Algorithmic trading is a flexible way to make money from the FX market. This way of trading allows market participants to choose strategies without involving emotional ups and downs.

The trading decision comes from algorithmic calculations in this way. Thus you don’t have to spend time seeking good trade setups on your own.

This article includes the top ten algorithmic trading methods. You can choose the best one that suits your trading goal. However, selecting the algorithmic strategy relates to other characteristics of traders such as style, return expectation, time frames, capital size, etc.

Top ten algorithmic trading strategies

We made a list of the best algo trading methodologies. Algo trading is an automatic trading system that allows trade executions without human interruption.

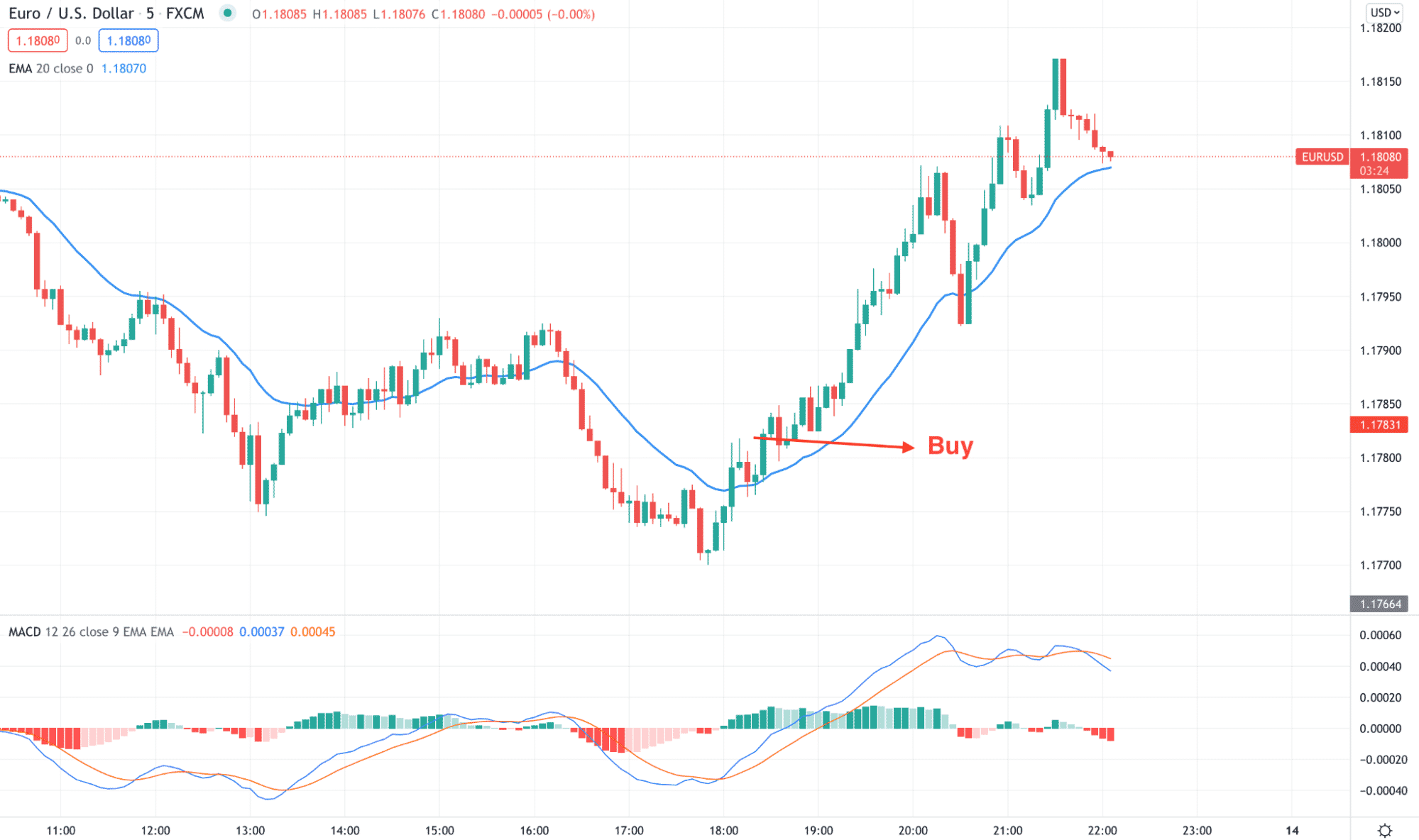

1. Forex scalping chart

