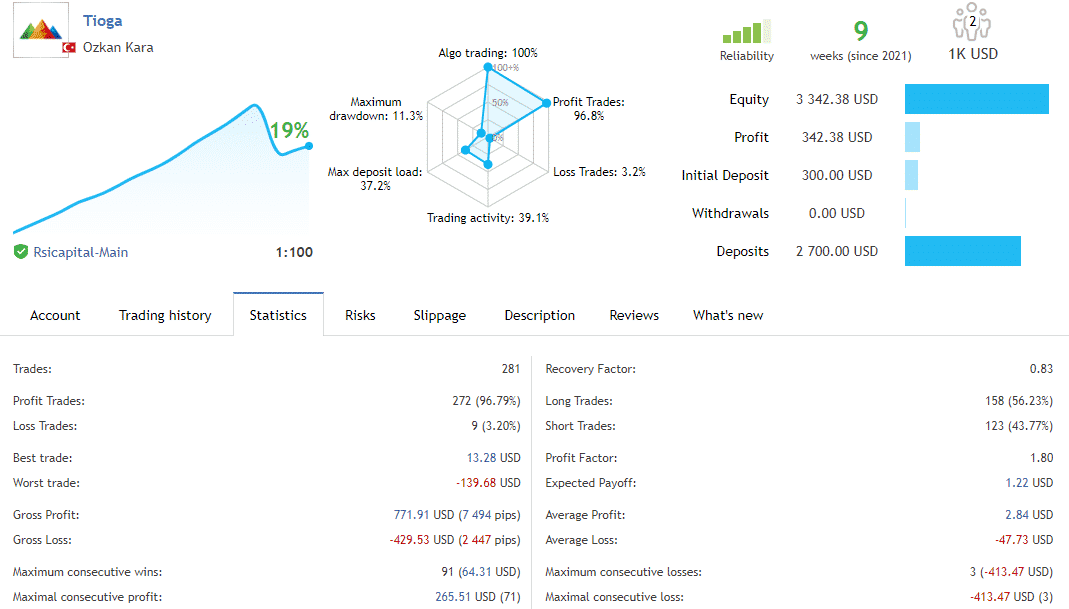

A live signal for the MT5 tool is present on the MQL5 site. Here is a screenshot of the trading stats.

From the above report, it is clear that growth of 18.64% is achieved by the EA for deposits of $2700. The profit generated is $328.38 and the maximum drawdown is 11.3%. For a total of 281 trades, the profitability was 96.79% and the profit factor was 1.80. Monthly growth of 4.68% is present for the account that started in December 2021.

From the results, we find the sample size is very small which makes the results random. Hence, we are unable to evaluate the system properly. Further, when compared to the backtesting, we can see that the profit factor was higher and the drawdown lower in the backtests. The discrepancy shows that the system is not as effective as the vendor would like us to believe.

People say that Tioga is…

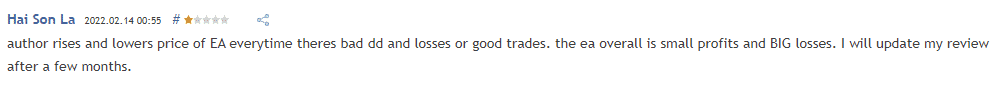

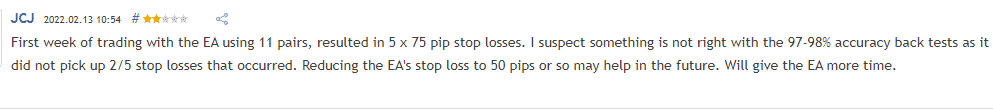

A doubtful FX EA as the system makes very small profits but loses big amounts of capital. Another user states that the system uses big SLs that wiped out the profits. The user claims that the EA has to lower the SL to ensure big losses do not occur.

Verdict

| Pros | Cons |

| A fully automated software | Small sample size |

| Low drawdown in backtests and real trading | Expensive pricing |

Tioga Conclusion

Tioga assures consistent but minor profits with its mean reversion-based approach. While the developer provides backtesting and real trading stats, we find that the sample size is too small to evaluate the efficacy of the system. Further, the product is overpriced and does not come with a money-back guarantee.