It is a trading technique that generally uses small time frame charts to execute trades. Scalpers hold positions for a shorter period and often not more than 5-10 candles. Scalping involves a series of quick profits or losses usually. So those who are good at it can have thousands of green pips per day. Algorithmic scalping enables traders to make maybe thousands of trading positions per day. That is a vast number of trade executions for manual traders.

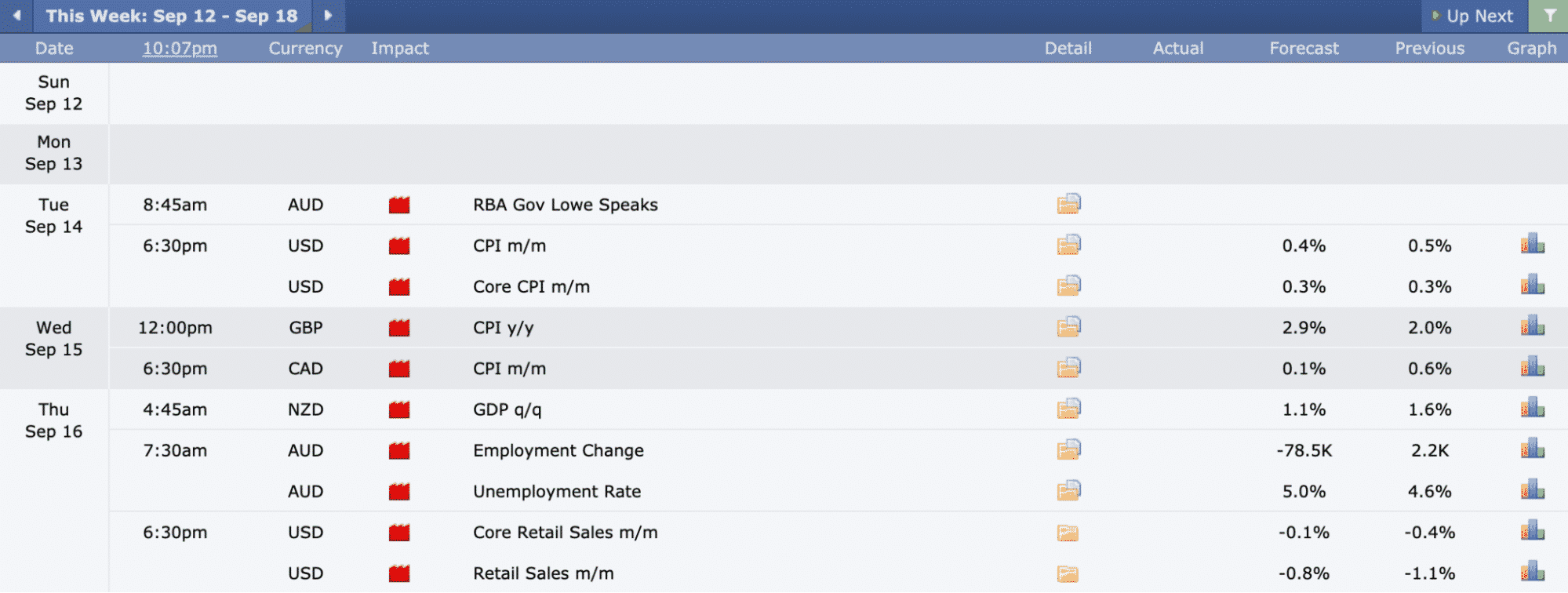

2. News-based chart

Several political, macro-, micro-and socioeconomic factors affect currency prices. For example, pandemics, wars, inflation, etc. put an impact on the economy. Algorithmic news-based trading strategies involve reacting to fundamental data on corresponding currencies. This method tracks fundamental events to generate profitable trading signals.

However, significant fundamental data impact often depends on participant’s behavior or reaction to that news. Many manual traders avoid news trading to reduce risk on trading. They try to sort out the profitable trading positions by observing other attributes. Among them are price action, price movement, trends, etc.

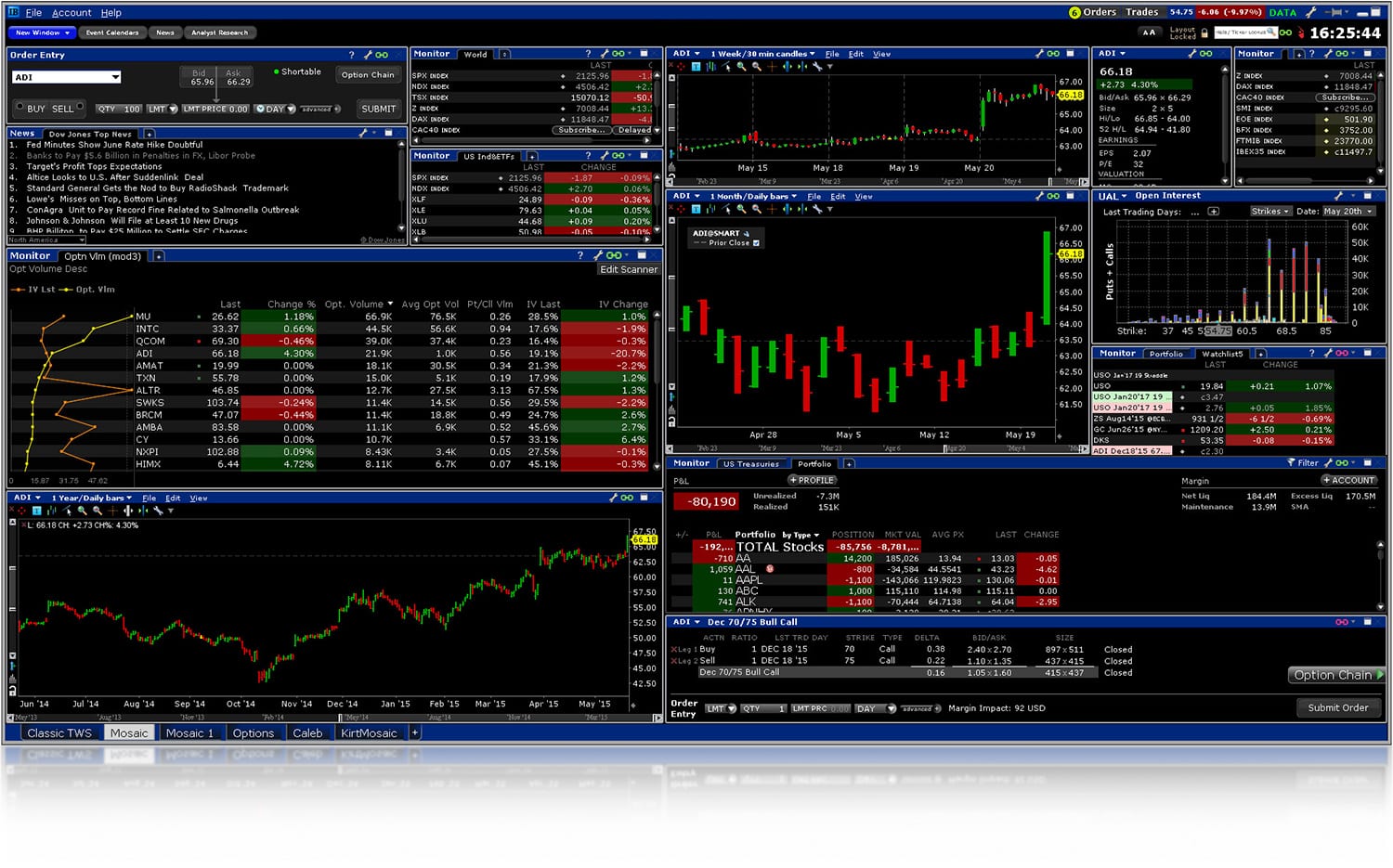

3. High-frequency trading chart

HFT is another algorithmic method to participate in the FX market. It allows making thousands of trading positions in less than a second. Manual trading has some limitations in mental and physical requirements in making trading decisions.

On the other hand, algo trading is free from these limitations. This method allows monitoring and taking action 24/7 without any human interruption. Besides, high-frequency trading can identify and execute trading actions in milliseconds. That can increase the potential profitability of trading FX. Scalping and HFT often share some similar order types in trading style.

4. Arbitrage trading

It generally depends on exploiting price anomalies across different available financial markets. This method was more profitable in the past. Nowadays, technology has become so advanced that the price gap doesn’t stay for long.

Moreover, the price gap between currencies is usually too small. So arbitrage trading enables trading with a large volume to make a considerable profit. By observing all facts, a triangular arbitrage trading involves two different currency pairs and a currency cross between those two.

5. Direct market access chart

Another top algorithmic trading strategy is direct market access or DMA. This trading method involves accessing sophisticated technology infrastructures of sell-side firms. The infrastructure of this method connects order books of different houses and many trading platforms.

Usually, buy-side firms use this strategy to participate in the marketplace. They use this DMA method to carry their trades instead of relying on broker-dealers and market-making firms.

6. Price action chart

It is a common way to approach the FX market. We all know this market is mainly a place of banks and financial institutes. Thus they follow some patterns to execute or hold their trading positions.

Algorithmic trading using price action charts involves executing trades by observing previous low and high or closing and opening prices. Generally, this method executes trades at similar levels where price may have reached before.

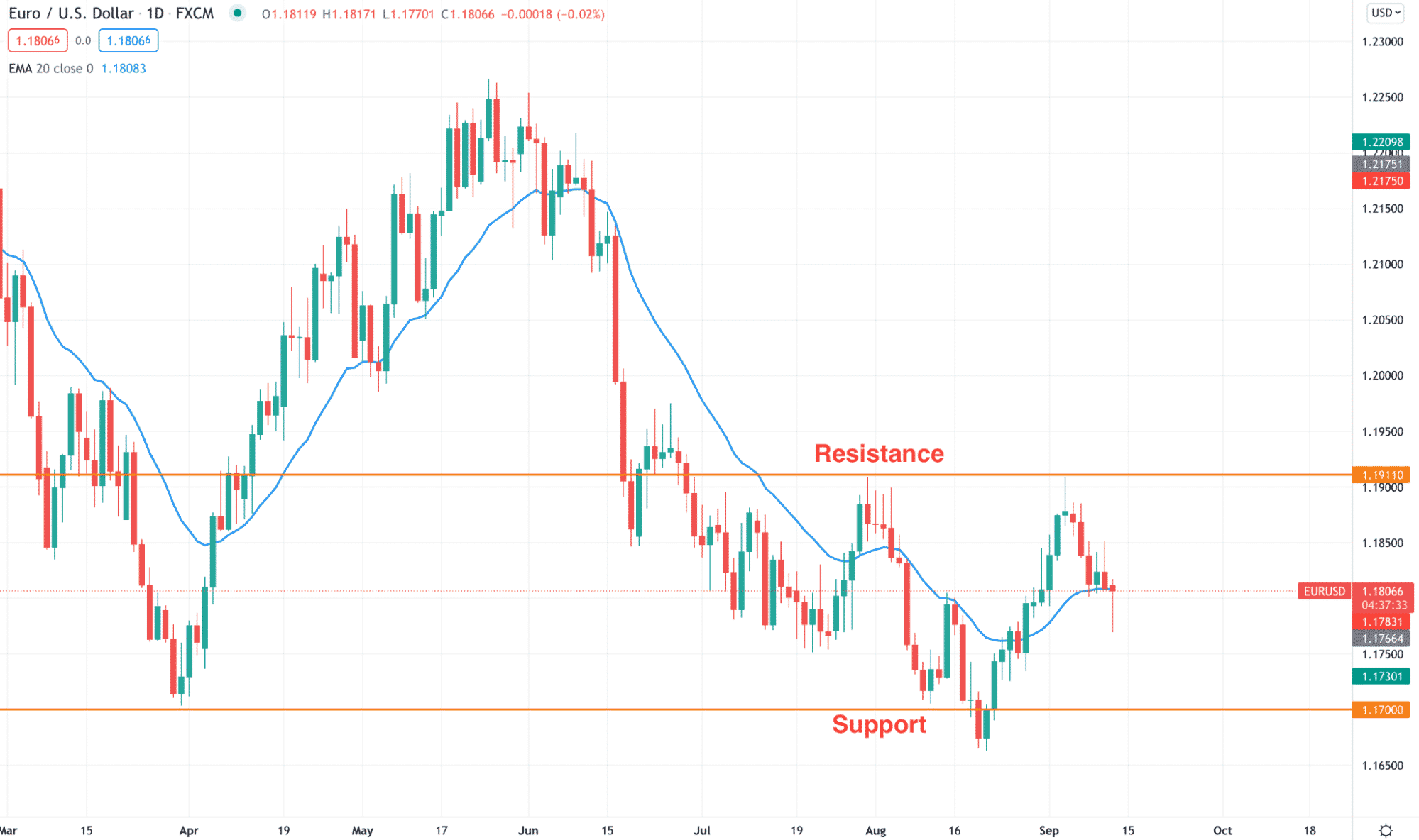

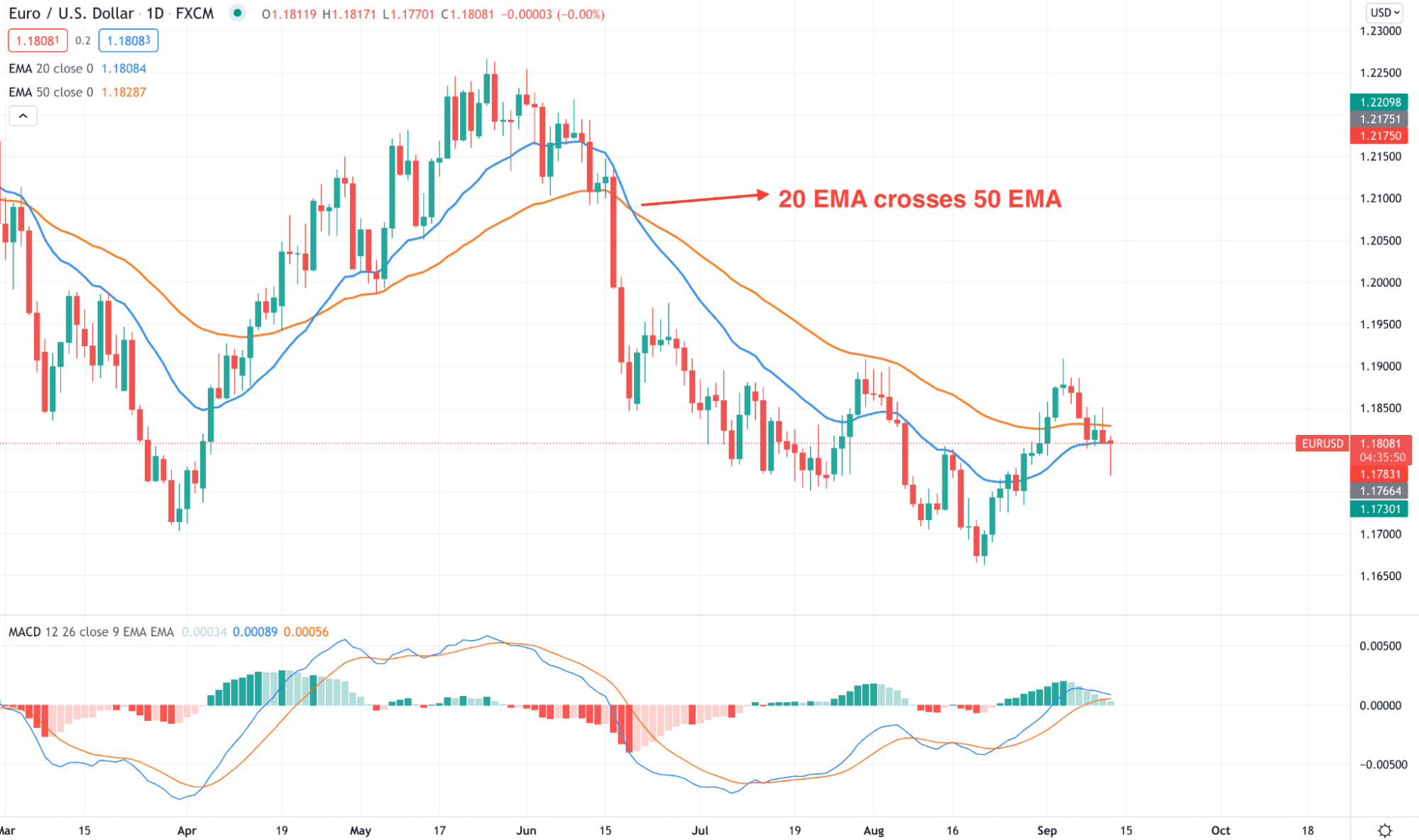

7. Trend-following momentum chart

In algorithmic trading involves trend-following momentum and momentum. Some trading strategies depend on the trend momentum without focusing on price actions. For example, using oscillator indicators and MAs is typical in finding trends. So executing trades also uses perusal from that technical indicator.

You can use two different MA’s values to identify the long- or short-term trends. For example, the algorithm can use a 20-day and a 50-day MA to identify and execute trades. On the other hand, there are oscillator indicators such as RSI, CCI, MACD, etc. They are best to identify overbought and oversold conditions of currency pairs in different time frames.

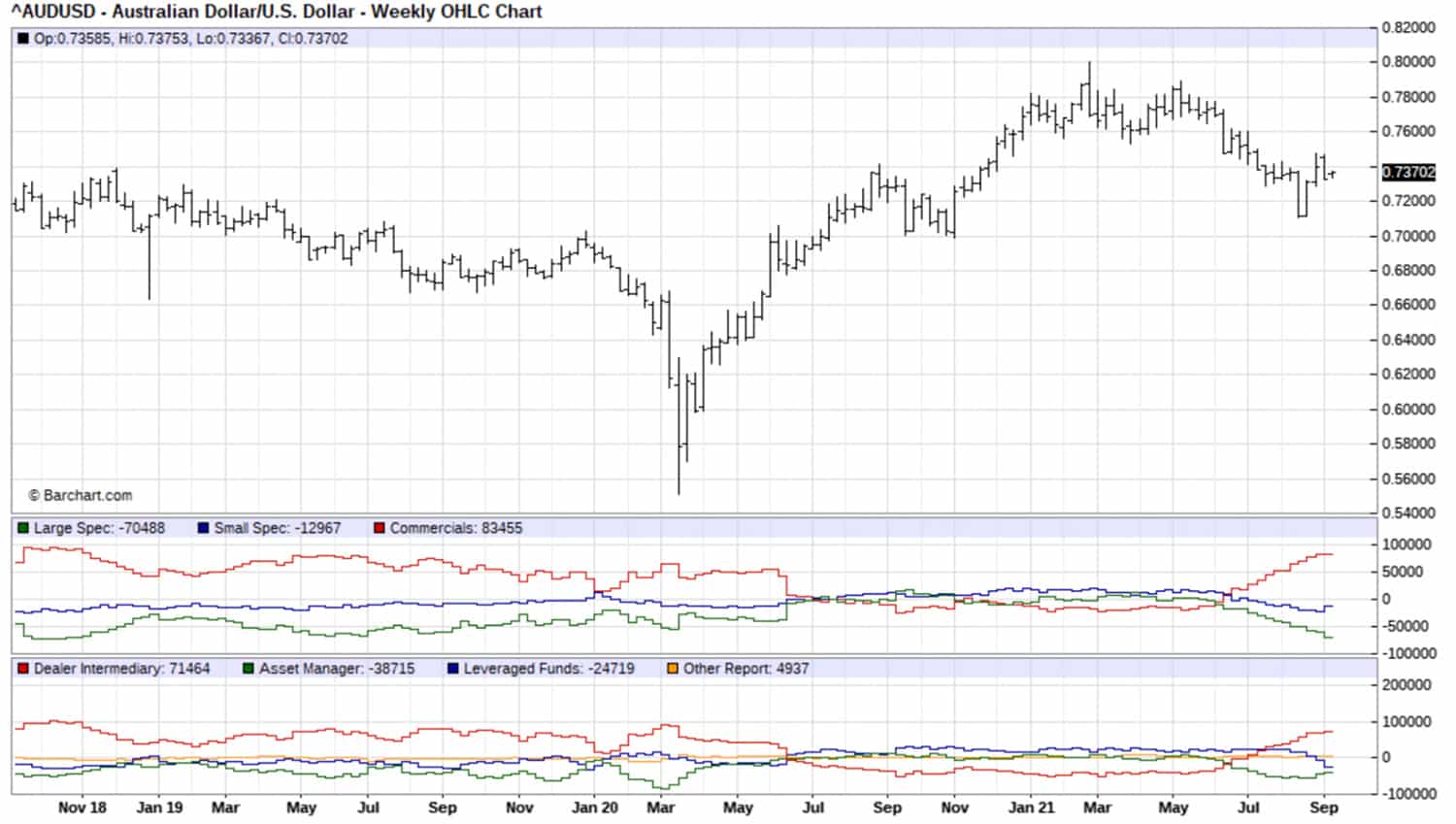

8. Market sentiment chart

You can use algorithmic systems to identify and execute trades, such as Commitment of traders data, scanning social media, etc. This method uses COT data often, which detect extreme net short/long positions in a particular asset. Besides, it monitors social media networks to get ideas about participants’ sentiments and future price predictions.

9. Statistical chart

This strategy depends on the series of historical data. Usually, this method collects bid-offer prices on various principles. Among them are highest, lowest, closing bid-offer prices. Later on, analyze the price behavior to identify trends and profitable trading positions. This method compares current and historical data to find potentially profitable trading positions.

10. Iceberg chart

Generally, large financial institutions use this algorithmic system. This concept makes a lot of trades by breaking one considerable forex trade. The algorithm of this strategy involves executing trades in multiple conditions to mask the actual volume of trades from other market participants.

Individuals or retailers following institutional trading volumes can only see ‘the tip of the iceberg.’ This trading method allows avoiding sudden price changes. Besides, it helps to trade in normal market conditions.

Final thoughts

These are the most common algorithmic systems that market participants use as the trading approach. Some of them are not easy to implement. Especially for the retailers and individual traders who don’t have knowledge or access to the marketplace. Anyway, some algo trading strategies are easy to implement and profitable.